No matter where you live, you’re in an area with some degree of flood risk.

To help you assess your particular risk, the Federal Emergency Management Agency (FEMA) provides an interactive map to help you assess information about your home’s flood risk.

But knowing whether or not your house is in a flood zone isn’t enough. You should always be prepared for disaster, even if the risk of flooding is minuscule. A little work now will save you a literal fortune if your home ever floods. We’ll show you how in this guide.

Is Your House in a Flood Zone?

Below, you’ll find a more detailed breakdown of the nature of flood zones and how to assess your home’s flood risk.

What Is a Flood Zone?

Kim Britten/Shutterstock

FEMA categorizes flood zones based on risk and location–in other words, it distinguishes a high-risk coastal area from a high-risk inland area. Its categorization system is as follows:

- A: High-risk flood zones. These areas have a 1% annual chance of flooding and a 26% chance of flooding throughout a 30-year mortgage.

- B: Moderate-risk flood zones. These zones lie in areas between the 100-year flood (flood events that have a 1% chance of occurring) and the 500-year flood (floods that have a .02% chance of occurring) for a given area. There are exceptions, including areas that are protected by levees. Newer FEMA maps categorize C Zones as X Zones.

- C: Low-risk flood zones. These are typically zones that are outside of the range of 500-year floods. Newer FEMA maps categorize C Zones as X Zones.

- D: Zones with possible but undetermined risk. These are areas where FEMA hasn’t conducted flood hazard analysis.

- V: High-risk coastal flood zone. This is a special categorization that designates coastal areas with a 1% or greater chance of flooding, a 26% chance of flooding during a 30-year mortgage, and additional hazards from ocean waves.

Flood Insurance

Vitalii Vodolazskyi/Shutterstock

One of the best ways to protect yourself from flood-related costs is by using flood insurance. You can buy it from a wide variety of private companies, but you can also buy government-sponsored coverage through the National Flood Insurance Program (NFIP).

This insurance is calculated based on FEMA’s data on the flood risk to your home. In some cases, this is required.

If you take a government-backed mortgage, which includes Federal Housing Administration, Veterans Affairs, and Department of Agriculture loans, then you must buy flood insurance if you live in a high-risk flood zone. That said, there are pros and cons to NFIP insurance.

The NFIP pays out a maximum of $250,000 in flood damage to homes and $100,000 for items in homes, and in some cases, this might not be enough. On the other hand, NFIP insurance cannot be canceled and is always backed by the government, making it very secure. However, it’s extremely expensive.

Regardless, lenders might still require flood insurance to secure a mortgage. Although the aforementioned isn’t federally mandated, buyers who purchase property outside of high-risk zones should consider this.

How to Learn Your House’s Flood Risk

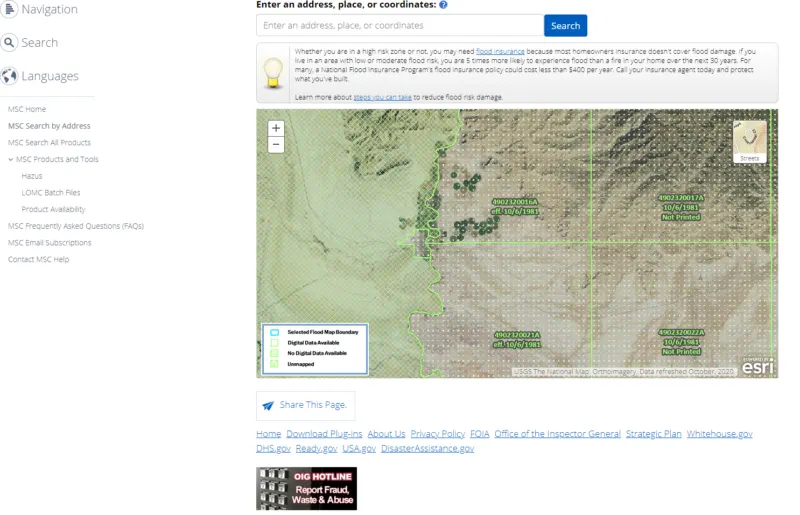

Image Source: Msc.fema.gov

FEMA offers an interactive map tool that allows you to see detailed information about your property. Simply navigate to the map, enter your address or city, and let the map load your area.

Then, click “Dynamic Map” to generate a FIRMette (a copy of a portion of FEMA’s Flood Insurance Rate Map) with detailed information about your area.

Some of the information on the FIRMette is somewhat technical, so if you need information, you can consult FEMA’s glossary of terms.

Keeping Up With Changes

Alan Budman/Shutterstock

FEMA periodically updates its flood risk designations. For that reason, it’s essential to check your FIRMette every five years or so to make sure that a rating change—or worse, a flood—doesn’t catch you by surprise.

This will be especially important in the coming year as FEMA introduces a new methodology for determining flood risk.

FEMA’s Risk Rating 2.0 system, implemented in new policies starting in October 2021 and existing policies beginning in April 2022, will use its mapping data to determine your unique flood risk.

This new risk will be generated based on information such as your home’s distance to water sources, the types of floods it might experience, and the cost to rebuild your home.

Be sure to keep up-to-date on your rating so that you’re prepared for any possible change in your flood risk rating or insurance rate.

Frequently Asked Questions

Below are some of the most commonly asked questions other people ask when searching for “is my house in a flood zone?”

Is the risk of a flood really that bad?

As we saw above, the flood zones with the highest risk have a 1% annual chance of flooding. This might seem small, but consider that floods are the most common natural disaster in the United States—even more common than fires.

So, in this context, don’t think of 1% as being an infinitesimally small chance—it’s a more significant chance than you might think!

Consider, too, that you’ll probably be living in your home for more than one year, which increases the likelihood that you might experience a flood at some point in your homeownership. For that reason, it’s often an excellent choice to consider flood insurance, even if the odds don’t seem high.

How do I prepare my home for a flood?

If you discover that your home is at risk of flooding, there are several steps you can take to protect it, even beyond getting insurance.

First, you can apply a wide variety of renovations to flood-proof your home. These might include raising your house on stilts, applying sealants to your foundation, raising your electrical outlets, and pointing your downspouts away from your home.

More dramatically, you can consider getting foundation vents or a sump pump installed in your house. The former allows water to flow through your home rather than pool around and seep into it. As a result, water drains out of your house and eases the pressure that floodwaters put on basement windows and walls.

On the other hand, sump pumps can pump water out of your basement, which is extremely useful for reducing water damage during a flood. In many cases, these improvements might be required.

The NFIP mandates that if a home or other structure receives renovations exceeding 50% of its market value, the entire structure must be overhauled to match current flood regulations. Keep this in mind in case you’re planning on adding renovations, including flood preparations.

How can I protect my home during a flood?

There are also several steps you should take once the flooding starts. First, be sure to clean out your gutters so that water doesn’t pool and leak into your home, then place sandbags to block any spaces that water might flow into.

If flood water enters your home, move furniture, valuable items, and electronics to a safe location, and if necessary, shut off your electricity from your circuit breaker. Make sure to use a sump pump or industrial vacuum cleaner as soon as possible to empty water from your basement.

How can a flood affect my home?

Floods can cause tremendous damage to any home and are often some of the most expensive natural disasters that can affect a home. Flood damage isn’t as simple as your home getting wet; water can irreparably damage many items, carry waterborne diseases, and threaten human lives.

Is it bad to buy a home in a flood zone?

Obviously, it can be risky to buy a home in a flood zone. For one, flood insurance and flood-proofing measures add additional expenses to your budget. Even setting the money aside, it can be stressful and upsetting when your home floods.

Not to mention if you need to evacuate the area due to a major emergency. Further, homes in flood zones may not have basement or underground parking, which many homeowners might want. That said, however, this risk is all relative and depends on your personal circumstances.

For one, home prices in zones with high flood risks tend to be cheaper, and depending on the cost of flood insurance and renovating the home, this might be worth it.

And, of course, the areas with high flood risks tend to be those in otherwise desirable areas. Beachfront and waterfront properties, for instance, tend to be designated by FEMA as being at a high risk of flooding, but at the same time, it’s hard to live the same lifestyle in places that don’t flood.

Is Your House in a Flood Zone? Do This Next

Michelmond/Shutterstock

You now have everything you need to know about the question: Is your house in a flood zone? Floods can be incredibly destructive events that can threaten your home and possessions.

Though not everyone needs to make drastic preparations for a flood, it’s always a good idea to review FEMA’s website to assess your flood risk.

Then, if you think the risk is significant enough, you should consider buying flood insurance through the government or a private company.