Imagine scoring a well-maintained $300,000 home for just a few thousand dollars.

Does that sound too good to be true?

It’s not. Read on to learn how to find tax delinquent properties in your area to accomplish just that.

The best real estate investing software. Period.

- Extremely powerful & stackable filters

- Find motivated sellers easily

- Extensive property database (MLS, private, & more)

- Very accurate comp tool & filters

- Very low $97 monthly price (less than others)

- Not a 30 day trial (but 7 days is more than enough)

What are Property Taxes?

Before we explain how to find tax delinquent properties in your area, we need to cover the mechanics of how property taxes work. If this is too elementary for you, skip to the next section.

If you’re new to this, keep reading, as this is good information to know. Long story short, every home and land owner must pay annual property taxes to the city, county, or township in which the property is located.

This money pays for roads, parks, emergency services, and anything else that the municipality offers to the public. In some cases, there are bonds added to specific parcels to pay for schools or other public amenities.

The municipality must be able to track the amount of taxes owed, the property owner, and a little information on the property itself. All this information is compiled by the tax assessor (or treasurer) and made available to the public.

How to Find Tax Delinquent Properties in Your Area

When property taxes go unpaid, or are delinquent for a period of time, this is recorded by the tax assessor or tax collector.

It’s public record, too. That’s the key to this real estate investment strategy.

Every tax delinquent property is compiled together in a ledger that can be called by many names:

- Tax Delinquent List

- Tax Sale List

- Delinquent Tax List

- Delinquent Tax Roll

- Tax Forfeiture List

Tax Assessor’s Roll

In the United States, it can take up to 5 years for a municipality to crack down and foreclose on these properties, but properties in tax delinquency don’t usually go ignored for that long.

Tax foreclosure can occur in as little as one year, though most states allow a property to get 2 years behind in taxes before seizing it.

Once a delinquent property makes the Tax Delinquent List, it becomes a golden opportunity for real estate investors and wholesalers.

The delinquent tax list is essentially a list of properties in your area that are likely to be seized in tax foreclosure (i.e., for sale and cheap).

This investment philosophy has been around for quite some time, and most serious real estate investors have at least looked into it.

However, it’s received widespread attention by Robert Kiyosaki in his book Rich Dad, Poor Dad.

What Happens to Foreclosed Properties?

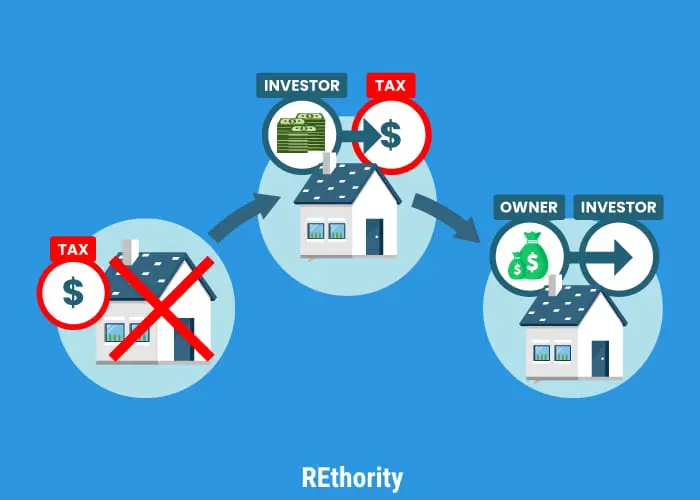

Before a home is foreclosed upon, owners can pay their back taxes or tax bill in full (plus late fees) at any time before the property is seized.

However, this doesn’t happen as often as you’d think. Many properties end up being foreclosed on and sold at the city, township, or county’s yearly tax lien sale.

The town holds these sales in hopes of making back the cost of the unpaid property and real estate taxes, so the properties are usually auctioned at a fraction of their worth.

That’s tempting for a real estate investor, but it isn’t the key to unlocking the potential of finding tax-delinquent properties. Catching the property owners before the county forecloses and sells the property is the key.

The Problem with Waiting for Tax Lien Sales

The city, county, or township will hold a public auction or tax lien sale to try and recoup some of the unpaid property taxes at least once a year.

This isn’t a secret; it’s the avenue many real estate investors use to find and buy great properties for much less than they’re worth.

That’s the issue. So many longtime and beginner investors show up and show out at these auctions that a few negative things can happen:

- Too many bidders at the auction, less opportunity for each one

- Limited choice means only the properties already seized are available

- Bidding wars drive costs up, sometimes beyond market value

None of these are good things in the world of real estate investing. In order to access the best deals and the widest range of properties, you have to get out of the “highest bidder” mentality, get your hands on the delinquent property tax list, and contact pre-foreclosure property owners.

Getting the Tax Delinquent List

You already know how valuable this list can be. Now, you need to access the list. The best place to start is with your county treasurer (also called a tax assessor or tax collector).

Before you begin this process, it’s important to understand that the list is not free in most circumstances. Expect to pay anywhere from $100 to $500 to get the list for your area.

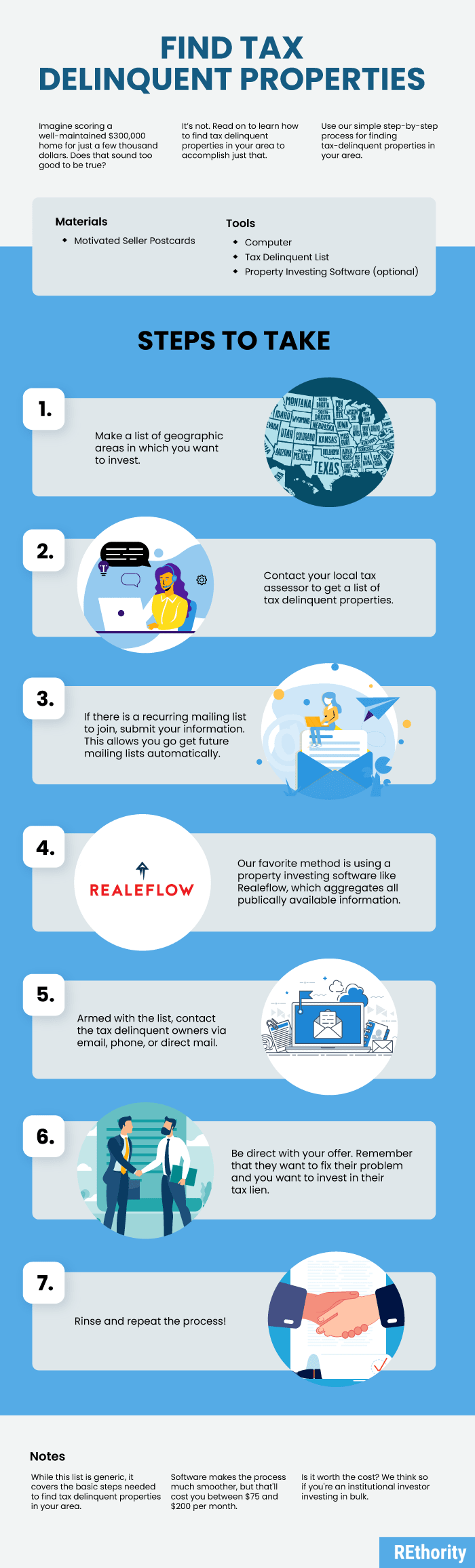

If you live in a very small county, you may be able to get the list for free. It’s worth asking about! The process is very simple:

- Ask your county treasurer for the tax delinquent list

- Determine the cost; it could be free or up to $500

- Mail a check to the treasurer’s office with a letter of instruction

- Receive the list using the method you choose (email, mail, CD-ROM, etc.)

Paying up to $500 for this list can sound expensive, but the potential savings it can create make it well worth the cost. The list will give you all the information you need to begin contacting property owners and cutting deals.

The information listed in this report includes a number of items. However, the main fields include the property owner’s name, their date of purchase, cost of purchase, tax amount, taxes owed, etc.

Many software platforms also let you see who’s behind on their taxes or mortgages. These include Realeflow or PropStream. For under $100 per month, you can have unlimited access to these owners.

Next Steps and Closing the Deal

On your list, you’ll be able to cherry-pick the properties that most interest you and fit your investment portfolio. Pick a property owner to reach out to and remember to be friendly, tactful, and confident in your approach.

You might contact the owner via phone, direct mail, email, or even in person. Most investors find it best to contact them via phone first.

Introduce Yourself

When you call, you should first introduce yourself as an investor and explain the situation briefly. The owner may not be aware that they’re behind on taxes, could be incompetent, or even deceased, depending on how up-to-date your county’s delinquent property list is.

Giving a short overview of the circumstances can help you determine if this is a good property to pursue; there is no need to reveal that you’ve specifically accessed the delinquent tax list.

Remind the property owner of the seriousness of their situation (they can and will lose the home, along with any equity they’ve paid into the home, if the taxes aren’t paid). This can help you segue into the next step: Asking them to sell.

Be Direct

Don’t be shy or beat around the bush. Ask the owner if they’re interested in selling the property and stopping the county from taking further action. Selling will enable them to keep their equity in the home.

This is the only way they will be able to do it without paying back taxes and fees. You’ll be able to determine whether or not they’re even remotely interested once you ask. You might be met with an enthusiastic yes or an angry no.

Be prepared for either reaction and decide whether or not this particular person would appreciate a follow-up. Remember, there are hundreds of names on your list, and this is just one!

Make an Offer

Decide how much you’d spend on the property and make an offer if the owner is open to selling. Don’t be afraid to throw a low offer out. Some of these properties sell for as little as the overdue tax amount.

But personally, I suggest trying to make it fair. I personally don’t subscribe to the mindset that you should take advantage of someone else’s situation.

No matter how you slice it, going after these properties before they go to auction and having the attention of dozens or hundreds of investors is the ticket to making a good investment.

Many people believe buying property starts with a For Sale sign, but as an educated real estate investor, you now know that isn’t the case. The very best opportunities are those that haven’t made their public debut yet, and they’re yours for the taking.

They start with unpaid taxes and end in a wise real estate investment. With a little research, the real treasure can be found just by taking a look at the tax records in your area.

My Take on Tax Delinquent Properties

VectorMine/Shutterstock

Let me start by saying that this is only my opinion. I don’t fault anyone for trying to find tax delinquent properties. They can be a great way to find property for a little money.

That said, my investment strategy revolves around helping people, and buying past-due tax notes just doesn’t fit my model. I couldn’t sleep well at night knowing I’d be taking someone’s house from them for a small past due balance.

Yes, business is business, but I just don’t believe in the model when it comes to buying with the goal of eventually taking the home. However, it can be highly profitable when done right.

And again, not everyone shares my investment philosophy, which is fine. Alternatively, some investors are just seeking interest, and tax delinquent properties offer a great return.

If you don’t actually intend to foreclose on the home, it can be a great way to help someone get back on track while also getting a little interest in the meantime. It’s a win-win.

I have looked into this, but the time and effort required were not worth the return for me. It’s a labor-intensive process, and most balances fall under $5,000, so even at a 14% interest rate, here in Nebraska, you’d only get 7% annually.

This is simply not enough return for me to invest my energy into a deal

How Do I Find Tax Delinquent Properties in My Area?

If you’re searching for “tax delinquent properties near me,” the best way to find them is to use your local newspaper. The newspaper will be published in the county you reside in if it’s in a state that sells tax deeds or tax liens.

On the other hand, if you live in a state that sells tax lien certificates, you’ll have to visit the county websites.

The site will reveal a list of tax lien certificates available for sale. Additionally, there are lists of tax-delinquent properties for purchase. You can use this as a reliable way to find delinquent tax properties.

There are also other options, such as brochures for states that may not sell tax liens but tax properties. The brochures will contain pictures of tax-defaulted properties, and an auction company will typically send them out to those that live in the county.

They only advertise to those that live in the county, but you can purchase the brochure online or travel to that county to buy it.

In the United States, half of the states sell tax lien certificates. With these tax lien certificates, you can earn 16, 18, 24, or even 36 percent interest.

Tax-defaulted property is sold at an auction for nearly the same amount as the back taxes. When these properties get sold—tax deeds or tax liens—the mortgage is eliminated.

So you can feasibly expect to buy tax-delinquent properties for sale for 10–30 cents on the dollar.

The best real estate investing software. Period.

- Extremely powerful & stackable filters

- Find motivated sellers easily

- Extensive property database (MLS, private, & more)

- Very accurate comp tool & filters

- Very low $97 monthly price (less than others)

- Not a 30 day trial (but 7 days is more than enough)

Bottom Line

If you’re looking for tax delinquent properties in your area, use our guide as a starting point.

While I don’t participate in this investment strategy, I’m interested to hear if you do.