Real estate has made many disciplined investors millionaires.

However, wholesale real estate contracts have also helped many real estate professionals pave their own road to riches. Read on to learn how.

What Is a Wholesale Real Estate Contract?

Wholesale real estate contracts can help you get started in real estate investing when you don’t have much money. It’s a way to generate profits by acquiring the right to purchase a property rather than actually buying the property.

After getting the right to purchase the property, the wholesaler can find a buyer to buy the property. Then the wholesaler can collect a fee for assigning this right to the buyer.

In a wholesale real estate deal, a real estate business person essentially acts as a middleman.

The Mechanics of Wholesaling

Wholesaling is not a conventional real estate investment strategy. However, it can be a successful way to make money off investment properties if it’s done right.

Here are the significant steps in real estate wholesaling:

- Identify a property owner willing to sell a property for significantly less than its market value.

- Offer the owner a wholesale purchase agreement allowing you to assign the right to buy the property to another investor.

- Find a buyer who will buy the property at the negotiated price while also paying an assignment fee.

- Finalize the deal, often at a double closing at a title office or real estate attorney.

While it sounds simple, there’s much more to it than you might think. Don’t worry; we’ll walk you through the steps to take in a wholesale deal.

Benefits of Wholesaling

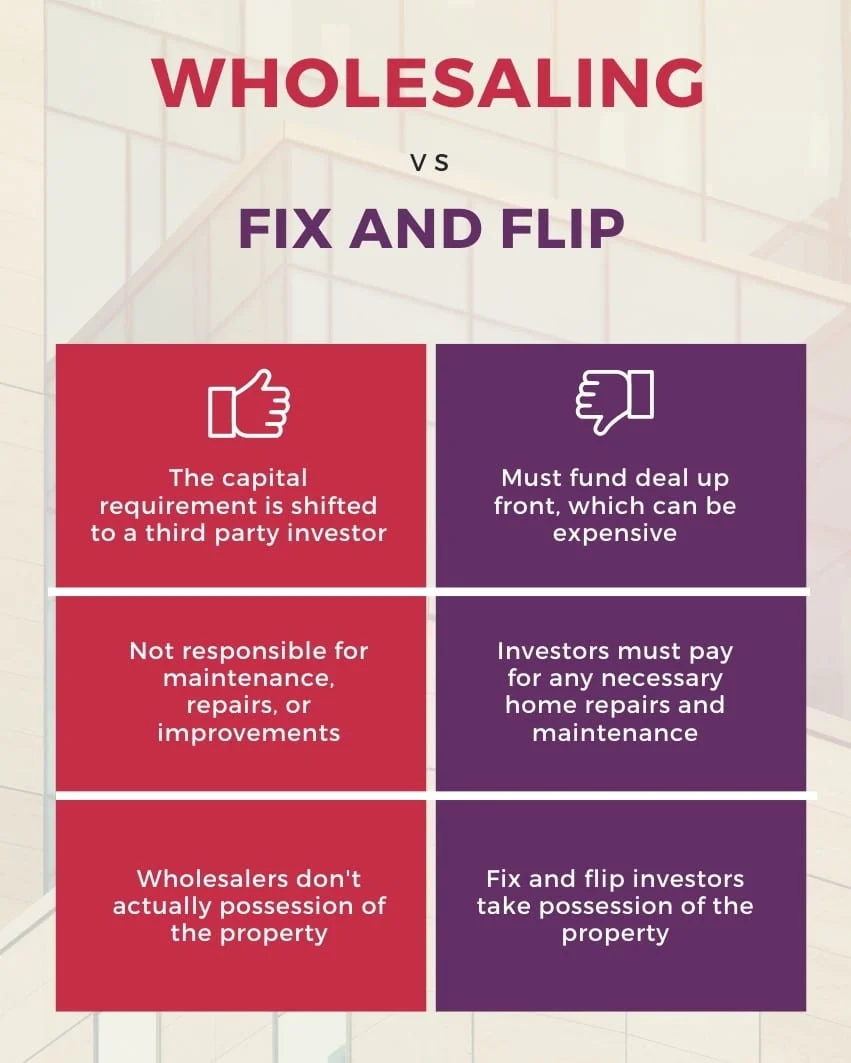

Wholesale real estate contracts don’t require you to put up any money to buy the property. They don’t need you to invest money to renovate properties. As a result, they involve relatively little risk to the wholesaler.

Wholesaling real estate can also generate profits faster than some other approaches to real estate investing. The entire process can be done relatively quickly, especially since wholesale deals are usually all-cash, so no lenders are involved.

Limits of Wholesaling

On the downside, wholesale real estate contracts are complicated. Even real estate professionals, including title companies and real estate attorneys, may be unfamiliar with wholesaling and how it works.

If the deal falls apart on a technicality, the wholesaler middleman won’t make anything. The potential profit on a given wholesale real estate contract is limited compared to the potential benefit from buying and selling a property.

It can be difficult to find sellers willing to sell low enough and buyers willing to pay enough to generate adequate fees for the wholesaler. Finally, wholesalers have to avoid trespassing on the turf of real estate agents.

If they appear to be acting like realtors, they can be subject to fines and criminal prosecution for practicing without a real estate license. And some states flatly prohibit any marketing of property that you don’t own.

In everything they do, from the way they present themselves to sellers to the contracts used to structure deals and the language used in prospectuses to potential investors, wholesalers have to make sure their role is clear and their rights are protected.

But if they address these issues, a wholesaling business can generate profits with relatively little risk.

Finding Motivated Sellers

The first step—finding motivated sellers—is the most important. A real estate wholesaler needs to get purchase agreements on properties for significantly lower amounts than the market value.

Why would anyone sell a property for less than it’s worth? Often, the reason is time. When sellers need to sell quickly, they may be willing to accept a lower price.

Property owners may need to sell quickly for a variety of reasons. Motivations often include:

- Tax-delinquent owners

- Divorces

- Health problems

In these cases, a wholesaler middleman who can quickly arrange for them to sell their property is performing a useful service. Sometimes, properties are seemingly underpriced because there is a problem with the property.

Wholesalers will want to avoid properties in poor locations with unfavorable zoning restrictions or other major negative issues. Wholesalers can identify motivated sellers by advertising online or in classified sections.

They may be able to use direct mail marketing, social media, or email campaigns to find sellers who need to sell quickly for an attractive price.

Wholesale Purchase Agreements

Wholesale real estate contracts are the legal documents that make wholesale investing work. The first one of these wholesaling contracts is the purchase agreement.

A wholesale purchase agreement gives the investor the right to purchase the property and also to assign that right to another party. It will explicitly state that the investor can assign that right to someone else.

The wholesale contract to purchase will also have a time limit, such as six months. During that time, the wholesale middleman has to produce a new buyer, or the deal will terminate.

It’s not enough that the purchase agreement has the necessary legal language stating the wholesaler can assign the right to another investor. Everything must be clearly explained upfront to the seller.

The wholesaler will make it understandable that he or she is not going to buy the property but instead is going to find an investor who will.

Wholesale Assignment Contracts

The other central part of a wholesaling contract is the assignment contract. This is where the wholesaler assigns to another investor the right to buy the property at the agreed price and to pay an assignment fee.

A wholesaler may be able to negotiate an assignment fee of approximately 10 percent of the purchase price. On low-priced properties, such as unimproved land, the fee may be a minimum of $1,000.

Since the wholesaler is not risking his or her own investment, doing any rehab, or paying repair costs, the fee may be capped at $5,000 or less on higher-priced properties.

It is a good idea to have a real estate attorney go over the assignment agreement and other documents used in wholesale real estate transactions. Different states have different rules about this process, so competent legal advice is essential.

It’s also essential that a title search be done before closing the real estate purchase. A wholesale resale estate deal is typically done on a cash basis, so no lender is involved.

Additionally, the paperwork is much less complicated. However, ensuring a clear title requires due diligence in any real estate transaction.

Finding a Buyer

With the purchase contract in hand, the wholesaler now has to find a cash buyer. The best way to do this is to build up a buyer list or network of investors who are willing to buy wholesale properties.

If the price of the property is attractive enough, finding buyers should not be too difficult. To present a property to a list of potential buyers, wholesale real estate investors use a property prospectus.

This briefly describes the property and its major features. That specifies the price, of course, as well as the assignment fee to be paid to the wholesaler middleman.

Closing

After a wholesaler has found a buyer, the deal can close relatively quickly since there is no need for loan underwriting. This may be done in the form of a double closing where there are three parties to the deal:

- The seller

- The wholesale middleman

- The investor

In a double closing, the wholesaler purchases the property from the seller. In contrast, at the same time, the investor buys it from the wholesaler. Double closings are unusual, and it may require contacting several title companies to find one that is comfortable with the deal.

If the deal doesn’t close, the middleman wholesaler may wind up with nothing. However, after a successful closing, the wholesaler can pocket a profit without ever having to risk his or her own money.

Wholesale Real Estate Contract Roundup

Wholesale real estate contracts can give investors who don’t have much money an opportunity to get started in real estate investing.

They can learn how to find motivated sellers and recruit well-heeled investors, all without risking their own money.

They can keep wholesaling as the focus of their business or use it as a way to learn about the real estate investing business and later do more conventional deals.