The topic of cash on cash returns is pretty simple, but investors occasionally misunderstand it.

We’re here to help you make sense of the concept and how it varies from other types of returns. Read on to learn more.

What Is a Cash on Cash Return?

If you’re thinking about investing in real estate, you need to understand what a Cash on Cash Return (CCR) is.

The cash on cash return (also called the equity dividend rate) helps you determine how much cash flow you actually earn each year.

This amount is then compared to the money (cash) you originally invested in a property by figuring in all your cash flow, expenses, and mortgage payments for the year.

It’s rare for a real estate investor to pay the full purchase price of a property in cash. Most take on some form of debt to cover part of the purchase price because commercial properties are so expensive compared to residential properties.

This is what makes the actual cash invested and the resulting cash flow so much more important to the investor than the total purchase price.

Why It’s Important for Investors

Atstock Productions/Shutterstock

The cash on cash return method is one of the most important ways for real estate investors to calculate ROI. As an investor, you’re not interested in just finding out the total annual return on your investment.

You want to know what your cash on cash return is when you factor in all your expenses, your mortgage payments, and your current cash flow.

You want to know how your investment is performing each year by finding out your true rate of return in terms of cash.

That’s why real estate investors almost exclusively use this method. It is rarely used by other investors, who benefit more from calculating the standard return on investment (ROI).

What Does a Cash on Cash Return Show You?

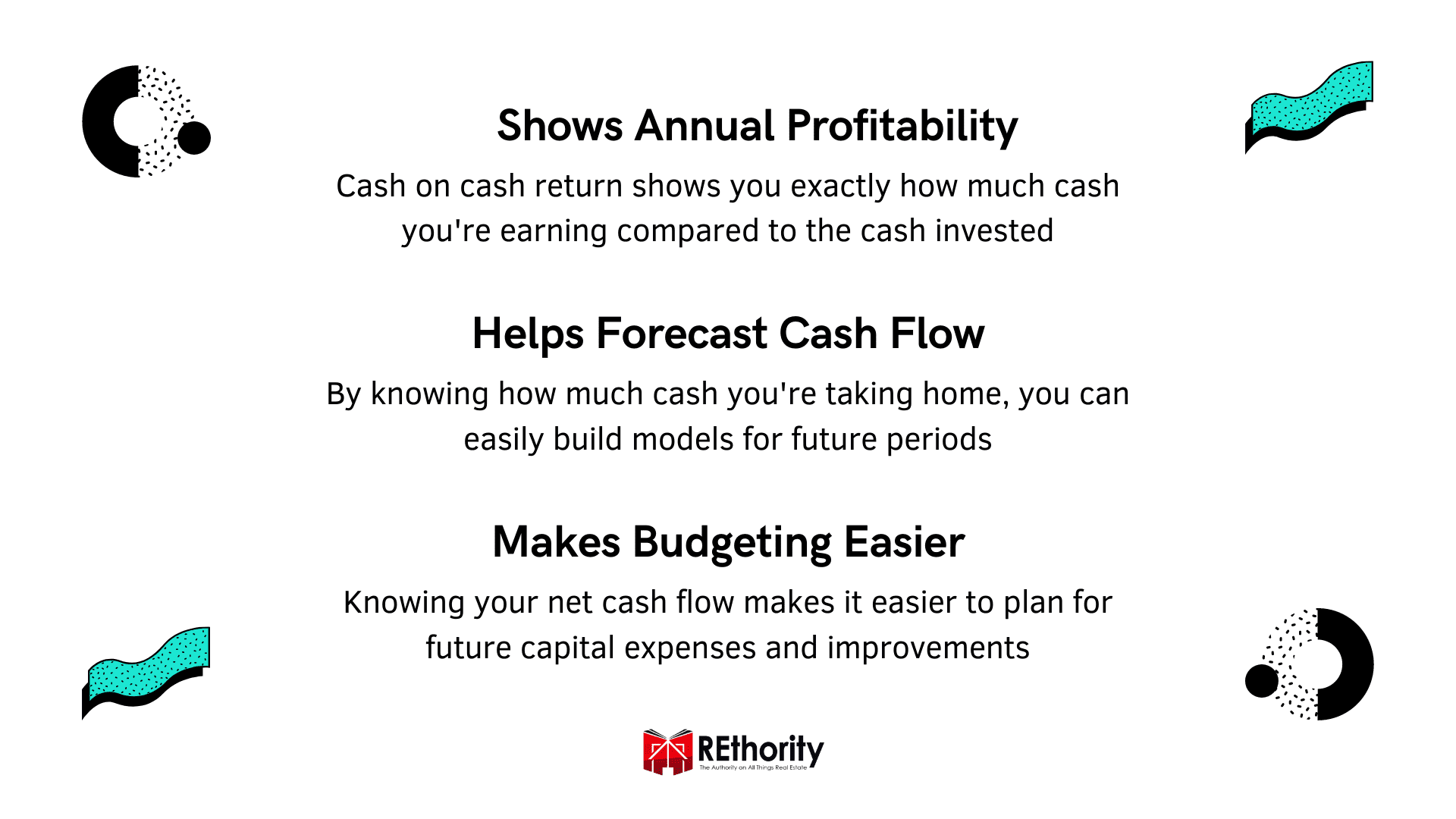

The cash on cash return rate shows your annual profitability by looking at the amount of cash you’ve invested (in mortgage payments and your original investment).It ignores the total purchase price of the property and focuses only on the amount of cash you invested.

You put potentially hundreds of thousands of dollars into the original purchase. You’ve paid thousands in mortgage payments over the year.

You’re generating monthly rental income from the property, but you’ve also had to pay insurance premiums, closing costs, and maintenance costs out of your own pocket.

How much are you really making when all that is said and done? What’s your actual rate of return? That’s what a cash on cash return calculation shows you.

A cash on cash return looks at the current period. While it’s not used to calculate your average annual return over the lifetime of an investment, it helps you develop an estimate of how much cash flow you’ll generate and how much you’ll pay in expenses in the coming year.

You can find your true annual profitability (pre-tax) with all things considered (expenses, mortgage payments, cash flow) by using the cash on cash return or equity dividend rate.

How to Calculate Cash on Cash Return

Rattanasak Khuentana/Shutterstock

Calculating the cash on cash return for an investment property is relatively simple. You’ll need to know your upfront and annual expenses and your annual cash flow to do this calculation.

Annual (Before Tax) Cash Flow / Total Cash Invested = Cash On Cash Return

- Your annual cash flow before taxes is the amount you make from the property, which is rent and any other income you make from it. It also includes your debt expenses.

- The total cash invested includes all the cash you paid upfront (your down payment) and all the cash you have to pay to keep the property running, which may include:

- Any renovation/repair costs

- Maintenance costs

- Supplies

- Cleaning services

- Property management services

- Utilities

- Insurance premiums

The cash on cash return is the amount of cash you’re actually earning when you factor in all your income and expenses for the property.

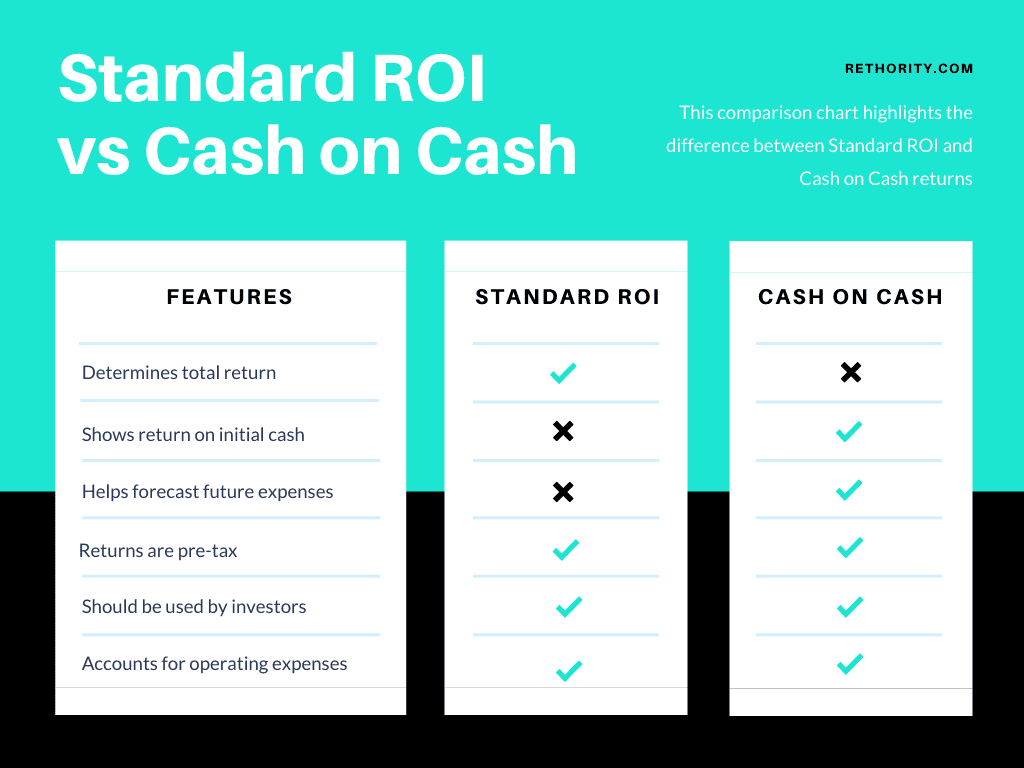

Standard ROI vs. Cash on Cash Return

Why can’t you just use the standard ROI calculation to find your rate of return on a commercial real estate investment?

Let’s look at a simplified example (no closing costs, no commissions, etc.) to see why standard ROI just doesn’t apply to commercial real estate investments.

Let’s say you purchase an apartment building for $1,000,000. You sell the property for $1,100,000. Standard ROI calculations would show that your return is 10%—you’ve made 10% more than the original total investment of $1,000,000.

The problem is, that return isn’t accurate because you didn’t invest $1,000,000. Your only investment was the 10% down payment on the property ($100,000) to buy it and your operating expenses to keep it running.

You need to look at the cash on cash return instead, which is 100% in this case. That’s because you only invested $100,000, and the property sold for $100,000 more than the purchase price.

The return rate on most commercial real estate investments (and many residential ones) just can’t be accurately calculated using the standard ROI. If you didn’t pay the full purchase price in cash, you need to rely on the cash on cash return rate instead.

Calculation Examples

Andy Dean Photography/Shutterstock

Let’s look at an example of calculating the cash on cash return on a property.

Annual Pre-Tax Cash Flow (Gross Income Plus Debt Expense)

First, you need to figure out how much you make in rent and other income (parking, laundry, soda machines, etc.) from the property in a year to plug into the first part of the formula.

This is the property’s gross income, not the annual cash flow; we haven’t yet figured out the debt-related expenses.

Add up your annual mortgage, principal, and interest payments (these reduce your overall cash flow) and subtract them from your gross income.

Let’s say your property’s gross income is $100,000, and you’ve paid $45,000 in mortgage payments over a year. That leaves you with $55,000 in annual pre-tax cash flow.

$55,000 / Total Cash Invested = Cash on Cash Return

Total Cash Invested (Down Payment Plus Operating Expenses)

Next, you need to find out how much cash you’ve invested in total. This includes your down payment and all your operating expenses.

If your down payment was $100,000 and your operating expenses were $20,000, your total cash investment would be $120,000.

$55,000 / $120,000 = Cash on Cash Return

Cash on Cash Return

When we divide the annual pre-tax cash flow of $55,000 by the total cash invested of $120,000, the result is 0.45. Multiply this by 100 to get a percentage of 45.8%. This is the cash on cash return, or equity dividend rate.

The total cash on cash return rate for this example is 45.8%, which would be an incredibly high rate of return.

$55,000 / $120,000 = 0.45 (x100=45.8%)

What Is a Good Cash on Cash Return Rate?

Rido/Shutterstock

More than likely, you won’t see a 45.8% cash on cash return as we did in our example. What’s a more realistic goal? Let’s look at what a good cash on cash return rate would be.

While the cash on cash return rate you should shoot for varies in different markets, a general rule of thumb many investors stick to to make sure an investment is worth their time is 8% to 12%.

Lower rates of return might be workable in certain markets, but you’d rarely want to invest your time and money in a property with a rate of return lower than 5%.

Should You Use a Cash on Cash Return?

How much are you really making from your real estate investment with all things considered beyond the standard ROI—your mortgage payments, your initial down payment, your operating expenses, and your annual cash flow?

The cash on cash return formula will help you answer this question with confidence. The cash on cash return rate is an essential tool to have in your investor toolkit. It won’t only help you make more sound property investments.

Does the Cash on Cash Return Do?

Pathdoc/Shutterstock

But it will help you get a more accurate look at how your investments are performing on an annual basis. After all, it’s important to know how much you’re making on your initial capital investment.

If you can estimate the annual cash flow before taxes and total cash investment on a property before you own it, this formula can help you determine whether or not it is worth your involvement.