Fund and Grow promises to help you secure small business funding using zero-percent interest credit card loans.

But is it worth the hassle? We think so. Read on to learn about the company, its product, and when to use it.

What Is Fund & Grow?

Since the financial crisis of 2008, lenders have tightened restrictions and skyrocketed interest rates for even the most attractive borrowers. Fund & Grow founder and CEO Ari Page knew there had to be a better solution.

That’s why today the company offers unsecured business credit with 0% interest. As the name suggests, this is a great option if you’re looking to fund and grow your small business.

How Fund & Grow Works

Thichaa/Shutterstock

If you’re currently thinking that large, unsecured credit lines at 0-percent interest sound too good to be true, you’re not alone. But Fund & Grow has proved many skeptics wrong. Here’s how it works:

Fund & Grow leverages the zero-percent interest offered by banks and equity institutions for business credit cards. These offers are available for anywhere between six and 18 months.

Fund & Grow is skilled at navigating these offers so that you enjoy the best benefits from competitive lenders. Your low-interest capital can essentially be used as cash.

Small businesses, startups, and real estate investors can receive up to $250,000 in credit and beyond. This essential capital can launch your business and propel short- and long-term needs.

Can’t I Do This Myself?

Wait a minute, if Fund & Grow secures loans by applying for business credit card loans, why can’t I just do that myself? Technically, you can.

But the rules are complex, and lenders are looking for a very specific borrower profile. So, you may apply for a personal credit offer and only receive a $5,000 loan, even with a perfect credit score.

The key to getting those big lines of credit is to negotiate each account. That’s where Fund & Grow comes in. The company can leverage its relationships with banks to negotiate on behalf of business owners.

So yes, if you have good credit, you can apply online for a $20,000 credit card. Fund & Grow can help you get five credit cards at $50,000 to $80,000 each.

Now that’s the kind of capital you need to boost your business or start a career in real estate investing.

Fund & Grow Programs

Interested in giving it a go? Fund & Grow offers two programs that will guide you through each step of the way. In both options, Fund & Grow does the legwork to obtain business credit lines.

Then, they’ll hold your hand through the application process. First, they will run a credit analyzer and do an in-depth credit review. These credit reports help give you the highest possible personal credit score.

Then, they will consider every possible outcome to get you the largest business lines of credit.

Finally, Fund & Grow will show you how to transfer balances and turn your credit line into cash. Here are the two options:

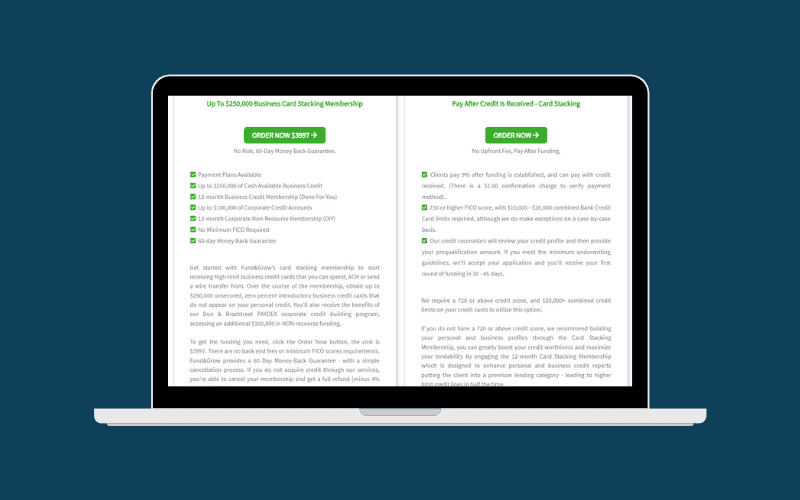

1. The 12 Month Membership

This 12-month membership works by signing you up for credit cards with 0% interest rates (in the name of your business) and then drawing on the cash advances.

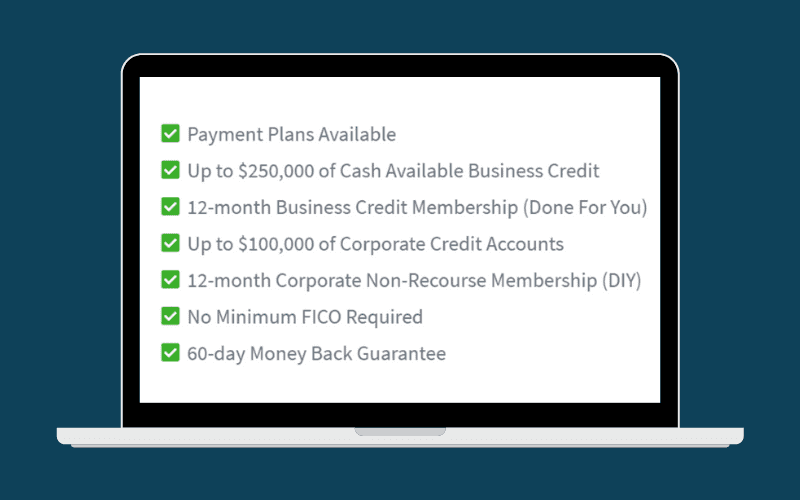

With this program, the company guarantees the following:

- Pay an upfront fee of $3,997 (payment plans are available)

- Guaranteed $50,000 to $250,000 cash credit at zero percent

- $50,000 to $250,000 of Corporate Credit Accounts (you do these yourself, with Fund & Grow’s help)

- No minimum FICO credit score required

- The fee is refundable for up to 60 days if no credit is procured

- CCB Accelerated Funding Membership

Keep in mind that Fund & Grow uses credit cards that offer 0% introductory rates. This means that any unpaid balance will be subject to astronomically high rates.

With their fee, a $50,000 loan equates to an almost 8% fee, though this decreases as the amount borrowed increases.

2. The Performance-Based Option

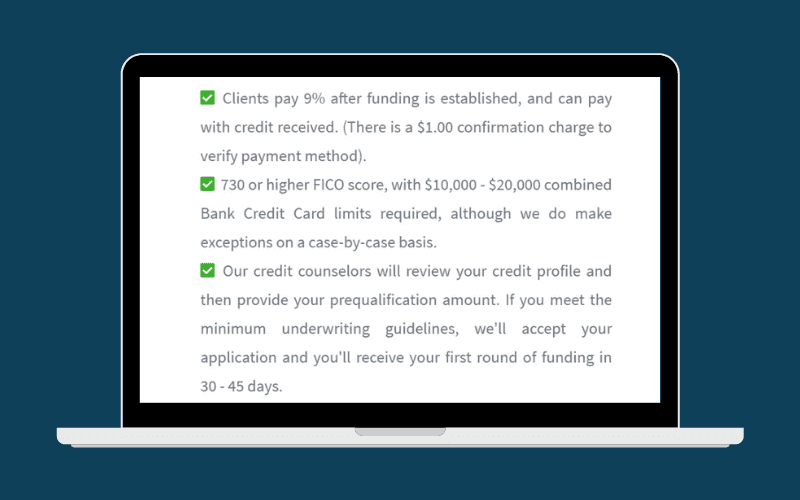

The second option comes in the form of a performance-based model. Essentially, Fund & Grow isn’t paid until you’ve received funding. This option isn’t as appealing and is more expensive.

However, there is no up-front fee, and it is a good alternative for those who don’t have business credit scores.

- No upfront fee

- Clients pay 9% after funding is established

- To qualify, applicants must have excellent credit scores: 730 FICO and above

- Must also have $10,000 to $20,000 in combined bank credit card limits

- Apply for only $1, and then credit counselors will review your profile and give you a pre-qualification amount

- If you meet all of Fund & Grow’s guidelines, you can have funding in 30 days

Note: Unlike the membership option, you are using your own credit score to qualify for these cards. Given that the loan is considered personal debt, this can hurt your credit score, as FICO takes the percentage of total credit used into consideration.

The Funding Process

Given my financial background, I did quite a bit of research to learn exactly what happens after you apply for a program.

Credit is like a house of cards; it takes a long time to build but can be easy to destroy.

How the process works

- Fund & Grow will conduct an initial consultation to understand your goals and credit situation

- Before you apply, they suggest building your credit score. This way, you’ll qualify for the best rates

- Fund & Grow will help you apply for cards with credit lines

- After your credit card accounts are established, they’ll help you draw on your credit lines

Tip: You will be automatically enrolled in the company newsletter for $50 per month. This seems like a waste of money to us, so make sure you opt out.

How Do You Get Your Money?

Here’s where things get tricky. Since these are credit cards and not a traditional business loan, you will most likely have to pay a fee for a cash advance.

Since this can be very expensive, most Fund & Grow clients use the credit cards to purchase gold and then sell it back for cash.

While brokers usually take 2% of the difference, this is still usually cheaper than the bank’s loan origination fees. However, a bank can cancel your card if they suspect you’re trying to avoid their fee.

Why You Need Cash

Dmitry Lobanov/Shutterstock

But if you are a real estate investor looking to purchase foreclosures, for example, you’ll need the cash. Here are some things you can do with the cash from your line:

- Reinvest in secure accounts. Fund & Grow can teach you how to navigate this complex financial atmosphere. For example, open a bank account in Europe without understanding the foreign currency.

- Replace equity loans with 0% interest by transferring the balance to the credit card. You will go from paying only the interest to actually paying down the principal.

- Invest in real estate. Fund & Grow can help sell properties to others who have good business credit and purchase your property. Since your buyer is also paying 0% interest, their cap rate will be much higher.

- Invest in high-yielding notes.

- You can even pay your taxes with a credit card.

Tip: Make a spreadsheet detailing each card’s information as they come in. Include the issuer, credit limit, and length of the interest-free introduction. Be sure to pay off your card before the interest-free period is over.

Fund & Gros Pros and Cons

Because this topic is financially related, you need to understand what you’re getting into. Inattention to loan expiration dates and fine print can cause the lender to call your loan due or even charge you sky-high fees.

Pros (what we like)

Yes, there are pros to this program. But as we’ve said above, make sure you fully understand the cons as well, as credit is a tricky topic that takes great care to manage.

- Responsible credit card users can get fast business funding with low interest.

- Your loan is unsecured, which means you don’t need to put up any collateral for the loan.

- It’s fast. Most participants report getting funds in about four to six weeks.

- By setting up a sole proprietorship, the business line of credit will not effect your personal credit score.

Cons (the downside)

Make sure you fully understand the cons. Especially the fact that you’ll have to refinance or pay off these loans to avoid high interest rates kicking in.

Just like a balloon mortgage, most loans have a clause in which banks can call the balance due.

- The money is in the form of credit cards, not cash. Cash advances from the credit cards can levy more fees.

- For some, is better to use the credit for business expenses than cash advances, since you won’t lose any capital in the process.

- Of course, Fund & Grow needs to make a profit as well. So you must either pay the enrollment fee or a percentage of your loan.

- Most importantly, these are short-term loans. After the intro rate expires (usually 12-15 months), you’ll either be assessed a high interest rate or will need to roll the balance into another card.

Our Take

We are conservative by nature and subscribe to the “minimal debt” principal. For that reason, we’d never try using this service, as I believe there are too many variables.

HOWEVER… that’s just us. If you have limited access to capital, this is a unique way to unlock credit that banks wouldn’t otherwise extend to you. But be sure to know what you’re getting yourself into.

Lots of Work

Bacho/Shutterstock

Next, this is just a lot of work. You have to do lots of paperwork, and the rates are anywhere from 6%-9%. Chances are one card won’t let you take a $250,000 draw, so you’re going to open at least a few card accounts.

Short Timeline

First, this is short-term financing that relies on introductory credit scores. After 12 or 15 months, you’ll either have to transfer or pay off the balance.

In order to accomplish that, you’ll have to open more cards, which can ultimately hurt your credit score if the card makes you personally guarantee them or act as a cosigner.

Complicated Structure

Finally, you need to keep track of your various cards, loan due dates, monthly payment dates, etc. Although we applaud the creativity, we think it’s far too complicated and expensive than other market options such as hard money loans or a simple promissory note.

While our experience should not act as a barometer for the larger market, we find that that in our Midwest market, personal notes range from 8% up to 12%, based on whether they are secured or unsecured.

Even though it takes work, establishing a network of “money guys” is actually much easier to do than you’d think, as long as you don’t mind prying into someone’s personal business over a few drinks.

In fact, we’ve found that most people volunteer financial information if you have established trust, common interests, and have fostered a relationship with them.

Should You Use Fund & Grow?

Zivica Kerkez/Shutterstock

Fund & Grow promises to do just that for your small business. If your startup needs help getting off the ground, or you’re looking to make an investment in a property, the company’s unique premise can garner unheard of zero-percent loans.

While this sounds great, you should thoroughly research how such a low rate is possible. That’s not to say you should write off this option, because we’re sure it’s great for some people. Just be sure to research the company’s unique product before signing up.