A home warranty is an excellent investment to protect yourself from unexpected home repairs. In 2018, the average cost of home repairs was $6,649.

For homeowners who don’t have significant savings or simply don’t want such a big bill at any one time, the home warranty plan is the answer.

By paying into the home warranty, the homeowner can fix their costs for repairs based on what the warranty costs and any trade service fees. Let’s dive in.

What Do Home Warranties Cover?

Simply put: a home warranty is a service contract. You pay a monthly or annual fee to the warranty company, who will, in turn, cover the costs of your home repairs when you have a claim (less the service fee).

The goal is to mitigate expenses and unexpected repair costs for plumbing, home systems, and appliances. Every home warranty company is different with a different list of what is covered and what is excluded.

It’s important to make sure you purchase the home warranty from a reputable source with the financial stability to pay a claim. Here’s a horror story relayed to us by real estate agent, John Myers of Myers & Myers Real Estate, Inc:

One of our clients purchased a home warranty from a local home inspector. When the first rainstorm came, the roof had several leaks. The home inspector did not identify any issues with the roof. The home buyers contacted a roofing contractor to evaluate the roof. The roofing contractor notified the home buyer the roof needs to be replaced. The homeowners contacted the local home inspector to collect on their home warranty. The local home inspector did not have the finances to back up his warranty. They are headed to court to resolve this issue.

This is why shopping around is the best bet for homeowners to make sure they get a home warranty that covers their biggest risks and concerns.

Systems Coverage

Most home warranty companies will offer a plan that includes systems coverage. This might be part of a more comprehensive plan or as a stand-alone contract.

Systems are the functional components of your home that are necessary to live safely or comfortably. Home warranties often have a list of systems coverage that includes:

- Heating

- Ductwork

- Central air conditioning

- Electrical systems and wiring

- Garage door openers

- Fans – attic, ceiling, and exhaust

- Central vacuum systems

- Doorbells

- Smoke detectors

For example, assume your garage door suddenly stops working. You’ve changed the remote batteries and attempted a few DIY tricks you found on YouTube to get it to go up and down.

But when you hit the button, all it does it rev the motor without the door moving. You call the home warranty company, pay the trade service fee, and they cover the $495 repair bill to replace the motor bands instead of you.

Plumbing Coverage

Some plans list plumbing as part of the overall system’s coverage, while others list plumbing as its own category. Some of the components of the plumbing that are covered include:

- Toilet tanks and bowls

- Water heater

- Plumbing system – pipes and connectors

- Plumbing stoppages

- Circulating pump

- Sump pump

- Pressure regulators

In general, the plumbing system applies to pipes and components within the home’s walls or under it. This means that once the pipes extend beyond the home’s footprint, it is likely not covered under most plans.

Anything happening within the home is covered, but keep in mind that accessing the components might require other work, repairs, can costs. For example, your water heater stops producing hot water.

Rather than be left with cold showers until you can afford a new one, you call the home warranty company, pay the trade service fee, and have a technician come out.

This is a covered claim as long as the problem with the water heater isn’t the result of rust or corrosion in the tank.

The technician finds out that the electrical board that controls the water temperature is fried and needs to be replaced. It’s a much easier fix than ordering a new water heater gets you back to hot showers within a couple of days.

Appliance Coverage

The appliance coverage option is one of the most important parts of a home warranty plan for many homeowners who worry about the refrigerator or dishwasher dying on them.

While every plan is different, the most common appliances covered in plans include:

- Refrigerator

- Dishwasher

- Oven range

- Garbage disposal

- Instant hot water dispenser

- Trash compactor

- Washer and dryer

Appliance coverage means that the warranty company will either fix or replace a covered item. Upon a service call, the technician evaluates the problem and provides the warranty company with their professional assessment.

Attempts to repair the issue will be made first unless the unit is deemed to be unrepairable. For items unable to be repaired, the home warranty company will replace the item up to policy caps with the same or similar model of appliance.

In most cases, the replacement is an upgrade since older models are no longer viable options for replacement. For example, your gas range stops igniting when you turn the nob. You only hear clicking that lasts for several seconds.

But nothing ignites as it should. You debate whether or not you should replace the range, but it’s a high-end range valued over $1,500. Remembering that you have a home warranty, you make the call.

A technician comes out and replaces the starter mechanism in the range that seems to do the trick. However, a week later, the same issue happens again.

The repair is still under the warranty of the same trade service call, so you ask the warranty company to revisit the issue. It turns out that it wasn’t the actual starter mechanism but corrosion within the gas line preventing a steady flow.

This is replaced as well. Now you have two new components to your high-end range with service calls and parts costing more than $500 for the $75 service fee you paid. Your range works fine after the second call.

Optional Add-Ons

Most plans offer special upgrades or optional coverages. For an extra fee, you can get additional items covered. These add-ons often include:

- Additional refrigerators

- Pool and spa equipment

- Well pumps

- Guest unit coverage

For example, you have legally converted your garage into a guest studio with a separate bathroom and kitchen. You’ve opted to have your home warranty plan cover the guest unit as well and pay an additional annual fee for this.

The toilet in the guest unit backs up. As the landlord, all you need to do is call the home warranty company and request service. Warranty companies usually respond within 24 to 48 hours though they may expedite service if the unit is uninhabitable during the claim.

The plumber arrives and fixes the toilet and snakes the line for the service fee owed by contract. In an example such as this, it is good to ask the home warranty company if you are allowed to call your own service repair person and get the repairs covered by the home warranty.

Some providers do allow this as long as it is known ahead of time and for emergencies. This can expedite the repairs while taking advantage of the home warranty.

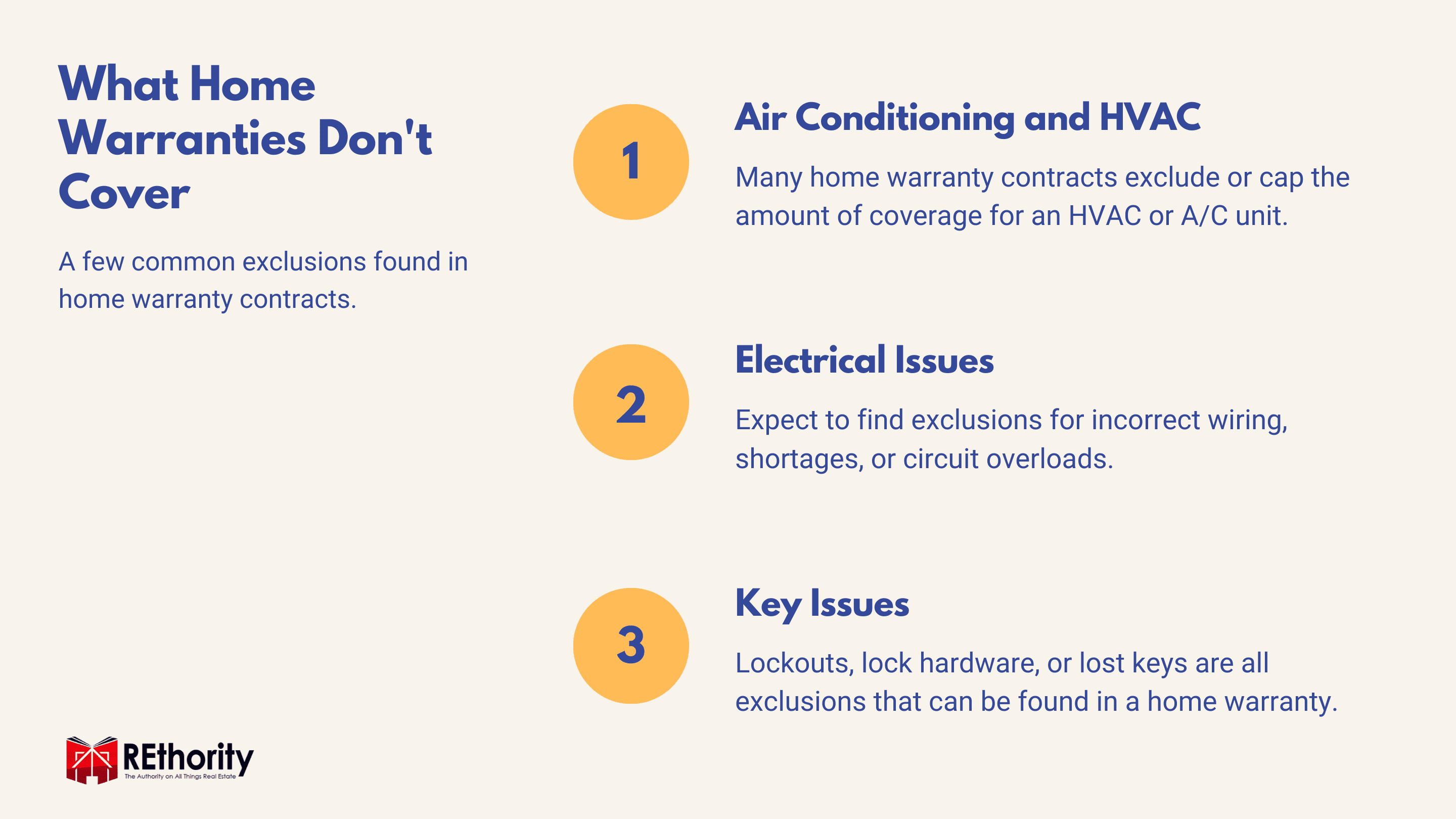

What Home Warranties Don’t Cover

Although the warranty covers a lot of major repairs and breakdowns, a home warranty contract isn’t an all-inclusive contract. Every contract from every provider usually has a long list of particular exclusions.

You should read carefully before committing to a contract. Understand what the exclusion means and how it affects the costs of a repair if part of a failed system isn’t covered.

Some common examples of items excluded from coverage include:

- Air conditioning and heating: wall units, outside or underground pipes, water towers or chillers, storage tanks, portable units, source heat pumps, and wood heating units. Many home warranty companies cap how much will be paid for ductwork as well.

- Electrical: Circuit overloads, AV or intercom and alarm systems, and telephone wiring.

- Plumbing: Pipes outside of the home, stoppages caused by collapsed or damaged drains, pipes infiltrated by roots, saunas, and steam rooms.

- Water heaters: Solar water heating systems, storage tanks, damage caused by rust or corrosion.

- Re-key: deadbolts, knobs, or associated hardware with locks and doors.

- Pools and spas: Liners, jets, above ground pools or spas, lights, and jets.

Exclusions mean the service contract may not cover part or all of your warranty claim. Often, there is language in the contract that states that any modifications or adjustments to the house are not covered when fixing or replacing a covered item.

For example, if your washing machine breaks down and the service technician determines that the entire unit needs to be replaced, your washing machine would be covered up to the contract limits.

However, if the installation of the new washer required the replacement of a corroded water valve connecting the washing machine to the house, it would not be covered by the repair.

Note that the valve may be covered by the plumbing systems and subject to a second service call. This is why it is important to understand trade service fees.

What Are Trade Service Fees?

A trade service fee is what you pay when you make a claim on the home warranty contract. Think of it as a deductible with a homeowner’s insurance policy.

Like a homeowner’s policy, there is the premium you pay and then a deductible you are responsible for in a claim. The home warranty company has the contract fee you pay and then a trade service fee when you call for a repair.

Most companies in the industry call this a trade service fee, and you may see it shortened in sales or contract literature as “TSF.” Most trade service fees range from $65 to $110 for home warranty companies.

As noted in the example above, you may end up having two trade service fees for the same issue. Say your original call was for a washing machine that stopped working, so you paid your first trade service fee.

You might pay a second one to have the valve changed so that the entire repair is covered less the trade fees. Of course, you’d probably want an estimate on the cost of something like changing a valve as it could be less than the cost of a second trade service fee.

Home Warranty vs. Homeowners Insurance

When something goes wrong in your home, it can be confusing to know who to call to get the help you need. With a good home warranty and a homeowner’s insurance policy, many things are covered. The question is, which covers what.

As already explained, home warranties cover unexpected repairs to home systems and appliances. Homeowners insurance, on the other hand, covers losses from covered perils such as theft, fire, and internal flooding from something like a burst pipe.

Let’s take a look at a couple of examples to fully understand how you can maximize your coverage when something goes wrong with the least amount of frustration possible.

Example 1

Imagine that you have an internal pipe that bursts, leading to water damage through your kitchen and hallways. Not only is the pipe broken and in need of repair, but the kitchen cabinets, drywall, and hardwood floors are saturated beyond repair.

Where do you make the call: home warranty or homeowners? The reality is you call both. The home warranty company will fix the pipe that broke; this in and of itself is not a covered claim with your homeowner’s insurance.

However, the home warranty company will not pay for the damage to the house itself resulting from the burst pipe. This means your cabinets, walls, and floors are not going to be repaired or replaced by the home warranty company.

This is where the homeowner’s insurance kicks in and pays for the repair and replacement of a loss resulting from a sudden and unexpected pipe burst.

Example 2

Imagine that you have a kitchen fire. In the fire, your refrigerator and oven range are destroyed. While these are covered under a home warranty for repairs, they are not covered by the home warranty company for losses due to a fire.

This claim, along with the damage to everything in the kitchen, is covered by your homeowner’s policy, less your deductible.

If your deductible is $1,000, you will pay that, and then the insurance company will fix your kitchen and replace your appliances. This isn’t a scenario where your home warranty will be called for anything.

So, What Do Home Warranties Cover?

After reading our guide, are you still asking, “what do home warranties cover?” We hope not. Taking the time to understand the ins and outs of home warranties helps you get the most from your money when investing in one.

Every homeowner should consider what their most significant financial risks are when planning for home repairs and upgrades. The home warranty makes sure you have the coverage you need even if you don’t have the saving compiled yet.

Resources: