Looking for an online cap rate calculator to make determining the return on your real estate investment a breeze?

Read on to learn about cap rates and how to easily calculate yours.

What Is a Cap Rate?

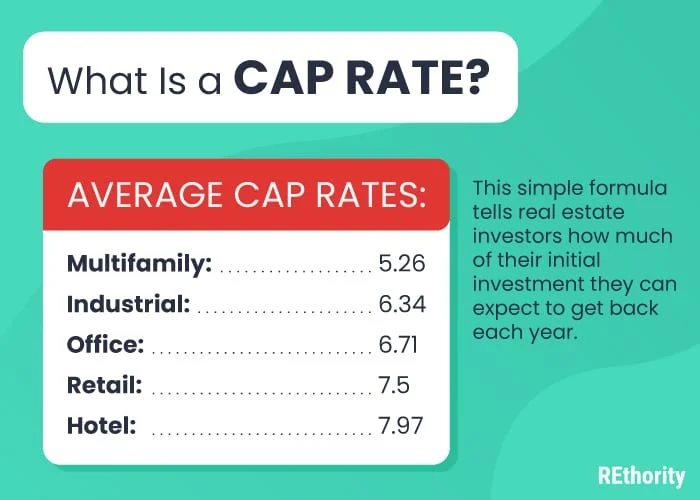

The cap rate (or capitalization rate) is a way to measure the profitability of an income-producing property.

This simple formula tells real estate investors how much of their initial investment they can expect to get back each year.

Click for Video Explaining Cap Rates

Cap rates vary largely by property type, location, and class. However, the old adage “high risk equals high reward” typically holds true in these calculations.

- Multifamily: 5.26

- Industrial: 6.34

- Office: 6.71

- Retail: 7.5

- Hotel: 7.97

These numbers come from the CBRE market update. Their data team compiles a great recap of average cap rates for commercial properties across the country.

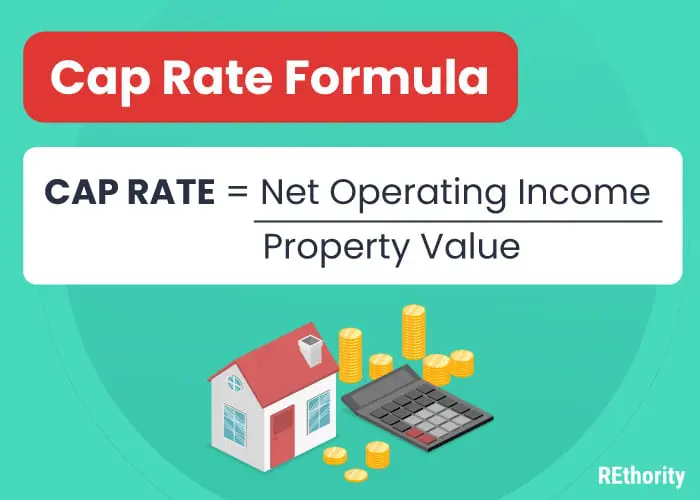

Cap Rate Formula

The cap rate is the property’s annual net operating income (NOI) divided by the property’s current market value. The cap rate formula is simple:

Cap Rate = Net Operating Income / Property Value

It’s easiest to calculate this value manually. However, if you’re like me, math is not your strong suit. In this case, you can use a cap rate calculator to determine the return on an investment property.

You only need to know the net operating income and the value of the property for the cap rate calculation. With these numbers in hand, simply:

Calculating Cap Rate

- Start with the property value, which is what you paid for the property, given that you own it now. Or it could be the market value.

- Find net operating income (NOI) by first adding up all the monthly expenses. This includes items such as property taxes, property management, utilities, insurance, and homeowner’s association fees.

- Now subtract the expenses from the monthly gross rental income. This gives you a monthly NOI.

- Multiply the NOI by 12 for the annual NOI.

- When you have the annual NOI and the property value, you divide the NOI by the property valuation.

- This gives you the cap rate, which is expressed as a percentage.

Cap Rate Calculation Example

For example, say you have a property you paid $100,000 for. The monthly rent is $1,000. The monthly cost of property taxes, management, utilities, insurance, and HOA fees is $400.

- Subtracting $400 in expenses from $1,000 in monthly rent income gives you $600 in monthly NOI.

- Multiplying the monthly NOI of $600 by 12 gives $7,200 as the annual NOI.

- Divide $7,200 by the $100,000 you paid, and you get 7.2.

So the cap rate on this property is 7.2%.

You can add estimates for minor repairs to the expenses to give a more realistic figure. You can also improve accuracy by accounting for vacancies. Online calculators such as this one make including vacancy rates easy.

Note: Cap rate figures are for operating income. That means it doesn’t include income taxes or mortgage payments for interest and principal.

Keep in mind that the operating expenses are expressed as a percentage, not a set number. Many readers make this mistake, and it’ll skew values.

Why It Matters

The cap rate is used for a number of purposes in real estate investment. Valuing individual properties is one of the main uses. We’ve highlighted the main reasons for using a cap rate calculator below:

Determining Relative Valuation

You can use the cap rate to see if a property is being offered for sale at a fair price. You can also use it to help you decide how to price a property you are selling.

In either case, do some research to find out what the cap factor is for similar properties of that type in that real estate market. A real estate broker should be able to provide this information.

Say a property is being offered at $200,000 and will produce a monthly rent of $2,000. You estimate operating expenses at $650 per month.

That means NOI is $2,000 minus $650 times 12, or $16,200. At a sale price of $200,000, the cap rate on this property is 12.35%.

Verifying Return Claims

Say your broker tells you the cap rate for this type of property in this market is 10%. Since this property indicates a higher cap, that suggests this is a deal worth looking at more closely.

You can do the same thing in reverse to suggest a selling price for a property you are unloading. You can also find out cap rates from appraisers and commercial services such as RealtyRates.com.

Guiding Purchase Decisions

Because a cap rate can suggest what kind of return a given property will generate, you can use it to choose between investments.

All things being equal, the property with the higher cap rate will be a more profitable investment.

Evaluating Overall Markets

You can use the cap rate to evaluate how healthy a market is. Lower cap rates indicate a stronger market where properties are in high demand. Major cities usually have higher cap rates than smaller markets.

Determining Lending Limits

Cap rates are used by rental income investors, but they are also used by appraisers when placing a value on a rental property. This is done by dividing the NOI by the cap rate.

For example, say a property has a cap rate of 10% and a NOI of $10,000. The value of this property will be $100,000. As cap rates decrease, prices increase. If the cap rate was 5%, the value would increase to $200,000.

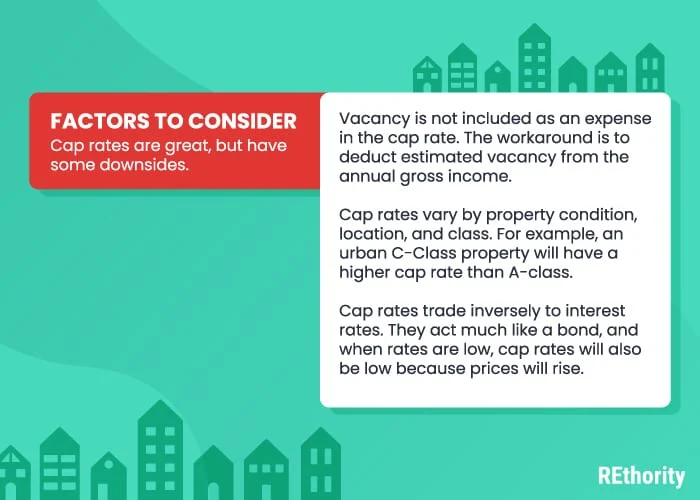

Cap Rate Factors to Consider

Because cap rates don’t include income tax or debt service, they don’t tell the whole story of an investment.

It just tells you how much you can expect to earn before income taxes and payments against loan principal and interest.

Vacancy Not Included

Also, unless you’re including vacancies in the way you calculate the cap rate, it won’t account for that factor.

This can be significant in high-turnover rental properties, such as student apartment complexes.

Vary by Location, Class, and Condition

As noted, cap rates are also location-dependent. A cap rate in Houston could be very different from a cap rate in a small market like Wichita Falls, Texas.

Cap rates may also vary by sub-market. Returns in the Dallas suburbs will likely be quite different from cap rates in downtown Dallas.

Cap rates are also dependent on the class and condition of the property. A new high-rise luxury apartment building will have one cap rate.

A garden apartment complex built decades ago that has a lot of deferred maintenance will have another.

External Factors Matter

External factors matter as well. Overall residential cap rates in the U.S. fell to very low levels just before the 2008 housing market collapse.

In that case, cap rates were driven down by low interest rates and easy credit to ultimately create a speculative bubble.

Cap Rate Alternatives

So, you’ve used our cap rate calculator to determine your return. And this number offers a simple way to measure a complex business.

So most real estate investors consider it only as one tool for evaluating investments.

But what other formulas and rules of thumb are available to investors? Well, it depends on what you want to calculate. Some popular formulas include the tools below.

Cash on Cash Return

Cash on cash return are another useful way to look at real estate investments. This adds debt service costs to the operating costs.

Then it divides the result by the cash invested in the property. Cash on cash is a good way to evaluate a property that is being financed.

Return on Investment

Return on investment is another option for cap rates. It takes into consideration the reduction in principal caused by making loan payments.

ROI is the ratio of cash after debt service plus principal reduction to invested capital.

Debt Service Coverage Ratio

Debt service coverage ratio (DSCR) is another measure. It compares the NOI to the required debt payments. To figure it, divide NOI by the loan payments.

Gross Rent Multiplier

Gross rent multiplier is a ratio of the price to the income the investment will generate. To figure it out, divide the purchase price or market value of the property by the gross annual income.

This is simpler than the cap rate. It only looks at income instead of also accounting for expenses, as the cap rate does. However, it can be a quick screen when looking at a large number of properties.

Limits of Cap Rates

Long-term rental investors often use the cap rate to compare and screen investments. House flippers don’t usually calculate the cap rate, however. Rental investors who only expect to own properties for a short time also probably won’t use the cap rate.

Cap rates are also of limited use when a situation is complicated and will change a lot over time. For instance, say you have purchased a multifamily property and plan to make significant upgrades in stages over a long period of time. A cap rate won’t help you much there.

Different cap rates may also be due to factors that are hard to see. A property may have a high cap rate compared to other market properties. But that could be because it has serious issues.

For these reasons, savvy investors rarely use cap rates alone to make investment decisions. It’s a screening tool and one of several assessment methods that can help identify good investments.

What Is a Good Cap Rate?

By now, the question of what a good cap rate might be is probably front and center. The short answer is that anything above 7% is an excellent cap rate in many markets. Typically, the cap rate in any given market will fall between 5% and 7%.

Of course, these factors vary based on location, property class, and market cycle. Assuming a 7% rate can help with quick screening. If a property has a higher cap rate than that, for instance, you may want to investigate it further.

Cap rates are a basic measurement of a real estate investment’s profitability. Understanding how to figure it out and when to use it is a basic skill for real estate investing.

But if you don’t want to do the math, we hope that our free online cap rate calculator makes it easy to quickly determine the returns you’re getting on your property.

FAQs

Does a cap rate include mortgage?

No, a cap rate does not include the mortgage. It only includes operating expenses, which allows you to easily determine the return on your investment and helps you find the best real estate deal.

What does a 7.5 cap rate mean?

In simple terms, a 7.5 cap rate means you should expect a 7.5 percent gross return relative to the value of your property each year. If your property is $100,000, expect to make $7,500 from it (before mortgage).

How do you calculate cap rate?

- Determine gross income and subtract your expenses to get net income

- Divide your net income by the purchase price.

- Convert this number into a percentage by moving the decmial 2 spaces to the right. That's your cap rate.

Is 5% a good cap rate?

Typically, 7 is what most investors strive for, so 5% is considered a lower than average cap rate. Given inflation is hovering around 5%, you'd essentially break even on your investment, and that's before factoring in any debt.