Typically, investing in real estate requires a large, up-front cash investment. Most investors need enough cash for a 20% down payment on an investment property or the full purchase price.

But creative real estate investors in the know use a few unique strategies to invest in real estate with no money down.

In fact, many investors use one or more of these strategies to get started without a huge cash investment up front. That’s not to say that someone can invest in real estate with no money, period.

The money comes from somewhere, but if you’re savvy, it doesn’t have to come from you. The less cash you put into an investment property, the better the returns you’ll earn.

That’s why even experienced real estate investors with plenty of cash to invest still favor methods like those we’re about to show you in this guide.

5 Ways to Invest in Real Estate With No Money

To invest in real estate with no money, you have to get a little creative. In fact, you’ll end up using one of these popular strategies:

- Using other people’s money

- Looking into seller financing

- Taking cash out of property equity

- Wholesaling properties

- And even “house hacking”

Our complete guide does a deep dive into each of these strategies, their pros and cons, and how to maximize the money you do have to earn huge returns. Read on to learn more.

1. Partner With Other Investors

Other real estate investors can be excellent allies if you want to invest in real estate with no money down. If you can find a great deal on a property, you can present a partnership deal to another investor.

There are a few ways you can work with other investors to buy an investment property without actually putting your own money down.

- You can ask another investor to supply the cash for the down payment (or the full purchase price) in exchange for a percentage of the property’s rental income, equity, and appreciation over time. This is a joint venture.

- You can ask another investor to supply the cash for the down payment (or the full purchase price) and take a preferred return. This ensures your partner receives an agreed-upon percentage of their investment back before you start taking your cut.

- If the other investor doesn’t want to partner on the deal but is willing to lend you cash, you can borrow cash for the down payment and pay them back over agreed-upon terms.

New real estate investors can learn a lot about investing and start earning profits quickly by engaging in a joint venture. Joint venture partnerships are commonly 50/50 or 70/30, depending on who’s putting more time and cash into the investment.

How Joint Ventures Work

A joint venture allows you to consistently earn a percentage of the rental income alongside a partner who is (hopefully) knowledgeable about real estate investments.

Typically, in a joint venture like this, one investor might be the financial partner, while the other is the hands-on management partner.

Suppose you’re not putting any cash down. In that case, you could handle the management side of the investment property—finding and managing tenants, preparing it for tenancy, handling tenant requests and issues, etc.

This management is what makes you an asset to your partner, who probably just wants to put the money down and passively earn income from it each month.

Any investor can benefit from earning 30% to 50% of a property’s profits without putting any money down.

2. Get Seller Financing

Seller financing is an option for real estate investors who want to arrange a unique deal that may involve little or no cash down.

Not every seller will be open to, or in the position to offer, seller financing, though. You have to look for the right property and seller to try this method.

If a property is vacant and racking up expenses for the seller, or if it is owned outright (the seller owes nothing on it and owns it free and clear), you may be able to negotiate seller financing on your terms.

In this case, that would be making monthly payments on the property with no down payment. Sellers may offer to finance vacant properties because upkeep and trying to find tenants cost them money every single month.

Carrybacks: Shift Risk

What should be an investment property for them has turned into a money pit. By financing the property for you, they can get rid of this expensive problem and receive regular payments from you in exchange for it.

Sellers may be willing to self-finance free and clear properties for the same reason: why not receive regular monthly checks (your payments) that increase their income?

Sellers willing to offer seller financing won’t need the cash from the property’s sale to buy a home.

They are likely homeowners who are willing to part with a second property in exchange for a new stream of monthly income that is more secure and less time-consuming than renting.

Once they sell the house to you and start accepting payments, they aren’t responsible for any of it anymore. Repairs, taxes, home insurance, etc. all become the new owner’s responsibility.

If a seller does agree to finance the purchase for you, you’ll have to negotiate to drop the standard down payment from the terms. Be prepared to make some concessions that benefit the seller to make this happen.

Higher monthly payments, an increased interest rate, or a balloon payment at the end of the agreed-upon financing period could help you make your case to buy the property with no money down.

3. Pull Cash Out of Property Equity

If you’re thinking about investing in real estate, you’re very likely already a homeowner. If you have considerable equity in your home, you may be able to borrow cash against it to cover your down payment.

In general, you could qualify for this type of loan (a home equity line of credit, or HELOC) if you have a great credit score (700 at minimum) and have plenty of equity in the property you currently own.

A HELOC can supply you with as much as 80% of your property’s equity in cash that you can repay over time.

So if you’ve paid $100,000 on your property, you could take out up to $80,000 in cash to cover the down payment for your purchase.

4. Wholesale Real Estate

Wholesaling real estate can enable an investor to earn a profit without putting any money down. It’s a simple idea, but finding wholesaling opportunities can be a challenge.

In general, here’s how wholesaling real estate works: an investor finds a property for sale listed below market value (typically, a distressed property).

The investor creates a purchase contract with the seller to find a buyer for the property within a certain time.

The purchase contract should include two things: an assignment fee for the wholesaler to find a buyer and a contingency that allows the investor to exit the deal if a buyer can’t be found in time.

Once a buyer (investor) is found who is willing to pay the agreed-upon price, they take over the purchase contract and close on the property.

Returns Without the Risk

The wholesaler collects their assignment fee from the purchase price, and the new buyer takes ownership of the property. The wholesaler never actually pays for, owns, rehabs, or renovates the property.

They are just the middleman who finds a willing buyer in exchange for an assignment fee. We interviewed 20 wholesaling experts to find out how much they make on each transaction.

Here’s what we found:

- Most make $5K to $10K per deal

- On the low end, some make $1K to $3K per deal

- On the high end, some make up to $40K per deal

5. House Hack

Another option for real estate investors who don’t want to put money down on a property is house hacking. House hacking won’t enable you to put $0 down on a property.

But it allows you to invest without paying the typical 20% down payment. House hacking is the purchase of a multi-family property, like a duplex or triplex, and living in one of the units.

The other unit(s) are then rented out to other individuals to create a stream of rental income. Because you’ll live on the property, you can take advantage of down payment assistance and low-down payment financing options.

One of these is the ever-popular Federal Housing Administration (FHA) 203K loan. A small down payment equal to 3.5% of the property’s price is the only money you’ll need upfront.

Three Huge Benefits

Buying a duplex priced at $275,000 would only require a down payment of $9,625 (3.5%) in this case. And once purchased, you get three huge benefits as an investor:

- There is no separate mortgage payment if you live in one of the units

- Rental income from the other unit(s) in the multi-family property

- Appreciation and equity in the property over time

While house hacking isn’t technically a way to invest in real estate with no money, it’s a way to invest with very little money down.

So, How Do You Investing in Real Estate With No Money?

Investing in real estate without spending a lot of cash can be tricky. If you keep the following considerations in mind, you’ll be better off in the long run.

You might be able to invest in real estate with no money down, but you’re going to need a steady flow of cash to keep up. You’ll need enough cash to cover ongoing and emergency expenses related to your investment properties.

The rental income generated may cover these expenses, but consider that vacancies and emergencies do happen. What will your safety net be?

How much cash do you have saved up to cover mortgage payments if the property is vacant? What about unexpected maintenance issues or needed repairs?

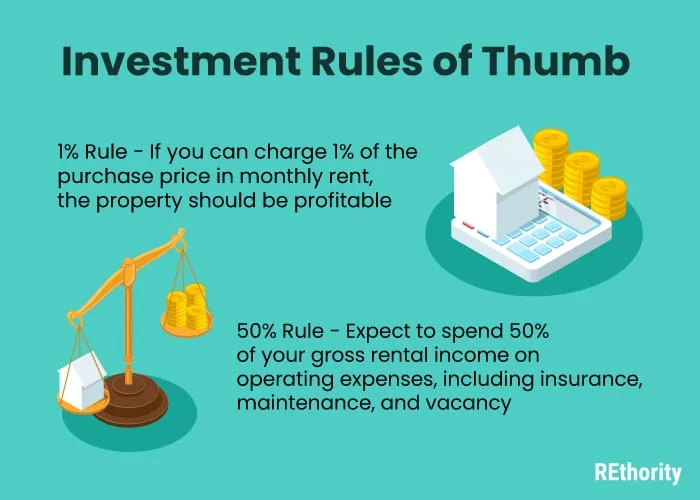

It’s also a good idea to keep a few investor “napkin math” formulas and rules in mind to ensure you’re making smart investments.

Two Important Rules

- The 1% rule states that if you charge 1% of the property’s purchase price in rent, a tenant’s rent payments will be enough to cover your mortgage payments. For a $150,000 house, this equates to $1,500 in monthly rent.

- The 50% rule says that 50% of your gross rental income from a single-family home goes toward operating expenses (maintenance, insurance, taxes, inevitable vacant periods, etc.). If you plan for half of your gross rental income to be spent on operating expenses, is the investment property still profitable?

Overall, if you’re wondering how to invest in real estate with no money, you’re on the right track. It can be done, but remember, not every investment is a good investment.

If you do your research, partner with an experienced investor, seek out seller financing or HELOC loans, try wholesaling, or experiment with house hacking, you can earn excellent returns on real estate without putting money down.