Are you wondering about turnkey properties? If so, you’re in the right place.

Our guide explains these hand-off investments, gives things to consider, and helps you decide whether to buy one or move on.

What Are Turnkey Properties?

Turnkey properties are homes that that have been purchased, renovated, and sold to another real estate investor who intends to rent them out. They are called “turnkey” because a tenant can turn a key and move in.

The idea is that once a distressed property has been rehabbed and repaired, an investor can come along, purchase the property, and immediately get tenants moved in to start generating rental income.

Turnkey rental properties are often purchased and renovated by companies that provide their own labor and materials to repair and update older properties or homes in disrepair.

It’s not uncommon for those same companies to offer property management services for the investors who eventually purchase their turnkey properties. We’ll talk about this in more detail below.

Who Buys Turnkey Properties?

Real estate investors who want to generate consistent rental income without using the traditional fix and flip method may find turnkey rental properties an attractive option.

Whether they’re short on time, living in a different state, or just don’t want to schedule and oversee the repairs a property might need before it can be rented out, for most investors, buying turnkey properties is all about convenience and faster returns.

There are several reasons an investor might choose to buy a turnkey property rather than rehabbing it on their own. In most cases, they’re trying to avoid the risks that come with fix and flip deals. These include:

- Repairs and renovations are completed before they get involved.

- Contractors, labor, and materials are paid for and managed by the first buyer.

- No searching for distressed properties worthy of renovating.

- Some turnkey rental property companies find tenants and manage the property for the new owner.

- The investor can own the property from out-of-state and still generate rental income.

The downside, of course, is that these conveniences and benefits are eventually paid for. That includes the higher purchase price of the rental property.

And through additional fees, the turnkey property’s original owner may collect for property management. While they are convenient, you’ll have to pay market prices.

How Much Do Turnkey Properties Cost?

In a report by property management software company Buildium, they found that the average fees for turnkey property acquisition are about 3% to 10% of the purchase price.

- Property acquisition: 3% to 10% of the total purchase price

- Property management: 10% to 20%

- Average property cost: $50,000 to $150,000

They estimated that the average fee for ongoing property management of turnkey properties is about 7% to 10% of the income generated from it.

However, FitSmallBusiness found that the cost for turnkey property management was between 10% to 20% of the income generated. As far as the actual price of turnkey rental property, most sell in the neighborhood of $50,000 to $150,000.

Many turnkey properties are purchased by out-of-state landlords. They live in high-priced markets and see the opportunity to invest in cheaper property without the need for in-person involvement.

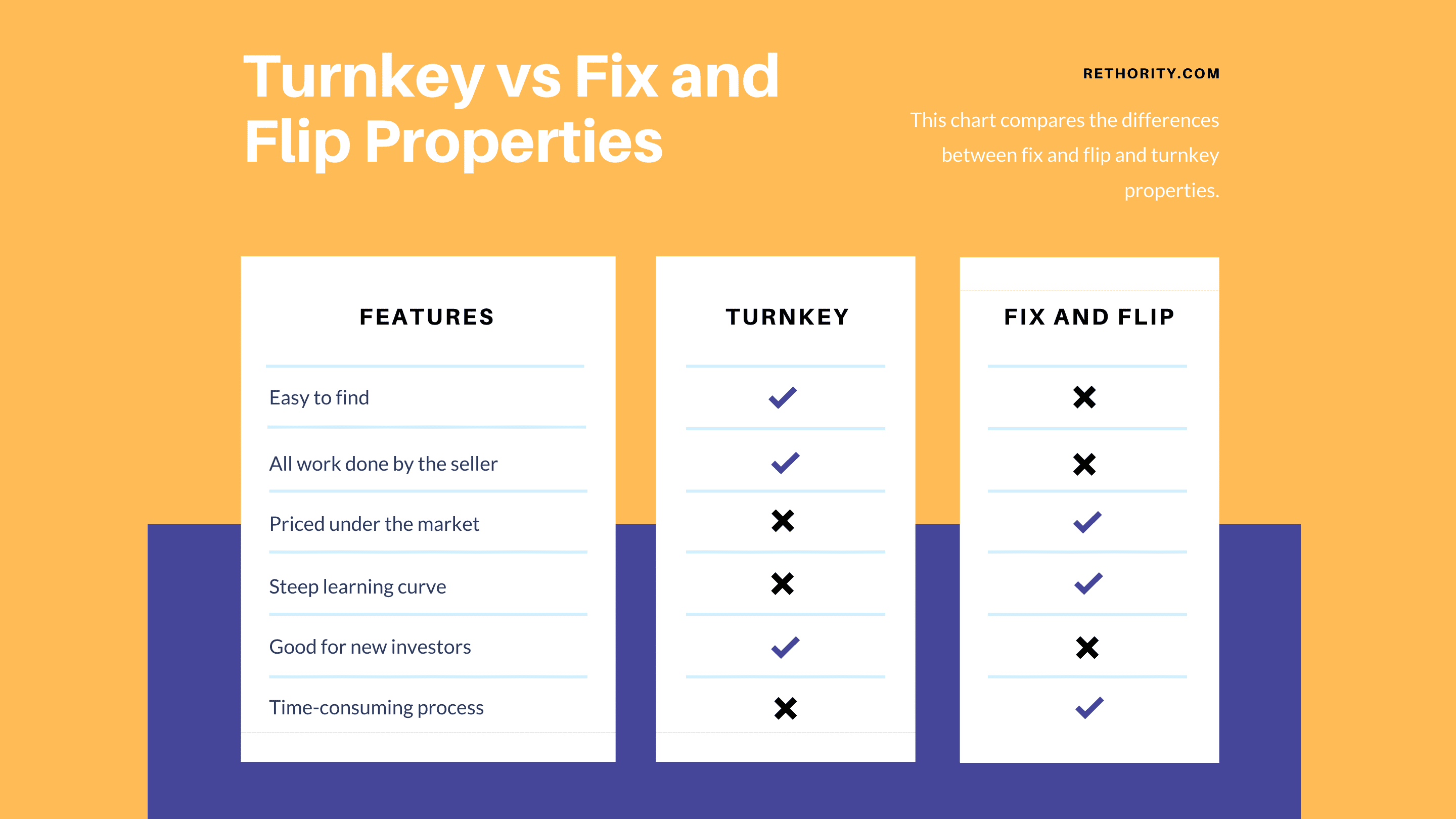

With this in mind, let’s look at the differences between turnkey rental properties and the traditional fix and flip method, which tends to target lower-priced properties that can produce more significant profits.

Turnkey Property Vs. Fix and Flip

Turnkey properties don’t need any work or renovations before a tenant can move in. Once an investor closes on a turnkey property, they can find tenants and have them move in the very next day.

The quicker an investor can move tenants in and start generating rental income, the faster they see a return on their investment. This is simply compounding interest at work.

Turnkey properties are passive, long-term investments. Real estate investors who buy turnkey rental properties don’t need to be experienced or know a lot about renovating a rental property.

Because turnkey rental properties don’t require a lot of experience or involvement from investors, they are best suited for beginning real estate investors or those who want to generate passive income long-term.

When an investor buys a distressed property, makes repairs and renovations to it, and sells it for a higher price than they paid, they’ve used the “fix and flip” or house flipping method. House flipping is an active form of investment that requires experience and knowledge.

If you can’t estimate how much repairs will cost, predict a property’s price, or manage the work of different contractors to complete the needed repairs, you can lose money on fix and flip investments.

House flipping is a short-term form of investing that is best suited for experienced investors. They want to maximize their profit potential, be involved in the entire rehab and repair process, and quickly sell a property.

Turnkey Property Pros and Cons

Turnkey properties have a mixed reputation in the world of real estate investing.

Some consider turnkey rental properties bad investments, while some like the convenience and ease of investing in properties that can generate faster returns. Let’s look at the pros and cons of investing in turnkey properties.

Pros (What we like)

Convenience. No managing contractors, identifying and estimating the cost of needed repairs, searching for properties, or (in some cases) managing the property after purchase.

Faster returns. Without a waiting period to complete repairs and renovations after purchase, tenants can move in quickly, and investors can see faster returns.

Little experience required. You don’t have to be a seasoned real estate investor to pay for a turnkey property and split some of the profits with them to cover the property management.

Hands-off investing. Buying a turnkey property and hiring the same company to handle property management and even finding tenants for a percentage of the profits makes this form of investment beneficial for less experienced investors.

Many turnkey property companies have teams of contractors, administrative staff, and maintenance providers that you can access to manage your property.

Cons (What we dislike)

Fees eat into profits. Property acquisition fees and property management fees eat into turnkey property profits.

If you’re paying up to 20% of your rental income in property management fees, you’re only taking 80% of your potential profit – and you already paid a premium price for the property itself due to the repairs and renovations made.

No local market knowledge. If you’re relying on a turnkey property company to find an investment for you, fix it up according to their specifications, and manage the property on an ongoing basis, you won’t likely have much knowledge of the real estate market where the property is located.

There’s a chance you’ll end up buying a property in a poor location, one that has more issues than previously disclosed, or one that has been shoddily repaired.

Paying a premium price. Turnkey properties are known for being priced higher than they are worth due to the convenience they offer investors. This can be in the form of fees and hidden costs built into the total purchase price for the property.

If you plan to hold the property for a while and sell it, this becomes an even bigger issue – you may lose money on a deal like this. In this case, it’s best to fix and flip distressed properties.

You’re not in control. If you live out-of-state and buy a turnkey property, sign up for property management services, and use the company’s contractors and team to care for your property in your absence, you don’t have much control over your own investment.

Low-quality tenants, poor repairs and maintenance, high turnover rates, additional fees, and more can plague you when you work with a turnkey property management company.

Should You Buy Turnkey Properties?

Taking a look at the pros and cons above, you can see why turnkey properties are such a hot topic in real estate investing. There are certainly some benefits to investing in these properties to generate rental income.

But the drawbacks are serious enough to cause most investors to focus on other methods. So, when is it reasonable to invest in turnkey rental property?

If you’re a beginning real estate investor and want to learn more about the industry, buying a turnkey property from a trustworthy company can be a good learning experience.

As long as you are careful not to overpay for a property (ensuring you can turn around and sell it later) and stay involved in the property management, you can test the waters of real estate investing without saddling yourself with lengthy repairs and property searches.

Alternatively, if you’re an investor looking to grow your portfolio and want to purchase cheaper property in lower-priced markets, turnkey investments may be a good option for you.

The ability to make 80% of the rental income without ever visiting or managing the maintenance and repairs for a property is worth it to some investors.

If you’ve got the experience and knowledge to find distressed property in a good location, estimate repair costs, manage a team of contractors, and price the property, you’d be much better off with a fix and flip than turnkey property investment.