If you’re reading this, you’re likely asking, “are home warranties worth it?” Well, that’s tough to answer in one sentence.

Fortunately for you, we’ve made a complete guide on the topic. But first, let’s explain what a home warranty is.

Home warranties are a specialized service that homeowners buy to prevent having to pay out-of-pocket for certain home systems and appliance repairs.

Home Advisor’s True Cost Survey found that homeowners spend an average of $6,649 every year on home repairs.

Repairs might be for a washing machine that went kaput or to fixing a toilet with any potential plumbing issues that go with it.

Even though they are not insurance, home warranties mitigate the cost of home expenses by covering certain systems and appliances for a monthly fee.

The goal is to give homeowners the confidence that they will not be stuck in a money pit of expenses because the most significant repair costs are taken care of by the warranty’s service contract.

What Is a Home Warranty?

In the most simplistic terms, a home warranty is a contract whereby homeowners pay a monthly fee to cover the unexpected costs of home repairs. There is often a trade service fee that is paid when a service contractor is called to the home.

Consider this fee similar to an insurance deductible. Homeowners may purchase a home warranty when they buy their home (or it can be purchased for them as part of the real estate transaction).

Or they can buy a warranty after living in the home, although waiting periods may apply. Most home warranty companies will cover the cost of repairs for things such as electrical and plumbing systems, kitchen appliances, and heating systems.

Every home warranty company has a different baseline for what it does and doesn’t cover; most having add-on coverage for an additional cost.

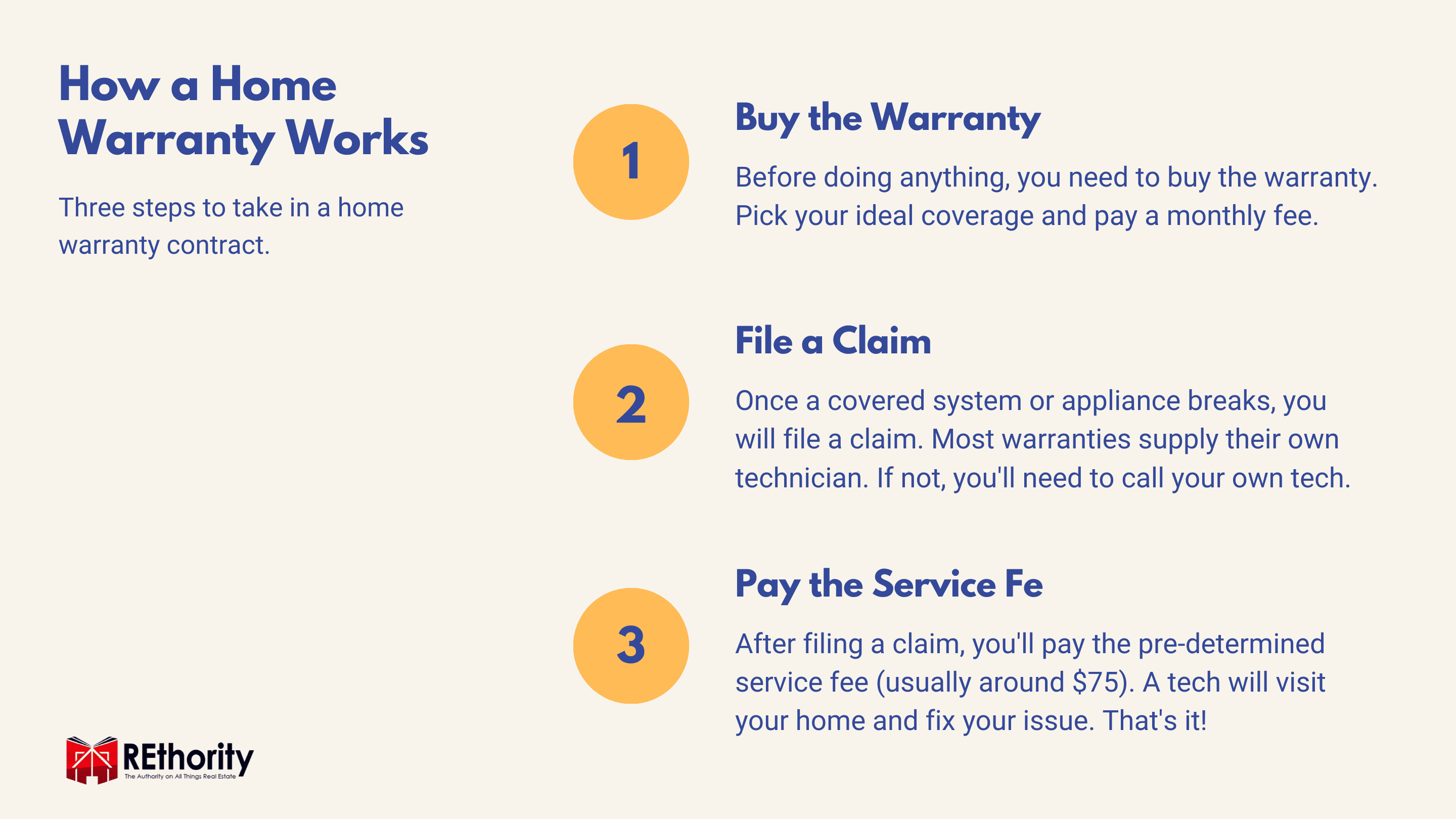

How Home Warranties Work

A home warranty is a service contract between the warranty company and a homeowner. The contract states what is covered, what is excluded, what the monthly costs are, and what the trade service fee is.

The trade service fee is the amount owed to the company when a repair call is made, and a technician needs to come to the home. Some home warranties expire without ever being used.

But if something happens during the contract term, say the refrigerator stops working, the homeowner calls the home warranty company who then calls a technician out to fix (or replace) the refrigerator.

Service call technicians will make the best effort to repair the issue before it is replaced. While a few home warranty companies allow homeowners to choose their own service technician, authorization is required before the repair work begins.

The service technician is paid directly from the home warranty company. Unless there is a cap, the only out-of-pocket costs the homeowner has at the time of the service call is the trade service fee – often around $85.

Pros and Cons of Home Warranties

While many people enjoy the benefits of home warranties, others see the service contract as a waste of money. Like with most things in this world, there are pros and cons.

The Pros of Home Warranties

Those who advocate for homeowners to buy home warranties will focus on the cost of repairs and the peace of mind that a warranty offers.

Some wouldn’t own a home without also having a home warranty in place, regardless of how old the home and its systems are.

- Often have caps and limits to coverage

- May never be used but still must be paid for

- Decisions made by the home warranty company to fix or replace items – not the homeowner

The Cons of Home Warranties

Those who oppose home warranties in favor of using the money for savings or investments don’t like the fact that most people don’t get their monies worth from a home warranty.

Warranty companies are for-profit entities that understand how to price contracts to work in their favor over time. Just like Las Vegas, the house usually wins.

The Cost of a Home Warranty

Costs vary widely among home warranty companies who charge contract fees either on a monthly or annual basis. Annual contract costs generally fall into the $300 to $600 range.

Remember that this doesn’t include the trade service fee, which is an additional cost when you call the home warranty company to come and fix something.

Trade service fees range from $65 to $110 and may be applied to multiple parts of the same job. For example, assume you had a washing machine where the drum stopped spinning.

As a covered item in your home warranty contract, you called the company and opened a claim, paying your $85 for the washing machine repair. When the technician arrived, he deemed that the washing machine needed to be replaced.

In doing so, a plumber would need to fix the corroding pipe the washer attached to. This might lead to a second trade service fee where you are now dealing with two technicians working on different parts of the same problem.

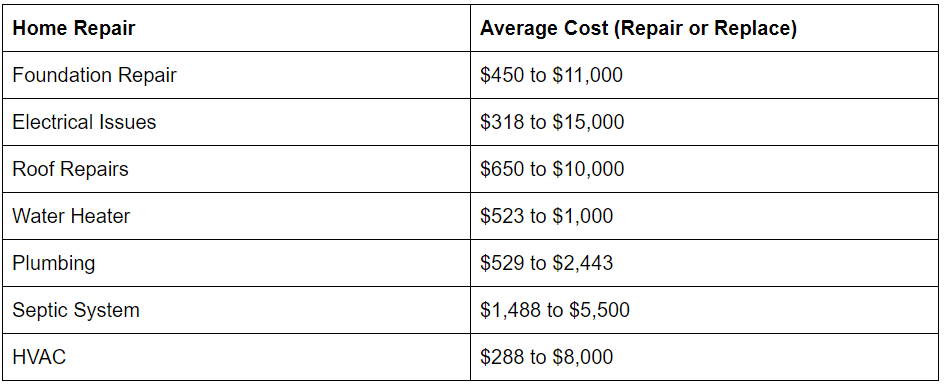

Average Cost of Home Repairs

It’s tough to tell how much something will cost if you don’t have previous experience in dealing with home issues.

However, there are some averages that every homeowner should be aware of when planning for unexpected home costs.

Not every home warranty company covers all of these types of repairs, but it gives a homeowner a good idea of how to prepare for the costs that arise over the years.

For someone who doesn’t have cash reserves or a home equity line of credit, paying for repairs or replacement of systems can break the bank.

What Do Home Warranties Cover?

While every home warranty company is different, there are some basic coverages that every homeowner should have when shopping for a home warranty company. The majority of home warranty companies cover major appliances and systems.

This means homeowners should confirm coverage in standard plans that include:

- Plumbing systems within the house

- Electrical systems within the house

- Kitchen appliances

- Washers and dryers

- Heating and cooling units and systems

- Water heaters

Often, for an additional cost, many home warranty companies will allow homeowners to extend coverage to things such as:

- Second refrigerators

- Swimming pools and pumps

- Limited roof coverage

- Septic systems

- Stand-alone freezers

- Well pump

While these are some basic expectations, homeowners should review the policy coverage of each home warranty plan to ensure they know what they are paying for.

When It Makes Sense to Buy a Home Warranty

Some homeowners couldn’t imagine buying a home without a home warranty. For many, the comfort of knowing that when something breaks down, their downside is limited to a trade service fee.

Think about that: for the majority of home claims, you would only be out-of-pocket the $75 to $110 trade service fee at the time of repairs. Yes, you are still paying for the monthly service contract fee.

But, like insurance, you would rather have a monthly budget established to cover unanticipated costs. The home warranty is for people who either don’t have the savings to handle costly repairs or don’t want to tap into their savings.

Certain homes are at more risk of repair needs than others. An older home with older appliances is a prime candidate for a home warranty. Many homeowners note that once one thing goes wrong, everything else seems to follow suit.

So even if a homeowner had the savings to fix something like the oven range, having to fix multiple appliances within the same year could be burdensome to their budget.

This is why many real estate agents buy a home warranty plan to help homebuyers feel confident that the new purchase of an older home doesn’t come with thousands of dollars of expenses shortly after closing escrow.

When You Should Skip the Home Warranty

For all the benefits of a home warranty, they aren’t for everyone. As Dave Ramsey suggests, if you have the savings to cover the costs of home repairs, keep the money and continue to invest or save it rather than pay a monthly contract fee.

Even with that in mind, some people opt not to get a home warranty simply because they don’t feel there is a risk of major repairs.

Those who have purchased a new home with new appliances, HVAC units, and electrical and plumbing systems may not feel it is necessary.

The new appliances would have their own manufacturers’ warranty, and there isn’t enough mileage on the house to worry about systems recently built meeting all the new code standards.

Home Warranty Example

Assume you are paying $600 a year for a home warranty plan – the upper end of the cost tier for home warranty companies. If you don’t have a claim during the year, you are out-of-pocket for $600.

Assume you pay for the plan for six years without a claim; this equals $3,600 you could have saved and put into a home repair fund. It’s this cumulative amount that advisors such as Dave Ramsey dislike.

Dryer Problem

If you didn’t have a claim, over time, that money could be better spent or invested elsewhere. However, imagine that in year six, your dryer stops working. You pay the $85, and the technician comes out.

He concludes that the dryer can’t be fixed and needs to be replaced. The cost is $1,100. So far, you have paid $3,685 to the home warranty company who has bought you a new dryer. Right now, the home warranty company is still winning this economic battle.

Electrical Problem

But now imagine that in year seven there is a problem with the electrical systems. You call the home warranty company who sends an electrician. Your total out of pocket costs is now the $3,685 from year six plus another $685 for year seven.

And the new service call for a grand total paid to the warranty company of $4,370. If the electrician says that the electrical system is no longer to code must be replaced due to it being a fire hazard to the tune of $6,000, your home warranty has suddenly paid for itself.

The Result

This is the type of assessment that every homeowner needs to consider when deciding on purchasing a home warranty. Of course, home warranty companies are designed to make money and not lose money with every contract.

But if you fear having to come up with more than a thousand dollars at any given time for a home repair, you may decide that the monthly service contract cost is worth it.

Becoming a Home Warranty Fan

New homeowners don’t always understand the value of a home warranty and see it as an unnecessary expense – that’s until they have a problem.

As Bob Gordon, founder of Boulder Real Estate News tells us about his long-term clients, “At each stage of their real estate empire building, they have upgraded their home warranty outlook.

The first house, they passed and shortly after moving in had some water tank issues. The second home had a warranty and covered the appliance issues that came up. Sometimes experience tells you that having a warranty is the best investment to protect your home purchase.

Gordon continues, “Last year when they purchased their third house with me. On the third house, we negotiated for the seller to get us the best warranty with three years’ coverage. The buyers are very happy clients.”

So, Are Home Warranties Worth It?

Home warranties are designed to prevent repair costs from overwhelming a household budget at any given time. No home is impervious to needing repairs or replacing appliances or systems.

At the same time, different homeowners have different abilities and financial means. Some people are great DIY handymen, while others choose to save money for the repairs over time. Buying a home warranty is a personal decision every homeowner must make.

The decision could be at the time of buying a home or at a period where they fear that systems and appliances will start to break down repeatedly.

Of course, if your real estate agent or the seller of your home is giving you the gift of a one-year home warranty, you shouldn’t dismiss it.

Resources: