Investing in real estate usually requires you to have a sizable amount of capital and knowledge about the real estate process.

If you don’t have a lot of money to spend upfront but want to learn more about the world of real estate investing, wholesaling real estate may be the perfect way to start.

Wholesaling is different from other forms of investing in real estate because it doesn’t require that you put your own money at risk or hold onto a property for an extended period of time.

You won’t need to rehab or renovate any properties, deal with tenants, or worry about a property’s value changing over time.

There are several essential points you should understand about wholesaling real estate before you get started.

We’ll cover them all here, show you some examples, and give you a checklist you can use to begin wholesaling when you find the right property.

What Is Wholesale Real Estate?

Real estate wholesaling involves a seller, a wholesaler, and an end buyer—someone who eventually purchases the property from the wholesaler. The seller lists a property for sale (usually one in need of renovations) and is contacted by the wholesaler.

The wholesaler acts like the middleman and accepts a pre-written contract for the sale of the property, but doesn’t buy the property themselves. Instead, they “shop” the property around for interested buyers.

When they find a buyer, the seller’s contract applies, and the wholesaler simply collects an assignment fee from the transaction. This might be a percentage of the total sale price.

It could be the difference between the amount the seller originally asked for the property and the amount the wholesaler had a buyer agree to. We’ll look at an example below. Who usually buys properties from wholesalers?

It’s often other real estate investors who can depend on the wholesaler to find properties priced below market value. Even with the fee the wholesaler takes out of the sale price, the price of the property will be lower than a property that has been “fixed and flipped.”

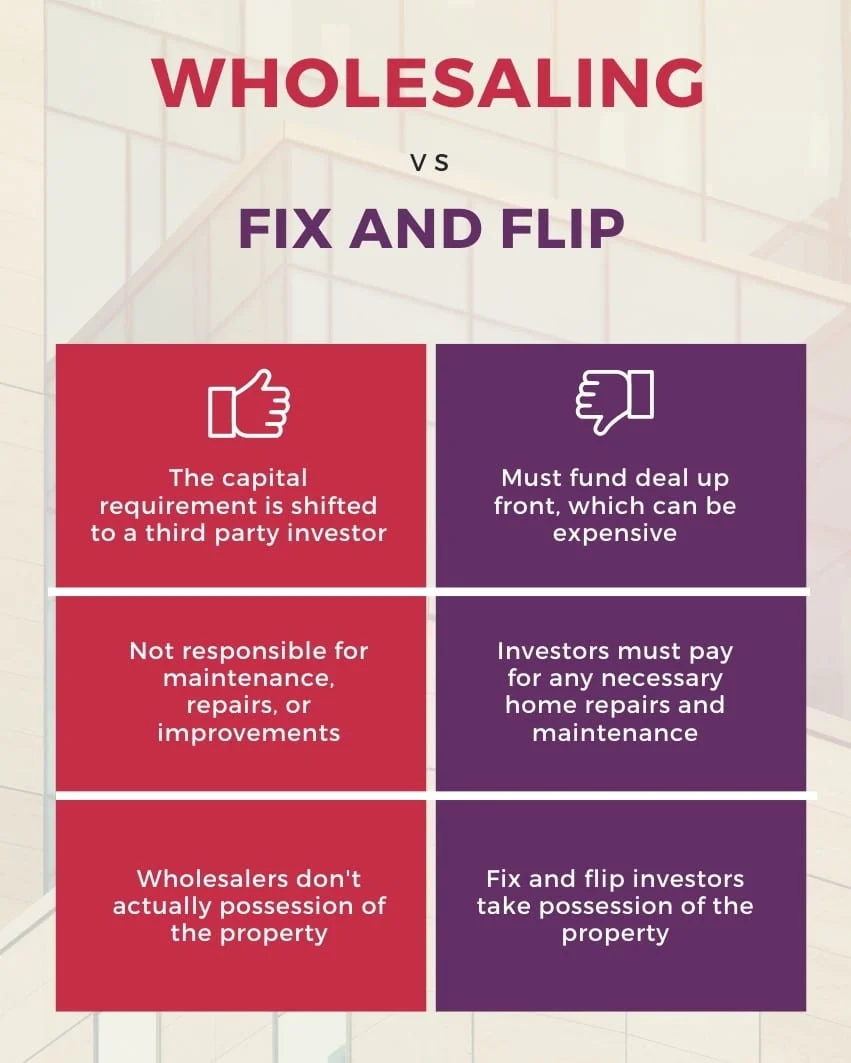

Wholesaling Vs. Fix and Flip

Wholesaling is not the same strategy as “fix and flip.” Here are the main differences between these two real estate investment strategies:

Upfront capital is required. Fix-and-flip investors buy and renovate a property to eventually sell it for a higher price than they bought it for. Wholesalers don’t need any capital upfront; their strategy is to find a buyer and take a fee out of the sale price.

Maintenance and repairs. Fix and flip investors are heavily involved in the property; if they’re not making the repairs and renovations themselves, they’re hiring crews to do them. Every cent comes out of their own pocket.

Wholesalers, on the other hand, aren’t on the hook for any maintenance, rehab, or renovation projects. That’s the end buyer’s responsibility.

Property ownership. Fix-and-flip Investors actually own the properties they are renovating. Wholesalers never own the properties they represent for sellers. They are purely the middleman during the transaction.

Period of involvement. A fix-and-flip investor owns the property for as long as they want. They might flip a house to sell it quickly or plan to hold onto it indefinitely to make rental income from it.

Wholesalers are involved on a very short-term basis. Once the contract closes with the buyer and they collect their fee, their involvement ends.

While there are some similarities between these two investment strategies, the goals of fix and flip investors are very different from the goals of real estate wholesalers.

Wholesaling real estate can be an excellent way to segue into fixing and flipping properties later on.

You’ll learn about the real estate sale process in detail, get a better understanding of the real estate market in your area, and meet other real estate investors who you can learn a lot from.

Wholesale Real Estate Example

Let’s consider an example to pull it all together. A woman inherits a house but doesn’t want to deal with the number of repairs it needs to sell it at market value. She puts the property up for sale at $75,000 and is approached by a wholesaler.

The wholesaler offers to quickly find a buyer for the property that will exceed her asking price on the condition that they are allowed to keep the difference.

She agrees, and the wholesaler contacts a few real estate investors to see if they’d be interested in the property at $85,000.

When one of the investors agrees to buy the property for $85,000, the wholesaler keeps the $10,000 difference in the asking and purchase price. That’s the fascinating part about wholesaling real estate.

In this example, the wholesaler collected a $10,000 profit without ever putting up capital, owning the home, worrying about repairs, managing tenants, or dealing with the eventual sale of the investment property.

If you think wholesaling real estate is right for you, take a look at our checklist below to see how you can get started.

Wholesaling Checklist

Build a roster of buyers. It’s helpful if you’re connected to a group of real estate investors who will appreciate investment properties being brought to them rather than seeking them out.

If you’re not already, you may want to join your local Real Estate Investors Association (REIA) to meet other investors in your area.

Find the right property. The next step is finding a “distressed” property (one that needs repairs or renovations) that is listed for a low price and will be attractive to investors. Distressed properties are likely to have motivated sellers who are willing to accept a lower offer.

If you’re considering making this a full-time pursuit, you can reach motivated sellers who may want to sell for a low price.

Do this by purchasing lists of property owners who are going through a major life change (divorce, change of job, property heirs, those who are behind on property taxes, etc.).

Do your research. You will need to do some local research to see if the price is right for the property. Also, consider what kinds of repairs the eventual buyer will need to pay for.

If the entire roof needs to be replaced, that’s a much bigger expense than replacing some siding or tearing out carpet. You want to make sure the deal you’re offering to investors is one they can profit from in the end.

Make an offer. Talk to the seller about the repairs and renovations the property will need. Explain that you will personally find a buyer who is willing to exceed the amount of your offer and that you’ll keep the difference or collect an assignment fee.

Remember: Make a fair offer that is low enough to leave you enough room to make a profit on the sale, but not so low that it’s offensive to the seller.

Add a contingency. Once you’ve made an offer and the seller has accepted it, you’ll enter into a purchase contract. This protects the seller and you.

As a wholesaler, you don’t want to be on the hook for a property if your efforts fail, and you can’t find a buyer. You will add a contingency to the purchase contract that gives you the ability to exit the deal if you don’t find a buyer in time.

Find a buyer. Ideally, finding a buyer is a step you should start thinking about much earlier in the process. As soon as you find the right property, you should begin asking investors you know if they’d be interested or start reaching out to them. Without a buyer, you won’t make any profit by wholesaling.

Assign your fee. When the buyer is ready to close on the property, you’ll create your assignment fee with the buyer.

You might ask for the cash difference between the amount on your offer and the amount the buyer purchased for, a percentage of the total sale, or a flat fee. Once your fee is decided, the rest is just paperwork.

Execute an assignment of a contract agreement. The purchase contract you signed with the seller before will now be assigned to the buyer, freeing you from any financial obligations and transferring them to the seller.

It keeps all the terms of the original contract. Once this happens, you might collect a deposit from the buyer while you wait for the closing.

Collect your fee. At closing, the buyer will have the funds to both purchase the property and pay your assignment fee. The title company you use will write you a check for the full amount of your assignment fee.

Is Wholesaling Real Estate Right for You?

With this in mind, is this something you can see yourself doing? Wholesaling might be the right investment strategy for you if you meet the following criteria:

- You don’t have a lot of capital to invest upfront

- You’re uncertain about investing your money into real estate

- Your credit score prevents you from getting financing

- You don’t want the hassle of dealing with repairs and renovations

- You don’t want to be responsible for property maintenance over time

- You don’t want to manage tenants and collect rent

- You prefer a short-term investment to a long-term one

- You want to learn more about real estate and connect with investors

- You believe you can find interested buyers

- You’re a good negotiator and communicator

- You have an understanding of real estate or are willing to learn

This is why wholesaling is a great “entry-level” way to get into real estate investing. In fact, wholesaling can provide you with the cash you need to start making larger and more profitable investments.

The profits you make from a few wholesale properties could be enough for you to buy a fixer-upper with cash.

While it’s a little more complex than just being the middleman for the sale of a property, it’s still an excellent way to generate cash quickly or simply see if real estate investing is something you’ll do well in.