Wondering who pays closing costs when it’s time to close on a house? Don’t let closing costs be an unexpected surprise for you as a buyer or seller.

Keep reading to discover who pays closing costs and what they consist of in most real estate transactions.

What Are Closing Costs?

Closing costs are fees that are incurred during the home-buying process and due at the time of closing. They represent a percentage of the total purchase price of the home or the mortgage amount.

Typically, closing costs are equal to anywhere from 2% to 5% of the mortgage amount. This means a $250,000 home would have about $5,000 to $12,500 in closing costs.

Instead of paying as you go for individual services like loan application fees, home inspection costs, and title insurance, they are all lumped together and due at the time of closing. Closing costs are due in cash at the time of closing.

Who Pays Closing Costs?

When it’s time to close on a house, both the buyer and the seller have paperwork to sign and fees to pay before the keys are handed to the buyer.

At closing, both parties participate in the official transfer of the home’s title, purchase funds, remaining down payment, and closing costs, along with their real estate agents and attorneys.

But who pays the closing costs? What do closing costs actually include? Where do buyers and sellers typically get the money to pay them? Read on to find out.

What Do Closing Costs Include?

Closing costs are not a general, flat fee. They are comprised of several smaller charges that are incurred during the home-buying process, from the mortgage application to the first property taxes and home insurance premiums.

Closing costs include fees related to the mortgage, insurance, property, and title. Below, we’ll break down each fee that may be included in closing costs.

Mortgage Fees

Application fee. The charge you incur when you apply for a mortgage.

- Cost: Varies

Assumption fee. If you assume the seller’s mortgage, you’ll pay an assumption fee.

- Cost: Based on the remaining mortgage balance

Attorney fee. This covers an attorney’s time if they were present at closing or worked with you during the process.

- Cost: Based on the hourly rate and number of hours worked

Prepaid interest. Your lender may require you to pay the first interest on the mortgage at closing. It will be calculated from the day of closing through the first payment due date.

- Cost: Varies based on the loan amount

Loan origination fee. It covers the lender’s preparation of your mortgage or the work they’ve done to secure your funding (notarizing, document prep, confirmation of financial information, etc.). Also called underwriting fee, administrative fee, or processing fee.

- Cost: About 0.5% of the total mortgage amount ($1,250 on a $250,000 home)

Mortgage Insurance Fees

Mortgage insurance application fee. Low down payments associated with loans like the FHA (Federal Housing Administration) may require you to get mortgage insurance from a private company that insures your lender for the loan amount if you stop making payments.

- Cost: Varies by lender

Mortgage insurance premium prepayment. This fee covers the first year of mortgage insurance, or in some cases, the complete payment of the mortgage insurance premium for the mortgage term.

- Cost: About 0.55% to 2.25% of the mortgage amount ($1,375 to $5,625 on a $250,000 mortgage)

USDA, FHA, and VA fees. The U.S. Department of Agriculture, the Federal Housing Administration, and the Department of Veterans Affairs collect fees for mortgage insurance and guarantee fees.

- Cost: USDA: 1% guarantee fee; FHA: 1.75% of mortgage amount; VA: 1.25% to 3.3% of mortgage amount

Property Fees

Inspection fee. The home inspection required by a lender is covered by this fee at closing. The home inspection looks for any issues with the home that would affect the structural integrity or safety of the home.

- Cost: Around $300 to $500

Appraisal fee. The initial appraisal of the home being mortgaged proves to the lender that the loan amount is not more than the home is actually worth. A licensed professional appraiser must do the appraisal.

- Cost: Around $300 to $400

Property taxes. At closing, the first two months of property taxes will be included in closing costs. These consist of both county and city property taxes.

- Cost: Varies

Annual assessments. Some HOAs (homeowners associations) charge an annual fee or a lifetime lump-sum payment upfront.

- Cost: Varies

Homeowners insurance premium. Most lenders require homeowner’s insurance by the time of closing. The first premium payment may be due at the time of closing.

- Cost: Varies

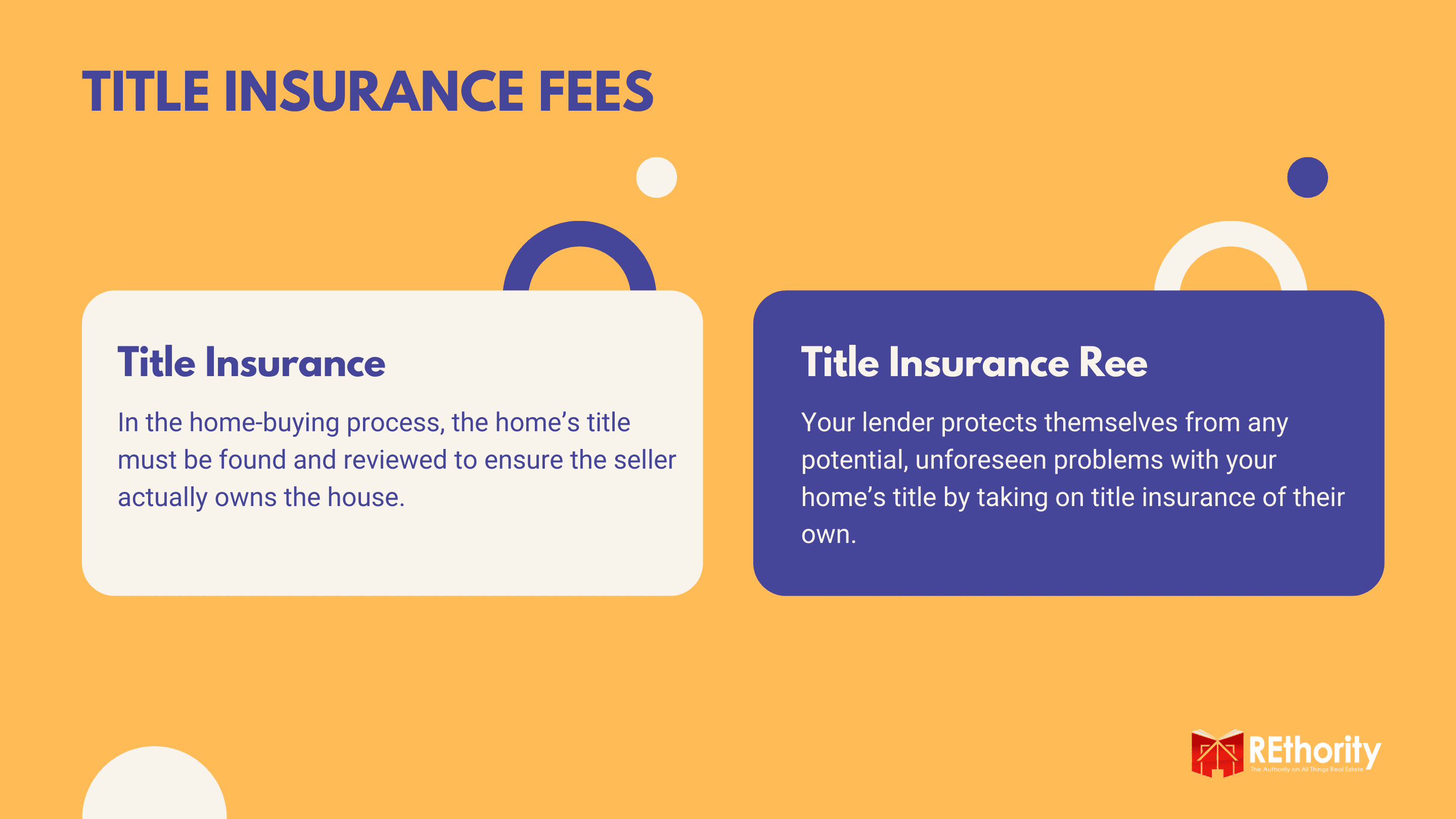

Title and Title Insurance Fees

Title search fee. In the home-buying process, the home’s title must be found and reviewed to ensure the seller actually owns the house. This search is often more involved than a simple computer search, as many older records are not digitized.

- Cost: Around $200

Lender’s title insurance fee. Your lender will likely protect themselves from any potential, unforeseen problems with your home’s title by taking on title insurance of their own. This fee will be passed on to you.

- Cost: Varies

Owner’s title insurance fee. Owner’s title insurance is optional but highly recommended. Owner’s title insurance covers you in case there are problems with the home’s title or ownership.

- Cost: About 0.5% to 1% of the total purchase price

Who Pays Closing Costs?

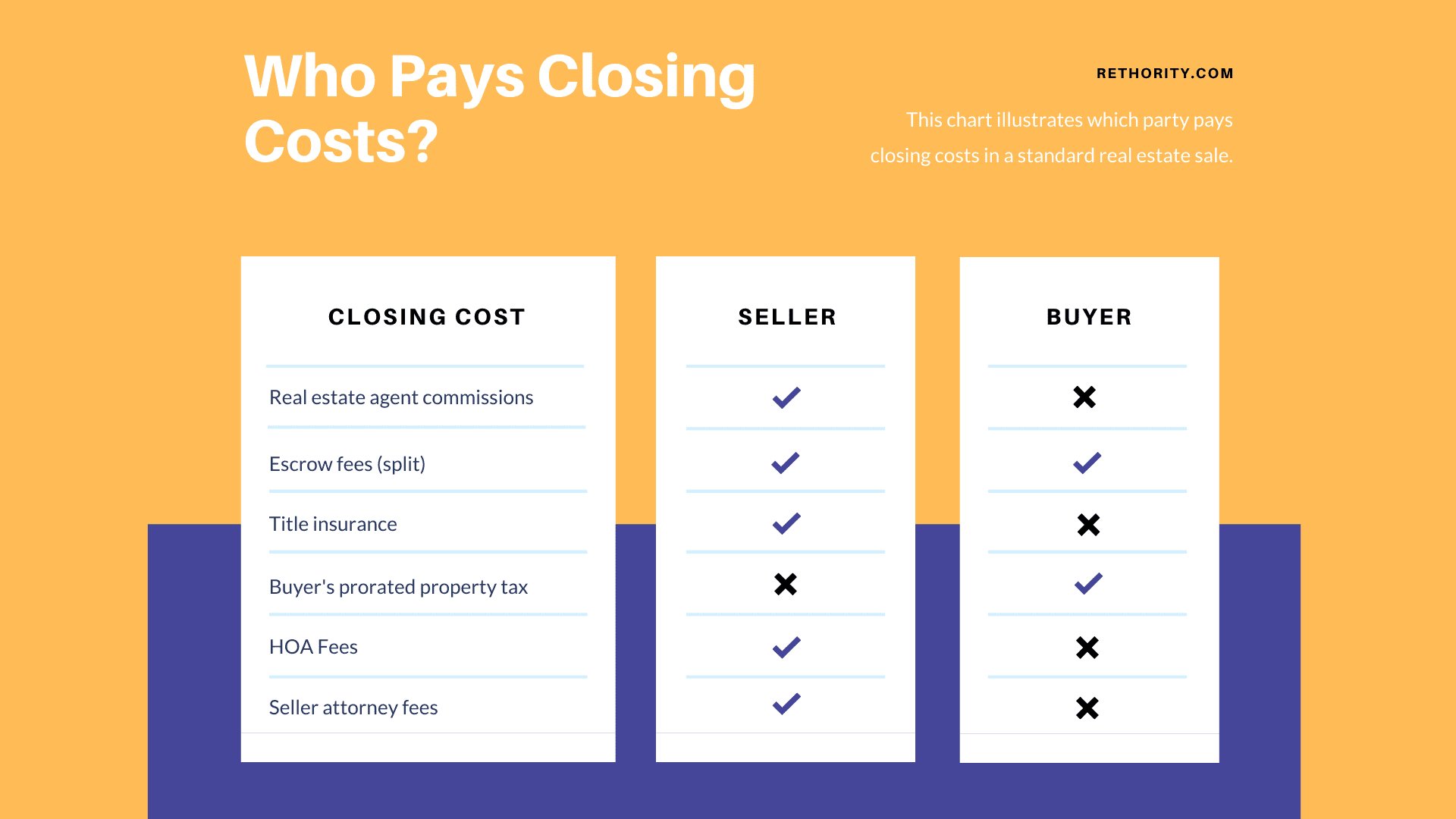

Now that you’ve looked through a list of the fees that may be included in closing costs, you can see that most of them are related to the buyer’s side of the transaction.

The buyer owes most of the closing fees related to the mortgage, insurance, and property appraisal and inspection. But is the buyer responsible for all closing costs? Not by a long shot.

Although the buyer typically pays most of the closing costs, the seller is responsible for paying several costly fees, too.

The main difference is that the seller rarely needs cash to pay closing costs. Instead, they are taken directly from the amount the home sells for.

Seller Closing Costs

Sellers don’t get to keep the full amount their property sells for. Out of that amount, they are typically responsible for paying about 8% to 10% of the property sale price.

Seller closing costs include the following fees:

- Real estate agent commissions for both agents (about 6% of the property’s sale price)

- Transfer tax for the property or deed

- Escrow and closing fees

- Title insurance

- Attorney fees

- Repairs agreed to in the contract

- A portion of the buyer’s property taxes

- A portion of HOA fees

The main exception to this closing cost arrangement is when a seller agrees to pay a buyer’s closing costs as part of the purchase contract. This might be because the buyer couldn’t come up with the cash.

As a result, they requested that the seller include the closing costs in the price of the home. It could be due to a weak real estate market or a highly motivated seller who wants to sell the home quickly.

How to Determine Your Closing Costs

For buyers, lenders are required to first show you what your closing costs will be when you apply for a loan in the Loan Estimate document.

A few days before closing on a home, you’ll get another document, the Closing Disclosure document, from your lender. This document outlines and breaks down all the fees included in your closing costs.

Sellers can find precisely how much they’ll owe in closing costs in the Statement of Closing Costs document at the settlement. This breaks down the total charges to show what fees are being taken out of the proceeds of the home.

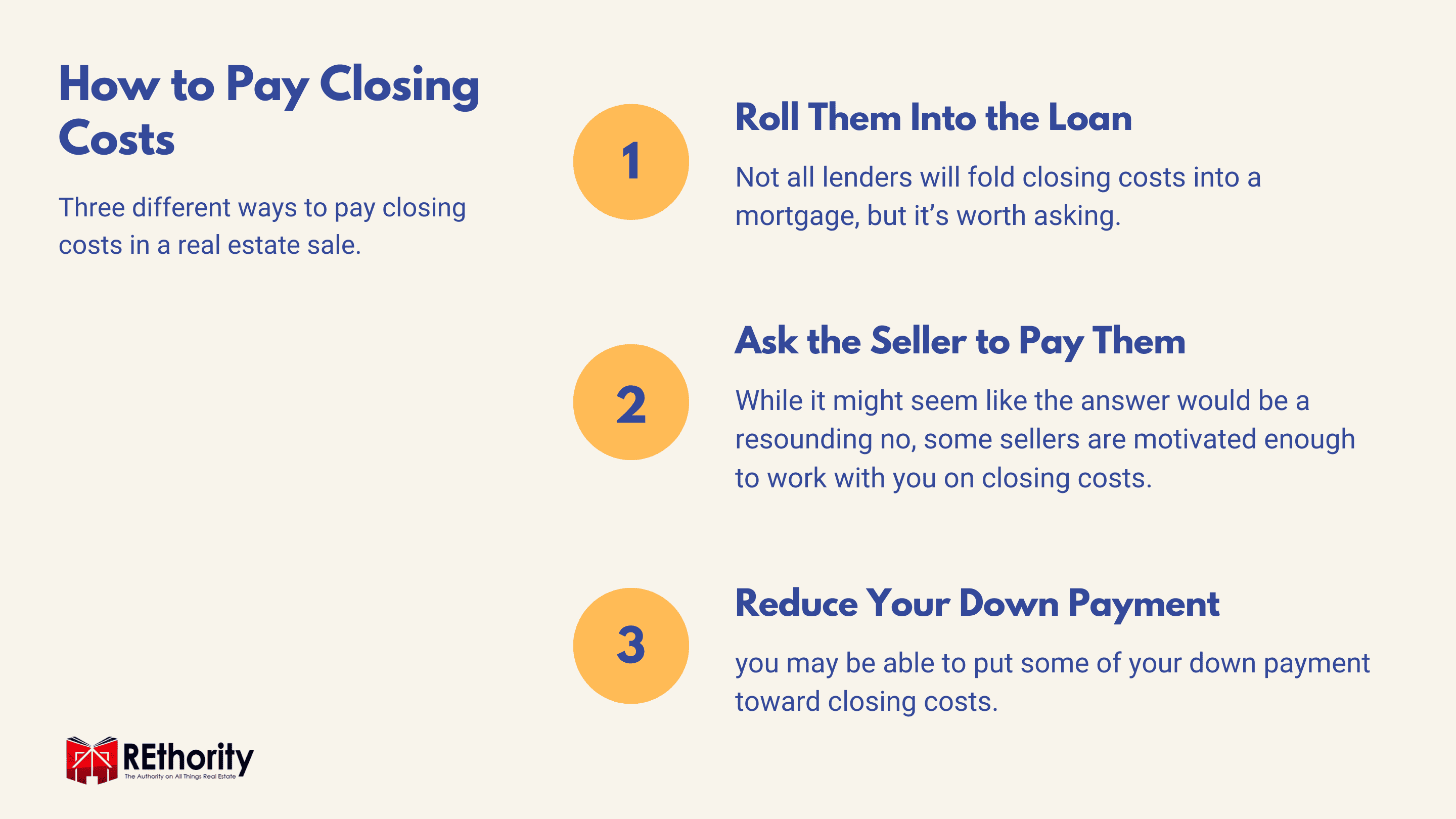

How to Pay Closing Costs

While it’s best to pay closing costs out-of-pocket as a one-time cash payment, that’s not always possible, especially after saving for a sizable down payment.

So, what do you do if paying closing costs is a major stumbling block that is suddenly keeping you from buying a home?

Ask your lender if you can include closing costs in the loan. Not all lenders will fold closing costs into a mortgage, but it’s worth asking.

In 2018, policies regarding closing cost assistance grants changed, and now, lenders can offer these assistance grants to their clients. It’s still a relatively new policy, so your lender may not offer it, but be sure to check.

Ask the seller to cover closing costs for you. While it might seem like the answer would be a resounding no, some sellers are motivated enough to work with you on closing costs.

Even if your lender won’t agree to outright include closing costs in the loan, negotiating with the seller may give you a way to work around it.

The seller may agree to cover closing costs if you offer the full asking price on the house or pay more than the asking price, with the difference covering your closing costs.

This allows you to get the amount for closing costs from the mortgage, though you’ll have a higher monthly payment due to the higher loan amount.

Reduce your down payment. If you were planning to make a 20% down payment and your lender will allow you to reduce that amount, you may be able to put some of your down payment toward closing costs.

There are a few drawbacks to this method, though. First, a lower down payment will result in higher monthly payments and interest rates.

Additionally, down payments less than 20% usually require you to get mortgage insurance, which is another fee that will be added on at closing.

So, Who Pays Closing Costs?

So, who pays closing costs? While a buyer pays anywhere from 2% to 5% of the purchase price of the home in closing costs, they’re not the only ones on the hook at closing. The seller is responsible for 8% to 10% of the sale price of the home in closing costs.

However, because the seller’s closing costs are taken directly from the proceeds of the sale (unlike the buyer, who is responsible for paying their closing costs in cash), they usually don’t need to bring cash to the closing.

From a buyer’s perspective, closing costs cover all the fees that are accrued through the home-buying process, from mortgage fees and homeowner’s insurance to property appraisals and home inspections.

From a seller’s perspective, closing costs cover charges like real estate agent commissions, part of the sold home’s property taxes and HOA fees, transfer taxes, and title insurance that covers them in case there are problems with the title after closing.

Whether you’re the buyer or seller, make sure you have a full and clear understanding of the closing costs you’ll be responsible for at closing, and don’t be afraid to negotiate with the other party to bring your costs down.