Choice Home Warranty is a name you’ve likely heard a lot of times.

But what does it cover and cost?

Don’t worry; we’ll answer both questions below. Read on to learn more.

What Is Choice Home Warranty?

Choice Home Warranty is a nationally known home warranty brand with George Foreman as their spokesperson. “Don’t let home repairs knock you out,” advises George.

And you can be sure that Choice promises to help homeowners pay for the unexpected costs when systems or appliances fail within the house.

We aren’t looking for a fight, but we want to give you an honest review as much as we love Big George. Ultimately, not every home warranty company is a fit for every consumer.

This Choice Home Warranty review will consider the company’s background, plan costs and types, what plans exclude, and how homeowners can make claims.

The goal is to give you the information needed to decide if Choice Home Warranty is the best warranty company for your needs.

The Company

Image Source: Choicehomewarranty.com

Headquartered in Edison, New Jersey, Choice Home Warranty offers protection plans offering nationwide coverage. It was founded in 2009 and uses local, pre-screened technicians.

The company answers repair calls 24 hours a day, seven days a week. Their goal is to give homeowners the confidence that someone is there to help in their time of distress.

They have an extensive network of service providers—more than 15,000—to aid homeowners when things go wrong. The company offers two home warranty plans to choose from: a basic plan and a total plan.

When to Buy a Plan

You can buy a Choice Home Warranty at any time. While many people buy them (or have them given to them) during the home purchase escrow process, you can buy the home warranty at any time.

Note that there is a 30-day waiting period before you can use the plan for covered repairs. This ensures that people are buying a Choice Home Warranty in good faith. And while expecting potential problems, I don’t have any immediate needs.

Choice Home Plans and Pricing

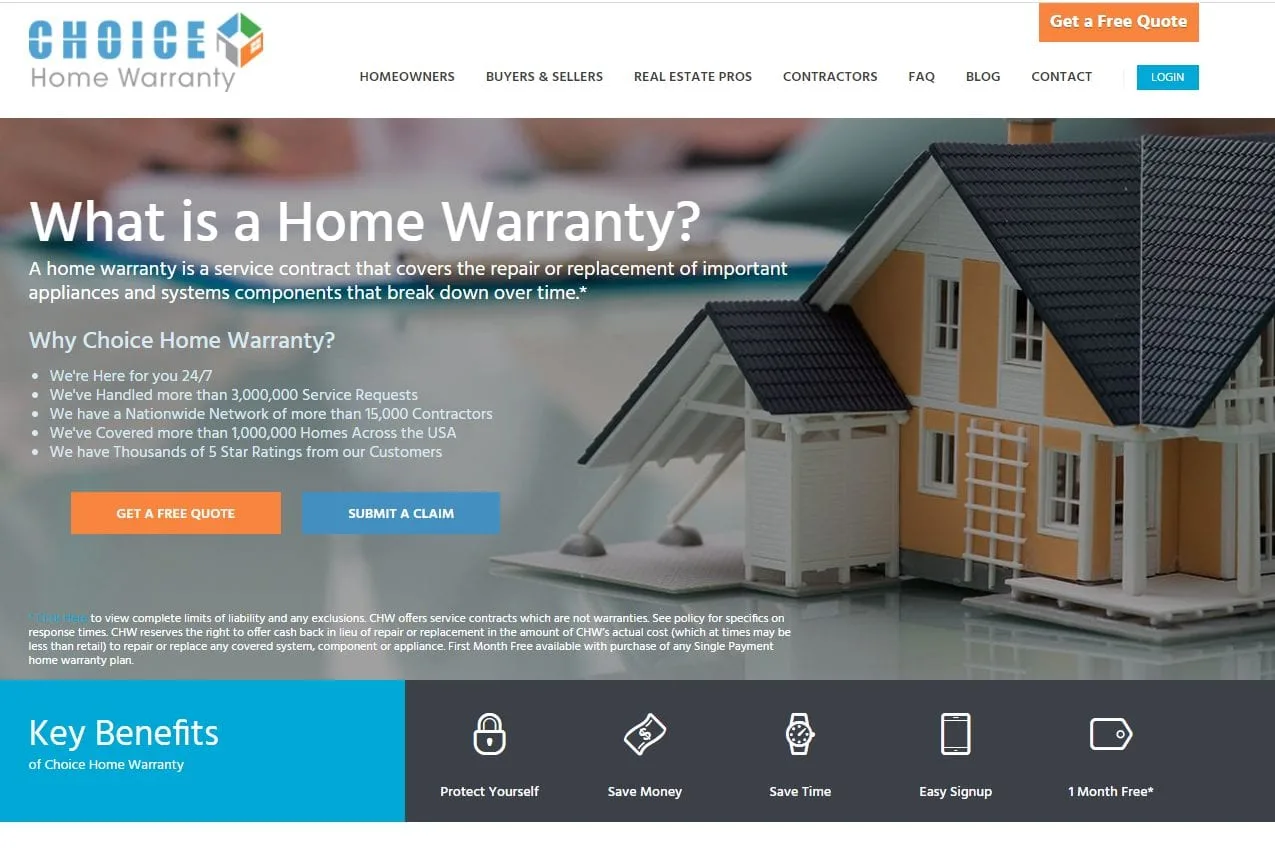

There are two types of plans you can choose from when buying a home warranty from Choice: the Basic Plan and the Total Plan.

Think of the Basic Plan as covering the most common essentials in a home, and the Total Plan as covering homes that have a few added upgrades.

For example, the Basic Plan covers kitchen appliances, plumbing, and electrical systems. But the Total Plan adds coverage for things such as air conditioning systems and washers and dryers.

Each of the two plans also offers add-on coverage for the things that not every home has (but you’ll want coverage for if you do). Take a look at the side-by-side comparison of the two plan types to determine which plan best suits your needs.

As you can see, the major differences are with the appliance coverage. If you want your most expensive appliances, such as refrigerators, washers, and dryers, covered, it is best to get the Total Plan for an extra fee every year.

Every homeowner should evaluate how old home systems are and the average age of appliances.

Newer appliances such as washers, dryers, and refrigerators might not need to have coverage. In this case, the Basic Plan covers the most significant risks for homeowners.

Plan Costs

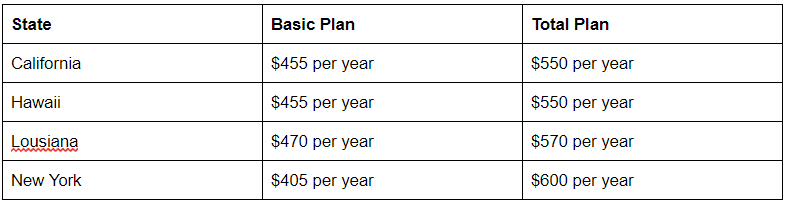

Choice Home Warranty plan prices will vary depending on where you live and which of the two plans you choose. Costs vary because of the varying costs of service repairmen in some geographic areas.

It is important to note that there is a trade service fee of $85 every time you call for a claim. This means that on top of your monthly (or annual) payment, you will pay $85 for a technician to come out and repair the item in question.

What is a Trade Service Fee?

Choice Home Warranty requires an $85 trade service fee due at the time of repairs. Every home warranty company charges a fee when a technician is called. This is your cost for the repair.

We have seen trade services fees with other providers range from $75 to $125, so we feel that this is a fair fee on the lower end of the industry standards.

If you think of a home warranty the way you would think about insurance, you have your insurance premium and a deductible owed when you make a claim. The trade service fee is similar to your deductible in a homeowner’s insurance policy.

In a nutshell, it’s your out-of-pocket costs for the actual repair. For the $85 trade service fee, a licensed technician will respond to the claims call, assess the problem, and fix it.

This might require multiple visits; these are all covered under the same trade service fee. Only a new issue would require a new trade service fee.

Sample Quotes Across the Country

It should be noted that when running quotes, Choice Home Warranty offers a promotional discount when signing up for either of its plans.

It is hard to discern if this is a standard with Choice Home Warranty or something that happens seasonally.

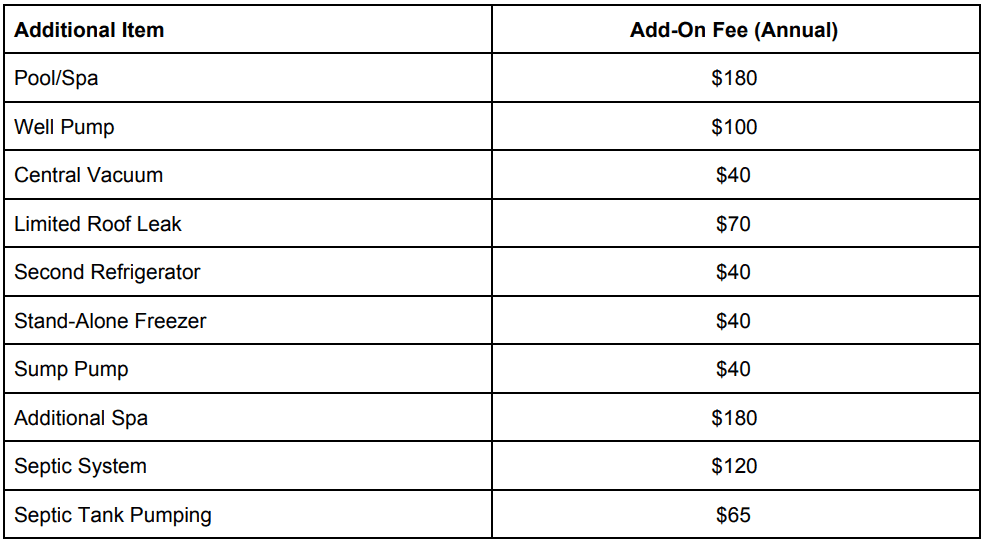

For the most current and accurate prices, consumers should run a quote for the specific needs of their own home. The following additional items can be covered for an additional fee:

Choice Home Warranty is one of the few home warranty companies to offer any type of roof coverage. While this is limited roof leak coverage, it is helpful to prevent thousands of dollars in out-of-pocket costs.

Home Advisor says that the range of average roof leak repairs is $351 to $1,388. For $70 a year, homeowners can rest assured that roof leaks are covered. Consider some of the other common household repairs:

- Plumbing: $175 to $450

- Electrical: $150 to $1,100

- Septic System: $577 to $2,534

- Sump Pump: $378 to $530

- Refrigerator: $200 to $400

- Oven Range: $150 to $400

If your home has older systems or appliances, it is only a matter of time before things start to go wrong. This is where having a Choice Home Warranty is a huge benefit.

You’ll have a finite expense when something goes wrong: the trade service fee of $85. Having a service contract eliminates the risk of not having the money for repairs.

Notable Exclusions

For everything that is covered, there is an equally long list of what is excluded from coverage with your Choice Home Warranty. For a complete list of exclusions, consumers should review the policy contract.

What is important to understand is the broad stroke exclusions of the Choice Home Warranty that typically can affect a claim. Pre-existing conditions, whether known or not, are not covered under your home warranty.

We realize that it might seem unfair to exclude something you were not aware of, but if the condition existed, say before buying the house, and wasn’t addressed in inspections, Choice Home Warranty reserves the right to deny the claim.

This is important to understand—note that this is common among all home warranty companies—because many people buy a home warranty during the home buying process.

This is to help you feel confident that you aren’t buying a money pit and have a resource to take care of unexpected repairs.

It isn’t to take care of things the seller refused to deal with during escrow. Don’t be fooled by sneaky sellers into thinking your home warranty will care for it once title transfers—it won’t.

Payout Caps

Most home warranty companies have coverage caps limiting how much a homeowner can get in individual and aggregate claim payments within a year.

There may be individual payout caps, such as $500 for electrical, plumbing, or ductwork work per contract term.

Choice Home Warranty will not pay more than $1,500 for specific heating systems and not more than $500 for whirlpool tubs. The total aggregate annual cap is $15,000.

Homeowners should keep this in mind when purchasing a home warranty: think about the total cost if something can’t be repaired but instead needs to be replaced.

In those scenarios, the homeowner may exceed the cap and be out-of-pocket for the difference.

Filing a Claim

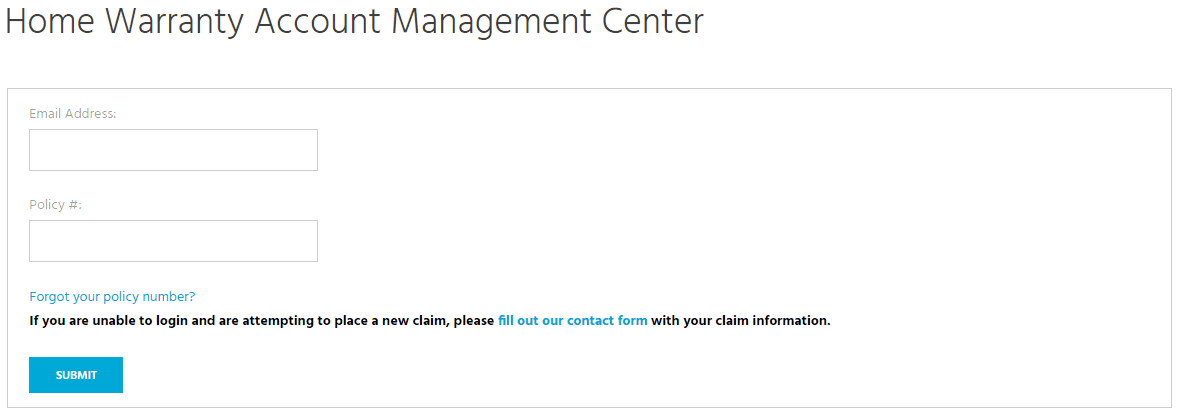

Image Source: Choicehomewarranty.com

To make a claim on your policy, you will need to call 888-531-5403. Claims representatives are available 24 hours a day, seven days a week, to take your call. Choice Home Warranty reserves the right to choose the service provider to use for repairs.

This is not something a homeowner can change. You will not be able to call a service repairman and expect Choice Home Warranty to reimburse your costs.

Choice Home Warranty makes every effort to address claims within the first 24 to 48 hours, meaning they will try to have a service repairman at your home within this timeframe.

This is considered better than expected among other home warranty companies and makes a big difference for homeowners who don’t want to be dealing with any system or appliance problem for an extended period of time.

Work Guarantees

Consumers might be concerned with a technician coming and claiming that the issue is resolved when it isn’t. Choice Home Warranty offers a 30-day guarantee on labor and workmanship and a 90-day guarantee on parts.

If you are concerned about a repair still giving you problems—think about a toilet that starts running again—it’s important to note the date of the original repair and contact Choice Home Warranty before the work guarantee expires.

If the work guarantee does expire, you may still call Choice Home Warranty and make a new claim. This is subject to a new $85 trade service fee and may be subject to service contract caps.

When possible, it is best to have the original service repair technician fix the problem while still under the work guarantee of 30 or 90 days.

Our Take

Overall, we like Choice Home Warranty. The plans offered are more flexible than some competitors, and the pricing is straightforward. Unlike other companies, both plans offered do not require a home inspection.

Monthly fees are reasonable, and the service call is about 20% lower than big companies like American Home Shield. Additionally, customer service reps are available 24/7.

If I were to buy a home warranty, I’d choose Choice Home Warranty for the flexibility, simplicity, and affordability its plans offer.

What Makes Choice a Good Warranty Company?

A good home Warranty will have thorough coverage to eliminate as much out-of-pocket cost for clients as possible while providing a seamless experience from placing a claim through completion of repair or replacement of a home system or appliance. – Scott Titus of the Patriot Investment Group

Choice works hard to process claims quickly. However, they also bill the service provider directly. This means the homeowners don’t need to be out-of-pocket for more than their trade service fee. Their guarantee shows that they stand behind their work.

The Bottom Line

Compared to other national brand home warranty companies, Choice Home Warranty offers competitive pricing for standard and premium plans. They have some exciting add-ons not seen with many other companies, including the limited roof leak option.

Choice Home Warranty is an excellent investment to help new and existing homeowners mitigate the potential expenses of home repairs and appliance replacement. In other words, Big George has you covered on this one.