If you’re like me, estimating your property taxes has you wanting to pull your hair out.

Read on to find it and much more in this complete property tax guide.

Why You Need a Property Tax Calculator

If you’re a homeowner or real estate investor, you need to know how much property tax is in your area. Depending on where you live and the home’s value, you could owe a couple hundred or thousands of dollars per year.

If you don’t want to be surprised by a massive tax bill, you’ve come to the right place. Since property taxes vary so widely by your location and the value of the home, relying on an estimate or guess isn’t enough.

Why Use a Property Tax Calculator?

You need to know how much you can actually expect to pay to keep unpleasant surprises to a minimum. As you’ve probably found, getting accurate, up-to-date property tax information online isn’t always easy.

There’s a lot of information to wade through. A property tax calculator makes it easier, but you have to use the right one. We found that many of the ones available online are using outdated info that over- or under-estimates how much you’ll owe.

That’s why we’ve created a free property tax calculator with the latest property tax amount. You can use it to calculate how much you’ll pay in property taxes in your area.

As it turns out, these rates can be surprisingly affordable in notoriously high-tax areas, thanks to lower median home values. And some of the lowest rates in the nation aren’t as great as they seem due to sky-high median home prices.

Using Our Online Property Tax Estimator

Our calculator helps you tell the difference and see which areas in the U.S. offer the best and worst tax rates. You’ll also see how your tax expenses would rise and fall by choosing different locations in the country.

[rethority-ept-calculator]Once you’ve used the calculator to find out the amount you’ll owe, you can learn more about the history of property tax, what it covers once you pay it, and other things you should know about paying property tax in our complete guide.

There’s a lot of good information here for both homeowners and investors. We cover everything from the basics to more complex topics you might be wondering about.

Keep reading to use our free calculator (it’s super easy) and learn everything you need to know about paying tax on your property. We’ll start with what these taxes are, how they’re calculated, and who sets them.

What Is Property Tax?

Property tax is a percentage of a property’s value paid to local, county, township, or municipal governments. It typically serves to fund community programs, schools, utilities, and safety programs.

If you’ve driven on local roads, called a police officer or fireman in an emergency, attended a public school, or experienced the conveniences of clean running water, gas, and electricity, you’ve seen the results of property taxes.

The amount of property tax you’ll pay depends on your location and the taxable value—not the market value—of the property.

What Is a Property’s Taxable Value?

The taxable value of a property is the amount the county tax assessor uses to determine how much you will owe in tax. It’s what the assessor says the property is worth for taxable purposes.

The important thing to note is that taxable value is not the same thing as market value. So even if you’ve recently had the property appraised or have an idea of the current market value, you still won’t necessarily know the actual taxable value until the county tax assessor determines it.

Tax adjustments (like a homestead, senior, or disabled exemption) can reduce the taxable value below the actual market value. Some states use an assessment ratio, or a set percentage of the property’s appraised value, rather than the full value.

In any case, less taxable value means less property tax is owed, regardless of the market value of the home or building and land.

How Is Property Tax Calculated?

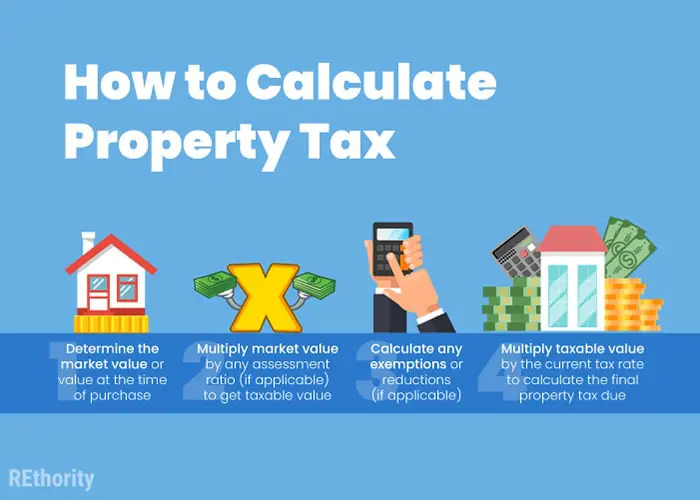

Different states and counties use various methods to calculate property taxes, but in general, this is how it works.

- Determine the market value or value at the time of purchase

- Multiply market value by any assessment ratio (if applicable) to get taxable value

- Calculate any exemptions or reductions (if applicable)

- Multiply taxable value by the current tax rate to calculate the final property tax due

Property tax is calculated by starting with the appraised market value of the property, which the county property assessor determines. Depending on the state or county, this could be the value when the property was purchased.

Or, the value may only be reassessed every few years. Then the property’s class and assessment ratio are calculated, if the state or county has such a policy.

The assessment ratio is a percentage of the property’s full market value used to find the taxable value. The property class may be residential, farm, commercial, or industrial.

For example, in Tennessee, residential and farm properties have an assessment ratio of 25% of appraised value, while commercial and industrial property assessment ratios are 40% of appraised value.

This means property owners’ taxes are based on 25–40% of the property’s value (depending on the class). From there, the taxable value is calculated. This is done by multiplying the appraised value by the state’s assessment ratio according to the property class.

If the owner qualifies for any exemptions, such as military service, age, or disability, they are worked out. Some states offer these exemptions as a reduction of the taxable value.

Some states fully exempt certain groups (especially veterans) from paying any tax. Next, the final taxable value is multiplied by the local tax rate.

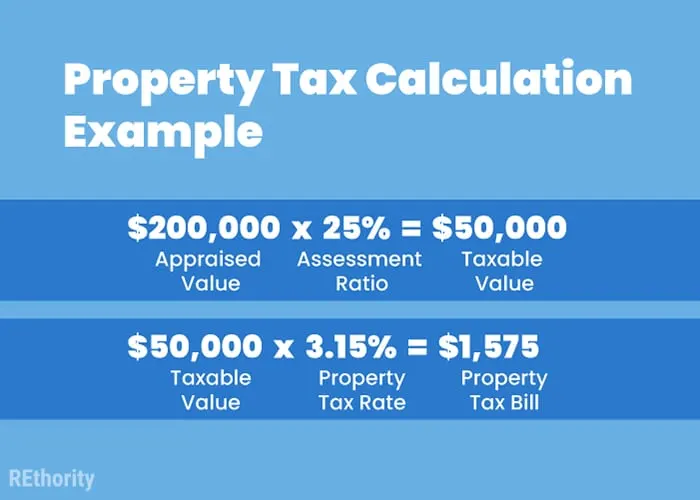

Property Tax Example

Let’s use the Tennessee assessment ratios above as an example. Say you own a residential property (25% assessment ratio) in Nashville, TN, where the tax rate is 3.15%.

If it is appraised to be worth $200,000, the assessed or taxable value—25% of the appraised value—would be $50,000. Multiplying the taxable value by the property tax rate of 3.15% means you would owe $1,575 in taxes.

It’s helpful to know how these rates are calculated, but there’s an easier way to do it. Just plug your information into our free calculator to find out how much you’ll owe on your property anywhere in the U.S.

Find out if you’ll be on the hook for a few hundred or several grand in annual taxes in less than a minute!

Who Sets the Tax Rate?

The county tax assessor is the one who calculates the taxable value of properties, but who’s responsible for setting the property tax rates in your area? That duty falls to local and municipal governments, including the local school board and county commission.

Local governments determine the tax rate by considering what services they provide for the public, the budget required to provide them, and the county tax base (the total taxable value of all properties in the jurisdiction).

First, they look at the operating budgets for all services and programs in the jurisdiction. Then, they consider the amount of revenue that is collected from all sources other than property taxes (like sales tax, state aid, etc.).

That revenue is subtracted from the budget to show the tax levy—the amount generated from taxes on property in the jurisdiction. Basically, they determine how much must be collected from property owners to cover the budget by subtracting all revenues from the total budget.

The tax levy is then divided by the total taxable value of every property located in the jurisdiction. From there, the jurisdiction will choose whether to charge tax rates on every $100 of taxable value or every $1,000. This is the property tax rate.

These rates do vary quite a bit by location and jurisdiction. Some areas provide more public services than others, which means a higher operating budget.

To cover the tax levy, they may charge a higher tax rate to cover the budget. Take a look at the highest and lowest tax rates in U.S. counties next.

5 Least Expensive Property Tax Counties

Here’s a look at the counties with the lowest property taxes. Most of these counties are in the southern U.S. Consider the median home price in these counties to get a clearer picture of how much you might pay.

And be sure to check our calculator tool to get a more accurate idea of what you’d owe in different areas. The figures listed are the effective property tax rates, which take the rate and the total value of homes occupied in the county.

- Daphne, AL: 0.33%

- Honolulu, Hawaii: 0.35%

- Montgomery, Alabama: 0.38%

- Tuscaloosa, Alabama: 0.39%

- Colorado Springs, Colorado: 0.41%

While Honolulu County’s rate is the second-lowest in the U.S., the median home price there is about $880K. Daphne County Alabama’s median home price is about $209K, so the annual taxes would be much lower there.

5 Most Expensive Property Tax Counties

The highest effective property tax rates are in the following U.S. counties.

- Alcona County, Michigan: 6.61%

- Bureau County, Illinois: 4.17%

- Allegany County, New York: 3.84%

- Salem County, New Jersey: 3.79%

- Sullivan County, New York: 3.55%

In Alcona County, Michigan, the median home price is around $112K. While that’s a low home price, the higher tax rate means you’d pay a lot more there than somewhere like Daphne County, Alabama.

Try it out yourself by using our property tax calculator to see what you’d owe in different areas of the U.S.

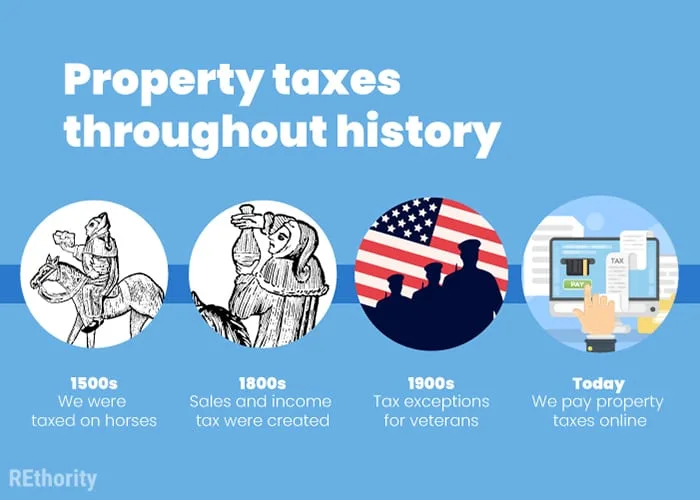

The History of Property Taxes

We’d be remiss if we didn’t dive into the history of property taxes. It’s boring to most, but intriguing to some. And it’ll help explain why the numbers our handy property tax calculator spits out vary so much!

Colonial Days

Property taxes have been around in the United States since colonial times. At first, most states (14 of the 15 at the time) taxed land, with only four states choosing to tax personal property as well (like livestock and items for trade).

In the early years of the nation, property taxes and how they were applied varied widely by state and local governments. In North Carolina and Vermont, property owners were taxed for the amount of land they owned.

In New York and Rhode Island, they were taxed based on how valuable or desirable the land was. In Delaware, owners were taxed based not on the property owned but on the income earned from it.

The differences in taxation across states and local governing bodies didn’t fit the “united” principle the states wanted. This was the driving force that created a new, nationwide principle to simplify the structure.

From 1796 through the end of the Civil War (1865), property taxes were applied, as the New Jersey constitution put it, “at one uniform rate.”

Instead of taxing based on the amount of land or the income earned from it, all states began taxing based on the land’s value. This made things a lot easier.

Post-Civil War

Once the Civil War was over, things changed a bit. Up to this point, land, livestock, and items for trade were the most common and important items of value for taxation.

But with the rise of corporate stocks and other intangible assets that were hard for local governments to track and tax, new state tax options were created.

Income and sales taxes created a way for states to tax property owners for their intangible assets. Property taxes remained the responsibility of county and local government bodies.

States collected revenue from citizens’ income and purchases; counties and local governments collected revenue from the property owners in their jurisdictions.

The Great Depression and WWII

This seemed to work well until the Great Depression hit. After a stock market crash in October 1929, a major economic downturn ensued and lasted through 1933. As a result, many Americans couldn’t pay their property taxes.

Local governments’ revenues plummeted. In an attempt to offer economic relief to those hit the hardest, many local taxing jurisdictions started offering new exemptions for military veterans. We still see these exemptions in many of today’s tax codes.

After the Great Depression and World War II, it was clear that unrestrained property taxes could be damaging financially for many American families. So different states started instituting their own limitations on these taxes to keep them in check.

These limitations included limiting the percentage of the taxes to no more than 1% of the full cash value (in California) and controlling how much property values could be increased through annual assessments.

Modern America

Today, there is still a lot of variation in how property is taxed in different states, counties, and local governments. But it’s helpful to understand the “trial and error” history of these taxes over the years and why they were instituted to begin with.

Now, let’s look more closely at what property tax actually covers and what its purpose is.

What Property Taxes Cover

Property taxes pay for programs and operations that the local governments offer for the convenience and protection of their citizens. Infrastructure, schooling, and safety programs are some of the things these taxes cover.

Cities, townships, counties, utility and special districts, and school districts all rely on property owners paying their taxes to cover their respective budgets. For example, school districts get about 83% of their funding from these taxes.

It costs money to offer essential services to the public, and that money has to reliably come from somewhere. By imposing a fixed tax on property owners who benefit from these services, the governing bodies ensure there is a steady stream of income to cover those needs.

Property vs. Income and Sales Tax

It’s a more reliable source of income than income and sales taxes, too. Income and spending habits can change, and when they do, the amount collected from income tax and sales tax also changes.

If paid on time, the revenues from property taxes don’t change unless a building, home, or lot’s taxable value changes. The revenues collected from property tax are always equal to the tax levy.

This is simply the amount the governing body has budgeted and needs to continue operating as usual. Such a levy helps run schools, build roads, operate fire and police departments, and more.

This is the reason that unpaid property taxes can result in government seizures. The tax is needed to continue operations, so if it’s unpaid by a property owner, the government will seize and sell the property to recover the amount and pay the taxes.

Things to Consider When Using a Property Tax Calculator

Now that we’ve looked at what these taxes are, how they’re calculated, who sets them, their history in the U.S., and what they cover, let’s look at a couple more things you should know about property taxation.

Home Prices Matter, Too

The tax rate is important for homeowners and real estate investors, but it’s not the only factor you should consider. The price of the home or lot you’re purchasing matters quite a bit.

For example, in Hawaii, taxes on property are at the lowest rate in the U.S. Property owners there pay an effective property tax rate of just 0.27%! But there’s more to the story. With a median home price of around $648K, the amount owners pay isn’t nearly as low as you’d think.

Look for property in a state with a lower median home value and a low property tax rate to ensure you’re not paying more than you expect in taxes each year. Learn about the states with the lowest property taxes here: States With No Property Tax.

Property Tax Exemptions

There are plenty of exemptions in different counties regarding owners’ responsibilities for tax payments on properties, but here are some of the most common:

- Homestead Exemption: Residents who own and live in their homes may pay reduced taxes compared to investors or any property other than a primary residence.

- Veteran and Military Service: Some states offer reduced or complete exemptions for veterans and honorably discharged military personnel, and sometimes their spouses if the service member is deceased.

- Senior Citizens and Disabled Citizens: Seniors aged 62 and older (65 in some states) and disabled citizens may be eligible for property tax reductions and exemptions.

- Low Income or Financial Hardship: Seniors with low income and homeowners with demonstrable financial hardship may qualify for tax exemptions in some states.

- Mobile Home Dwellings: Property considered a mobile home might qualify the owner for a reduction in the amount of tax owed in some states.

Reducing Your Property Taxes

Many people don’t realize that you can appeal your tax bill if something isn’t right. If you believe the assessment was incorrect or unfair for your property, you can always appeal or bring supporting information to your local elected officials.

If the assessment was too high, gather any proof that your property’s value has gone down or has not risen. If they agree with your proof, you could have your bill reduced.

If the rate has risen and you’re unhappy with it, you can always complain to your elected officials.

Did Our Property Tax Calculator Help You?

Make sure to use our handy calculator to see how much you’d owe in taxes in different areas in the U.S. You’ll be able to adjust the home’s value and see what the tax rate will work out to be wherever your property is located.

Whether you’re purchasing a place in New Jersey or California, knowing what to expect in terms of tax rates can help you make a more informed decision.

As a homeowner or investor, be sure you know what your ongoing expenses will be to stay current on your taxes. Remember, finding the right location and not overpaying is the key to keeping your taxes as low as possible.