Digital real estate is one of the last great frontiers on this earth. Investing in websites, or authority sites, can make you a fortune. But only few succeed.

Sound intriguing?

Though digital real estate has been around since the mid-80s, the advent of NFTs and the Metaverse reintroduced this investment phenomenon to the forefront of popular speculation.

If you haven’t heard of digital real estate before, this is the essential information you need to know about this form of digital investment and speculation:

- Digital real estate refers to buying and selling digital property that only exists on the internet.

- Forward-thinking investors can make steady passive income or massive profits if they are patient and detail-oriented.

The Upside

Anyone can invest in digital real estate. But no one successfully invests in it without a clear roadmap or plan. Unlike rental property, there aren’t many mentors or courses to teach you the ropes.

You’ll hear terms like SEO, sitemaps, script managers, CSS, and more. If you aren’t willing to dig in and teach yourself new skills, don’t consider digital real estate.

Digital real estate is all about speculation. Period.

For those who are willing to roll up their sleeves and work for months to years without pay to chase an eventual profit, the rewards can be huge. We’re talking 90% profit margins with minimal capital outlay.

Want to know more? First, you need to understand the industry, what kind of digital property to look for, common mistakes beginners make, and a few keys to profitability.

This guide will help you learn the ins and outs of digital real estate. You’ll understand the basics, know what makes a good digital investment, and what pitfalls to avoid.

By the end, you’ll be ready to start building your own digital investment portfolio. We’ll start with the basics and build from there.

What Is Digital Real Estate?

In digital real estate, you’re buying affordable virtual property that you foresee being much more valuable to someone later on.

As new technologies and opportunities are made available to consumers everywhere, the digital landscape will only become more deeply ingrained in our everyday lives. When faced with these undisputed facts, digital real estate looks like a logical investment opportunity for those savvy enough to recognize it.

While that may sound like a vague description, it is so open-ended precisely because digital real estate is one of the most versatile investment avenues available today. The most common digital investments are:

- Websites: Active affiliate sites, authority sites, blogs, eCommerce stores, etc

- Domains: Website URLs not yet in use

- Apps: Mobile applications for smartphones and tablets

- Digital products: Courses, training classes, guides, membership programs

Digital real estate isn’t so different from traditional real estate. When you invest in digital real estate, you buy property online and let it appreciate in value before selling it.

You can earn cash flow from both traditional (rental income) and digital (ad revenue or affiliate income) properties. You can increase the value of both types with improvements and renovations.

What This Means

This could be a fully built-out website that targets a certain audience and receives ample traffic or earns monthly ad revenue.

It could be an unused domain name that you believe a company or investor may want in the future. In any case, to be successful in digital real estate, you have to be strategic.

Investing in digital real estate is exciting because it’s a relatively new practice. Think about it – the first domain name was only registered in March 1985 (Symbolics.com).

Domains were actually free to register until 1995 when the National Science Foundation permitted tech consulting company Network Solutions to charge $100 for 2-year domain registration.

Today, domains are offered much cheaper, and anyone can buy one. Anyone can build a website for a very low cost, too. But you need to choose a domain name that is likely to be in demand sooner or later, and if you’re building a website, it needs to be done well to get plenty of traffic.

We’ll talk more about building websites and buying domains as digital real estate investments further down in this guide. But first, let’s dive into the benefits of digital real estate.

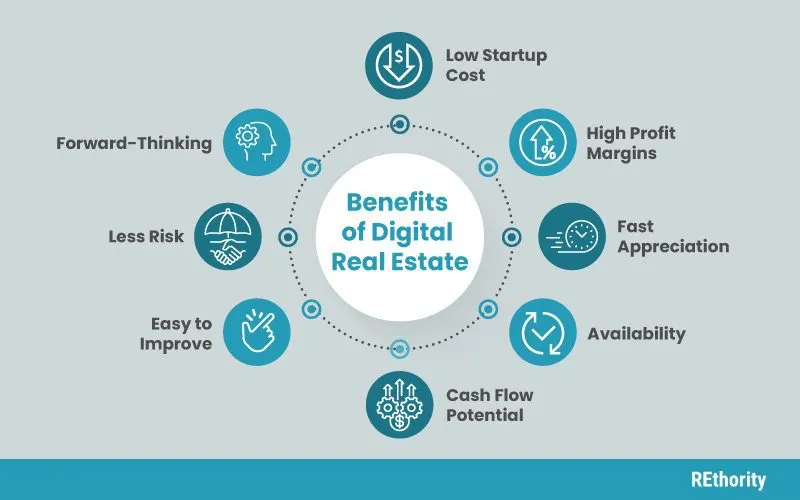

Digital Real Estate Benefits

Investing in digital real estate has so many benefits. It’s worth looking into even if you don’t consider yourself the investor type. Here’s what makes this form of investing so noteworthy.

- Low Startup Cost: Spend as little as $10 to register a domain and $5/month to host it, then build a website to start getting traffic or wait and sell the domain to the right buyer later on.

- High Margins: With such a low cost to invest and build, you can achieve gross margins of up to 80%.

- Fast Appreciation: The value of a website often grows 5X within one year, so your asset appreciates quickly.

- Availability: Domains and websites are never in short supply, are available worldwide, and anyone can buy them.

- Cash Flow Potential: You can earn cash flow from a website or domain before selling by placing ads on the site to earn revenue or becoming an affiliate to earn revenue by sending traffic or sales from your site to another.

- Easy to Improve: If you buy a cheap website with a good domain name, you can add content and improve the design more easily than you can renovate or remodel a house.

- Less Risk: Investing hundreds of thousands of dollars into a house or apartment building is always risky; spending less than $20 per domain carries a lot less risk.

- Forward-Thinking: The digital landscape will only become more and more part of our daily reality, so getting ahead of the game and buying online real estate is a smart financial move for the future.

Popular Digital Real Estate Investments

Technically, you likely have plenty of digital property. Social media accounts and email accounts are all digital real estate, though their value varies widely based on your follower counts.

Investing in run-of-the-mill digital property is not a great way to garner hefty profits unless you are a famous social media influencer or a celebrity.

While monetizing commonplace digital real estate can potentially lead to solid returns, we will not be touching on those investment avenues in this article.

Instead, we will focus on digital properties that anyone can invest in, regardless of their social media presence. Below you will find the most common types of digital real estate modern-day entrepreneurs can use to turn a profit.

1. Websites

Though they are the oldest type of digital real estate, websites are one of the stablest ways to make money from digital assets. Blogs, eCommerce stores, active affiliate sites, and authority sites represent some of the most common digital real estate investments available today.

Though they are the oldest type of digital real estate, websites are one of the stablest ways to make money from digital assets. Blogs, eCommerce stores, active affiliate sites, and authority sites represent some of the most common digital real estate investments available today.

Websites are also one of the cheapest ways to get involved in the digital real estate game, though it will cost you plenty of time and effort to get the most out of your investment. To create a profitable website, you have to commit to growing and building it on a long-term scale.

You cannot just go creating websites on a whim, mind you. Before you even consider starting your own website, you should ask yourself a few questions:

- What are you knowledgeable and passionate about the most?

- Do you have the time it takes to create and grow a website?

- How competitive is your niche market?

- How will this website make you money?

- How long will it take for you to turn a profit?

Once you are ready to start, you will need to find the correct content interface, suitable website hosting, and a unique domain name. Website hosting stores files for users online, while a content interface refers to software that allows users to interact with your website.

WordPress is the most popular content management software on the market today.

2. Domains

While you need a domain name to create a website, you do not necessarily need a website to invest in this form of digital real estate.

A domain name is a string of text that users can type into their web browsers to access websites online. This text connects to a numeric IP address. For example, to access Google’s IP address, you would type “www.google.com” into a browser window.

Every website’s address consists of a complex numerical code that looks like this: 105.24.567.9. You don’t have to remember this string of numbers with DNS technology. Instead, you can merely type in the domain name to find a website through a DNS lookup.

DNS stands for Domain Name System, and it’s basically the phonebook of the world wide web. The DNS translates a website’s IP address so that individual browsers can access them through domain names.

Domain registries manage these domain names, allowing people to reserve and purchase domain names for their websites. As of today, there are almost 365 million registered domain names.

Buying up a domain name is an easy way to invest in digital assets, but it can also be very volatile. When buying a domain name for a website you’re planning to manage, this process is a bit less risky.

If you are buying domain names on the chance that someone will purchase them for a high profit in the future, you can potentially net great returns. Just remember, this is one of the most turbulent digital real estate investments you can make. Truthfully, most domain names won’t make any money at all.

Example 1

A serial entrepreneur I worked with started a new company. The domain he wanted was already owned by someone who had “parked” it – purchased the domain and displayed ads on it while waiting for someone to buy it.

The entrepreneur ended up paying $5,000 for the domain that probably cost $10 – $20. He saw it as a necessary piece of digital property if he wanted to start his business with his already chosen name.

Example 2

A more impressive example is the sale of the CarInsurance.com domain. Digital marketing company QuinStreet bought it in 2010 for $49.7 million, making it the most expensive publicly sold domain name of all time.

They also purchased Insurance.com for $35 million and Insure.com for $16 million in the same year. Imagine if you had been the owner of one or all of these domains!

In both examples, the key to profit was the domain owner being willing to sit on the domain for as long as it took. The company or organization that wants to buy your domain may not even exist yet.

Example 3

If your strategy is to build an authority site, you will either buy or start a site with the goal of maximizing traffic. Say you are able to build a site to 50,000 monthly readers.

Using an ad network like Mediavine, you’ll realistically get paid about $.03 for each visitor. At this rate, you’ll earn $1,500 per month on ads alone.

If you wrote the content yourself, earned links through guest posting, and your expenses are $200 per month (keyword tools and hosting), your profit margins are 87% every month. Pretty good, right?

And that’s totally doable. You can realistically earn that much traffic from 50 or less posts. If you have 500,000 monthly visitors, you can earn $15,000 per month on ads alone!

3. Digital Products

Living in the digital age means that most of our purchases are online. In fact, in 2020, online retail sales amounted to $4.28 trillion worldwide and are expected to grow to $5.4 trillion by 2022.

If you offer any products or services for sale online, you have digital products to offer. These digital real estate investments consist of things like membership programs, Ebooks, online courses, videos, online guides, templates, and training programs.

If you want to build your own website, these are the best ways to turn profits, especially in a less competitive niche. If you have valuable skillsets and can translate them into digital products, you could start earning profits right away.

4. Apps

Unless you have been living under a rock for the past decade, you know just how important mobile apps for smartphones and tablets have become.

If you weren’t aware of this, the numbers don’t lie. By 2023, mobile apps are forecast to make over $935 billion!

What’s more, 49% of people open at least one app more than 11 times daily, and the average smartphone user opens ten apps per day and 30 apps per month.

Worldwide, there are more than 3 billion smartphone users and 1.14 billion tablet users, spending a whopping 88% of their browsing time on mobile apps.

These mobile apps have become a unique type of digital property that developers can produce and sell using their originality and creativity to turn a profit.

To be successful as an app developer, you will need to create an app that users want to download and use faithfully.

5. Blockchain-Based Digital Real Estate

As mentioned before, digital real estate is not a new concept, but the advent of contemporary blockchain technology forever altered the future of digital assets.

Blockchain-powered tech like cryptocurrency, virtual real estate, and NFTs have made us all rethink how value is managed in our digital world and will continue to fundamentally change how businesses function worldwide.

With the ability to represent assets using a digital system and make transactions with blockchain technology, new markets are opening up for assets that would once have been considered illiquid.

NFTs

Non-Fungible Tokens, or NFTs, are cryptographic tokens that can represent a unique product like a piece of music, a work of art, or an item in a video game. This digital token essentially certifies ownership and can be verified digitally using blockchain.

Investing in an NFT guarantees ownership of your digital assets and means that no one else can duplicate or sell them without your consent. They are sort of like virtual certificates of ownership. Think of a title for a car or a deed to a house.

Before the creation of NFTs, verifying ownership of digital assets was not straightforward because they can very easily be duplicated, downloaded, and shared. You can now prove provenance with blockchain technology, which makes buying digital assets a sounder and more lucrative investment.

Virtual Reality

You can’t have a conversation about the future of digital real estate without discussing the evolution of virtual reality and how its prominence will further shape the digital asset landscape from here on out.

The concept of virtual reality has been around for decades, but it is only within the past few years that these technologies, once thought of as Sci-Fi fodder, have become accessible to the masses.

This new digital universe, dubbed “the Metaverse” by some, will catalyze a seismic shift in how we interact with technology and with each other. The Metaverse consists of the entire digital landscape that we can access through the internet and VR technology.

In December of 2021, four of the largest metaverse sites, Somnium Space, Decentraland, CryptoVoxels, and the Sandbox, sold more than $100 million in digital land altogether.

Though we have yet to reach the full potential of the Metaverse, digital real estate in the virtual world has already begun to function in the same way that it does in the real world. This new digital economy opens up endless opportunities to create, market, buy, and sell digital assets.

Recently the first virtual reality real estate company, The Metaverse Group, was founded. The company set up its global headquarters in Crypto Valley in Decentraland.

Decentraland

The Metaverse Group made their new home in Decentraland, a decentralized virtual reality platform. Decentraland provides an immersive 3D experience to explore digital worlds using VR goggles.

All the digital real estate in Decentraland is called LAND and represented by NFTs. You have to use a cryptocurrency called MANA to buy them, which uses the Ethereum blockchain. Once you purchase digital real estate on the LAND marketplace, it’s yours to do with as you will.

Groupings of LAND are known as “Districts.” Shared themes or interests usually connect these virtual communities. Decentraland even has a voting app where you can discuss and vote on district issues.

The amount of political power you hold is based on the amount of land you hold in that district. The more you buy, the more say you have in what happens there.

The Sandbox

The Sandbox began its life as a hit mobile game in 2011, which spawned a sequel in 2016. In 2018, Sandbox’s developer opened up his creation, along with its large community of creators, from smartphones to the blockchain ecosystem.

The Sandbox allows creators to own their unique digital assets as NFTs through digital contracts and the use of three integrated software programs; VoxEdit, the Sandbox Marketplace, and the Sandbox Game Maker.

VoxEdit is a 3D voxel modeling package designed for Macs and PCs. Sandbox users can create and animate whatever 3D objects they dream up and export them into the Sandbox Marketplace as NFT game ASSETS.

The marketplace provides a place for Sandbox users to upload and sell NFTs made with VoxEdit. Sandbox’s blockchain securely stores these for proof of ownership.

Different token types encourage a circular economy between curators, players, creators, and LAND owners:

- SAND tokens are for any ecosystem transactions and interactions.

- LAND tokens represent a piece of digital real estate in the Sandbox metaverse. Users buy LAND and use it to store digital assets, showcase 3D game creations, and enjoy interactive VR experiences.

- ASSET tokens are the creation of players who make user-generated content. Players can trade them on the Marketplace to aid in creating 3D games and digital assets.

Sominum Space

Somnium Space is a virtual reality platform founded in 2017 where users can world build using autonomous digital real estate trading and ownership. It uses blockchain technology and offers its own currency, Somnium Cubes.

Users can exchange Somnium Cubes to buy digital property as they see fit. Though $1 million of seed money built the company, it is entirely crowdfunded through the sale of virtual real estate.

You can access Somnium Space on your desktop, mobile phone, or VR headset. When you use the mobile or desktop apps, Somnium Space will display as a 2D world. Users can authenticate their ownership using blockchain and can craft digital assets using custom 3D design software.

CryptoVoxels

Cryptovoxels is a virtual reality platform built on Ethereum blockchain technology to purchase and sell digital real estate and digital assets in the CV ecosystem.

Since its inception, CryptoVoxels has enjoyed more than 7,300 ETH in transaction volume through “parcel” sales, which are plots of land available in the CV metaverse. The demand for CV parcels only continues to grow, as does their value.

On CryptoVoxels, digital builders can create and charge for access to intricately designed worlds full of impressive build sites. Talented crypto artists can display their NFTs for sale in virtual art galleries, and all users benefit significantly from CV’s dedicated and talented development team.

Digital Real Estate Mistakes and Misconceptions

It would be misleading to say that digital real estate investments will enable everyone to “get rich quick.” Ask anyone in the industry.

There are loads of mistakes and pitfalls that you must avoid if you want to do well. Because digital real estate investing is so comparatively new, there aren’t that many established, proven best practices yet.

But from the research we’ve done and the things we’ve learned first-hand, there are a few common mistakes that are easily avoided when you know what to look out for. We’ll cover each in detail below.

“Buying digital real estate is a miracle investment.”

Nope. There are no miracles here. Your success in this sector depends entirely on your choices and strategy. If an online “guru” tells you that you can earn a profit in a month, they’re lying.

The domain names you buy, the audience you target on your website, the website design you select, the affiliates you partner with – these are the important things that determine how profitable your investment will be.

In fact, with most valuable domain names picked over, you’ll have the best chance of success at starting an authority site. But it won’t happen overnight.

The reality is that by the time you plan, design, and build the site, you’re looking at at least 18 months of work. But don’t get discouraged — you’re investing in future recurring revenue.

“Domains with trademarks will be worth a lot to the trademark holders.”

Trademark holders spend a lot of money to protect their trademarks and enforce them. That means if you purchase a domain containing a trademark, you could find yourself in an expensive legal battle.

Even if you don’t realize what you’re doing, it could end in disaster. You will more than likely end up in court, forced to pay penalties to the company for trademark infringement.

To avoid this, we highly suggest creating a unique, but brandable name to serve as the business and domain name. Ours, for example, is REthority.

I bought the domain for $12, and it was cheap because I created it myself (it didn’t mean anything before). But it’s unique enough to convey the main points of my site (authority and real estate).

“It’s easy to register a desirable domain and sell it for millions.”

If you want domain names that someone will actually buy later, you’ll have to roll up your sleeves and get to work. After all, it’s not the 1990’s anymore, and the good names are largely picked over.

It’s a highly competitive industry, and the top players design or use bots and software that “catch” the most desirable expiring domain names the millisecond they’re available again.

It’s worth noting that most domains don’t sell for millions – there’s a reason Business.com, CarInsurance.com, and VacationRentals.com are the major success stories you hear about over and over.

“I’ll register these domains and forget about them until I get an offer.”

Please don’t fall into this thought process! Don’t forget that domains need to be renewed regularly, anywhere from one to ten years.

One man shares that he owned community.com in the 1990s and failed to renew it. Today, SalesForce owns it, and it’s estimated to be worth six figures. That’s an expensive mistake.

“I’ll register a domain, build a website, and sell it for a profit next month.”

Building a website to the point where it’s attractive to companies or investors takes time. A lot of high-quality content, careful attention to SEO and marketing, and partnerships with affiliates will put you on the right path.

If you write the content yourself, use a budget hosting provider, and use free versions of graphic design software like Canva, you can create a site for under $1,000.

However, you’ll be doing much of the work yourself, and much of your time will be spent learning new skills. In any case, a quality site takes 12-18 months on average to start turning a profit.

Treat this just like physical real estate. The more you invest in it, the greater the return you get down the road. I highly suggest hiring professional writers and investing in a nice (or custom) WordPress theme.

After all, your goal it so attract investors down the road, and someone involved in this space will want your site to stand out from the mom-and-pop blogs that look stuck in the 90’s.

“As soon as someone offers me money, I’ll sell.”

Whether it’s a domain or website, selling too quickly is not smart investing. That’s why patience is a big part of this. Hang onto a domain or website until you get a fair offer.

However, as we stated above, it’s not the 90’s, so most good domain names are picked over. Today, the money is made creating high-quality, brandable websites with impressive content libraries.

Getting into Digital Real Estate

Digital real estate is an affordable, exciting, and unique way to invest in property. You can turn an investment of a few dollars into something potentially worth thousands if you do your research.

Knowing what to avoid and coming up with a solid strategy will give you the best chance of success. But don’t be fooled by online “gurus” that promise quick fortunes — it’s a ton of work.

Expect to spend between 12 and 18 months before seeing any money. However, if you have experience creating websites or enjoy researching domain names, you might consider getting into digital real estate.

This is what I’d consider one of the last unexplored frontiers, and now is one of the best times to get into it. With a simple, brandable domain, some hard work, and a strong work ethic, you can make a small fortune.

Frequently Asked Questions

What is meant by digital real estate?

When you read or hear the term "digital property," it refers to anything and everything you can own, buy, or sell online.

What are examples of digital real estate?

That might seem overwhelming, but it makes more sense when you understand that websites, URL's NFTs, domain names, and mobile apps are all digital assets that can translate into real-world profits, just like traditional real estate.

Is digital real estate lucrative?

Yes, digital real estate is lucrative. Like any investment opportunity, digital real estate can be very profitable under certain circumstances.

You just need to have the right tools, the correct information, and plenty of patience to cash in on digital real estate.

How do digital real estate investors make money?

There are tons of ways you could make money using digital real estate. If you run a business, you can use a website for advertising your services while making money from posting content that features affiliate links.

You can create an eCommerce site to sell goods and services, even if you don't own your own business. You can also use digital real estate to perfect your personal or company branding.

Much of the digital real estate available through access to VR tech is still in a very speculative stage. It can eventually make significant returns, but this process could take a while.

Why is digital marketing important in digital real estate?

Like traditional real estate, you'll need to market your products and assets to make money from your digital real estate.

If you want to monetize your social media, start a blog, flip domain names, or buy up some LAND parcels on a metaverse site, you will have to employ some form of digital marketing or another to be successful.

Your Next Steps

Be smart when you register a domain; look for .coms and generic keywords, avoid names with typos, and don’t go anywhere near a trademark battle, unless it’s for your own unique mark. If you’re building a website on your domain, put effort into it.

Make sure there’s great content, market it well, and choose something you think someone will have a commercial interest in. Above all, don’t expect to become a millionaire overnight.

Think of it as a money-making hobby with limitless profit potential. Never stop learning, and don’t get shiny object syndrome.

Invest the time and money it takes to make a great website, and you might find that digital real estate is a perfect fit for you. Will you be a prospector on one of the last great frontiers?

Resources: