The Rule of 72 is a great way for investors to eyeball their returns.

Basically, this rule helps you calculate the time it’ll take to double your money at various interest rates.

Read on to learn how it can benefit your portfolio.

What is the Rule of 72?

The Rule of 72 is a finance shortcut for figuring out how long it will take to double your money with an interest-earning investment. It turns a complicated calculation into one you can often do in your head.

And the accuracy is good enough for many purposes. The formula for the Rule of 72 is genuinely easy to remember. You just divide the number 72 by the annual interest rate the investment will earn.

The result is the approximate number of years it will take for the investment to double in size. Here are some examples:

- 72 / 6 percent = 12

- 72 / 8 percent = 9

- 72 / 10 percent = 7.2

Note that you write the percentage interest rate without dividing it by 100, as you normally do when calculating percentages. That is, an annual interest rate of 8 percent is entered as 8, not 0.08.

Uses for the Rule of 72

Calculating compound interest calls for some fairly advanced math skills. Few people can do compound interest calculations in their heads. Most can’t do them with pencil and paper.

As a rule of thumb, the Rule of 72 has many uses. It lets the average investor quickly make a mental calculation to get a reasonably accurate estimate of doubling time for an investment.

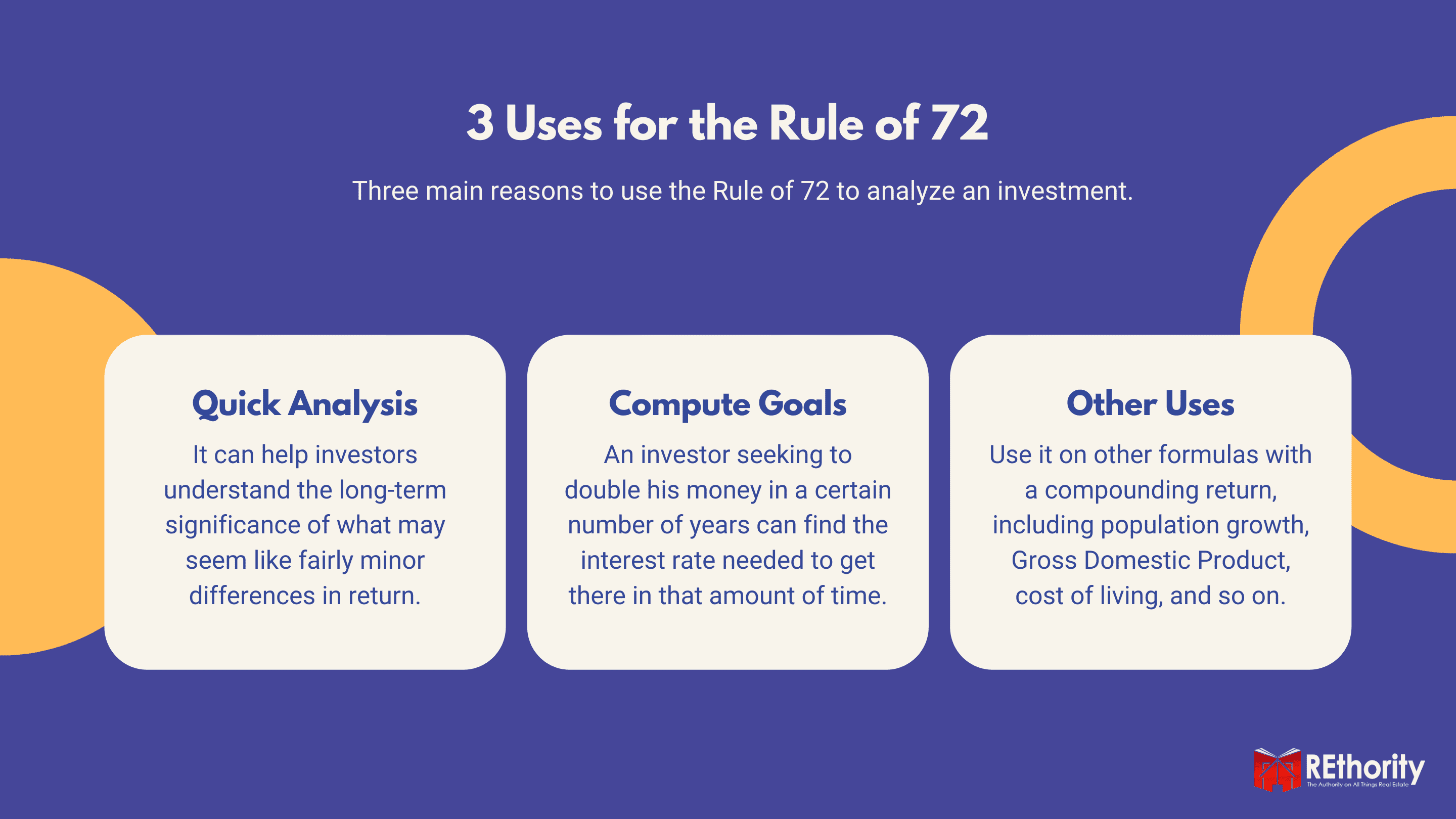

Easily Analyze Investments

Armed with the Rule of 72, investors can readily compare investments producing different rates of return. It can help investors understand the long-term significance of what may seem like fairly minor differences in return.

For example, an investment with a 4 percent annual rate of return will double an investor’s money in 18 years. An investment that pays 3 percent will take 24 years.

That’s six years longer due to a difference of just one percentage point. This kind of insight can shed light on the long-term impact of factors such as investment management fees.

Compute Financial Goals

The Rule of 72 can also be reversed to help investors figure out how to reach their financial goals.

That is, an investor who wants to double his or her money in a certain number of years can find out what interest rate is needed to get there in that amount of time.

For example, say an investor has $100,000. She wants to double it to $200,000 by the time she retires in 12 years. Dividing 72 by 12 produces 6. The investor knows to look for an investment with a 6 percent annual compound return.

Other Uses for Rule of 72

The Rule of 72 can be applied to anything that increases at a compound growth rate. That includes population growth, gross domestic product, cost of living, and so on.

You can use the Rule of 72 to understand how different rates of inflation reduce the value of money.

For instance, at an inflation rate of 2 percent, in 36 years, it will take $1,000 to have the purchasing power of $500 today. At a 3 percent inflation rate, that will happen in just 24 years.

The Rule of 72 can also tell you about the effects of rising costs. Let’s say your company’s health insurance premiums are rising at a steady 6 percent annual rate.

If that keeps up, in 12 years, you’ll be paying twice as much for health insurance as you are now. There are lots of applications of the Rule of 72 in real estate.

The long-term impact of rising rents, expanding property values, higher taxes, and other trends can be easier to understand using Rule 72.

Limits of the Rule

The Rule of 72 does have some limitations. One is that it can only be applied to compound interest, not simple interest.

Compound interest adds the interest earned to the principal. Then it pays interest on that larger amount.

That is, you earn interest on interest. Savings accounts are an example of something that features compound interest.

Simple interest is only calculated against the principal. The interest itself does not earn interest. Auto loans and personal loans may use simple interest. Some biweekly mortgages also charge simple interest.

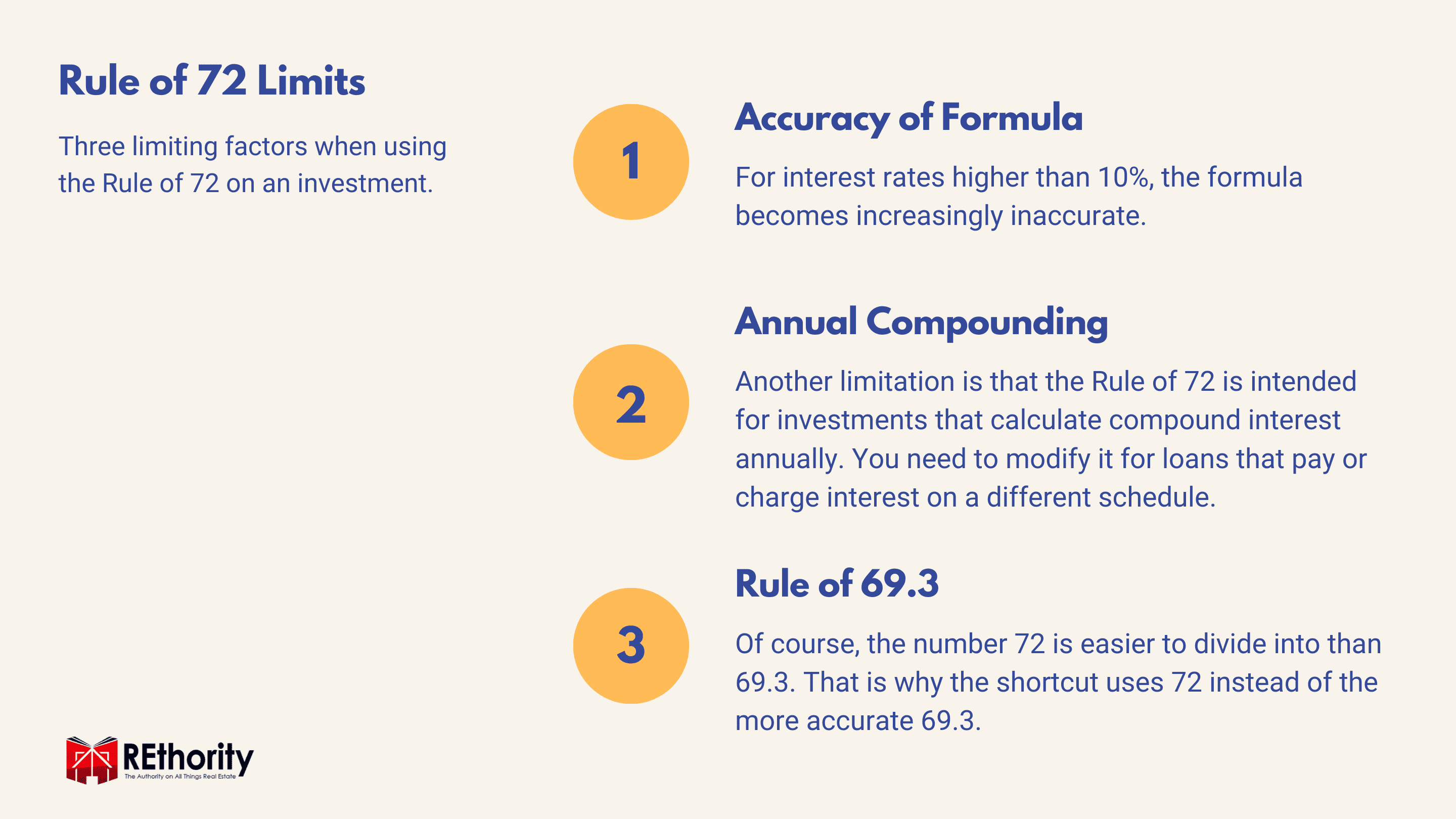

Accuracy

Accuracy is another limit. The Rule of 72 is most accurate with an 8 percent interest rate. And it’s fairly accurate for any interest rate between 6 percent and 10 percent.

For interest rates higher or lower than that, however, it gets increasingly inaccurate. You can adjust for this by adding or subtracting 1 from 72 for every 3 points where the interest is below or above 8 percent.

So if the interest rate is 11 percent, that is 3 percentage points more than 8 percent. In this case, add 1 to 73 and divide 11 by 73. If the interest rate is 14 percent, that’s 6 percentage points more than 8 percent. So divide 14 and divide it by 74.

For interest rates below 6, subtract 1 from 72 for each 3 points below 8 percent. So an interest rate of 5 percent is divided by 71. An interest rate of 2 percent is divided by 70.

Annual Compounding

Another limitation is that the Rule of 72 is intended for investments that calculate compound interest annually. You need to modify it for loans that pay or charge interest on a different schedule.

If interest is calculated quarterly, divide the result of the Rule of 72 calculation by 4. If it pays monthly, divide by 12.

For daily or continuous compounding, use 69 or 70 instead of 72.

The Rule of 69.3?

In mathematical terms, 69.3 is the natural logarithm of 2. And the natural log of 2 is the number to use instead of 72 to get the most accurate results when estimating investment doubling time.

Of course, the number 72 is easier to divide into than 69.3. That is why the shortcut uses 72 instead of the more accurate 69.3.

For daily and continuous compounding, it’s better to use the more accurate number. In fact, any time you want a more precise number of years for an investment to double, use 69.3 instead of 72.

To solve more complicated compound interest questions, you can use an online compound interest calculator. But for a quick idea of how long it will take to double your money, the Rule of 72 is often good enough.

Should You Use the Rule of 72?

Doubling your money isn’t an easy thing to do, but knowing how long it’ll take at various interest rates is helpful.

And the Rule of 72 is perhaps the best rule of thumb to help you eyeball the necessary returns to double your money.

We think it’s a great tool to keep in your back pocket when analyzing investment opportunities.