Real estate crowdfunding is a relatively new way to passively invest in real estate.

It offers an alternative to the capital-intensive method of buying your own property. Read on to learn more about this unique strategy.

What Is Real Estate Crowdfunding?

Real estate crowdfunding is a relatively new method that real estate investors use to buy shares in commercial real estate properties. Real estate crowdfunding enables investors to pool their money and fund big projects.

These are typically amateur investors looking for great real estate investment opportunities but unable to purchase an expensive commercial property on their own.

This might be because they lack the capital or just want to diversify their investment risk. Say you’ve identified an apartment building for sale for $4 million.

But you can only come up with $2 million. You might turn to real estate crowdfunding to source the rest of the cash. Each investor that puts money in earns a percentage of the profits you’ll make from the building.

You won’t make 100% of the profits this way, but you’d make no profits if you couldn’t come up with the cash to make the purchase in the first place. Real estate crowdfunding opens the door to purchasing the building and earning most of the profits.

How Real Estate Crowdfunding Works

So how does it work? Every real estate crowdfunding platform is an investment ecosystem that relies on two types of users: Investors and sponsors. Investors are the users who are willing to invest cash into properties.

And sponsors are the users (or businesses) that spot the investment opportunities and list them on the platform. Sponsors are responsible for most of the work that goes into the investment.

I.e. identifying good investment properties, making the purchase, working with vendors, handling lenders and financing if needed, and selling the property.

Sponsors might turn to crowdfunding because they’ve seen a great investment opportunity but don’t have enough capital to make the deal on their own. Investors are responsible for putting money up in exchange for a percentage of the property’s profits (income from rent, cash from selling the building, etc.).

They might turn to crowdfunding to diversify their investment portfolio, invest smaller amounts in a greater number of properties, or earn more passive income.

Suz7/Shutterstock

Example

Meg has $5,000 and wants to invest it in real estate. She doesn’t have enough capital to purchase a property on her own, but she hears about a real estate crowdfunding platform where she can invest a smaller amount and reduce her risk level.

On this platform, she discovers a 20-suite office building that can be rented out. She connects with the sponsor, who created the listing and puts her $5,000 in along with other investors. She becomes a shareholder, earning part of the building’s monthly profits from rent, and eventually, the sale price.

It would have been impossible for Jane to find this kind of investment property for $5,000 or to come up with the amount she’d need to purchase a property like this, but real estate crowdfunding made it possible for her to invest.

The Rise of Real Estate Crowdfunding

What led to the rise of this method of investment? Just like the rise of other crowdfunding applications (like GoFundMe, Kickstarter, and Indiegogo), widespread internet connectivity and social media platforms are key to the growth of this new sector of real estate investing.

Crowdfunding requires that you be able to share your idea or request with lots of people. It relies on a large number of smaller contributions, investments, or donations rather than a smaller number of large contributions in traditional investing.

Beeboys/Shutterstock

Real estate crowdfunding had a few hurdles to clear before it became a legal, accepted method of investment. Before the Jumpstart Our Business Startups (JOBS) Act was passed, you could only invest in real estate in a couple ways.

One was if you planned to purchase physical property. The second was to put the money into Real Estate Investment Trusts (REITs). Finally, you could invest in private placements, which usually required you to be an accredited investor.

What exactly is an accredited investor? Simply put, it’s a wealthy individual who understands complex investments. More importantly, it’s someone who can afford to lose the investment if things go sour.

However, the JOBS Act was passed and paved the way for crowdfunded real estate investments by changing the rules about how people can invest in real estate.

The JOBS Act allows anyone with capital (considered “non-accredited investors”) to invest in either equity or real estate transactions. This means you can now invest a smaller amount of money – let’s say $1,000 – and own a share in a property that you couldn’t afford to outright buy for $500,000.

With your $1,000 investment, you become a shareholder, and any profit that comes from the property will be divided out to you and the other shareholders.

This new ability to buy shares in commercial real estate without needing the capital to pay for the entire property is what led to the rise of real estate crowdfunding, and it’s only becoming more common.

Real Estate Crowdfunding Platforms

The platform is one of the most important factors in this form of investment. The platform is the medium through which the investors can scroll through different opportunities and deals.

So the platform has to evaluate each one before allowing them to be posted carefully. Let’s look at some of the most popular real estate crowdfunding platforms available.

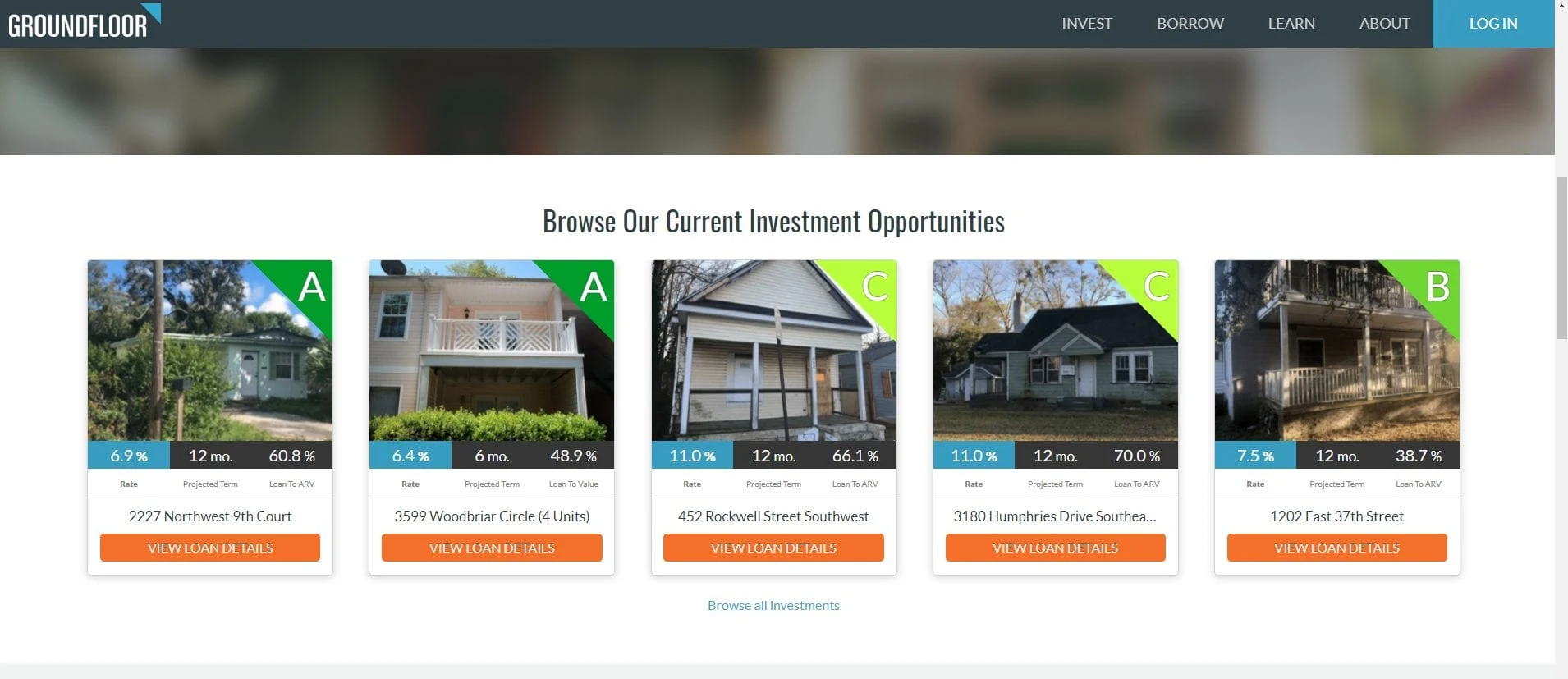

Groundfloor

Image Source: Groundfloor.us

This platform is great for new real estate investors who want to start with minimal investments to see how things work. You can invest as little as $10 on Groundfloor, which is lower than any other real estate crowdfunding site.

A sampling of their projects indicates expected returns of up to 10% from your investments here. You do not need to be an accredited investor to use this platform.

- $10 minimum

- Non-accredited investors

- Accredited investors

Fundrise

Image Source: Fundrise.com

Fundrise has an investment minimum on the low end ($500) and a pool of really high-quality real estate investments that are being improved rather than just bought and sold. Fundrise only accepts around 5% of the investment opportunities that sponsors try to list on the platform.

You don’t have to be an accredited investor to use Fundrise, but you may be limited to REITs only as a non-accredited investor.

- $500 minimum

- Non-accredited investors – may be limited to REITs

- Accredited investors

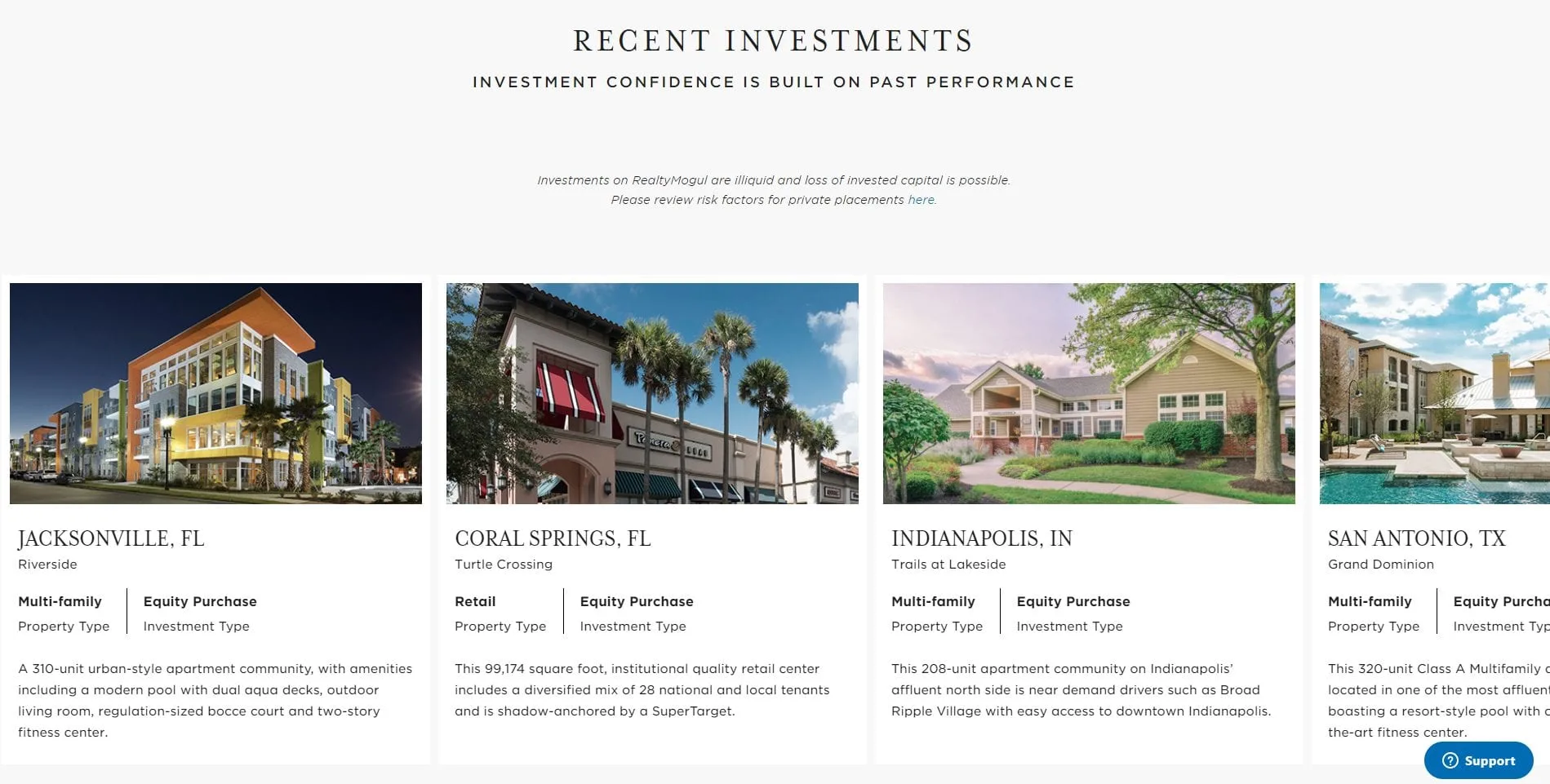

RealtyMogul

Image Source: Realtymogul.com

For security in your investment, RealtyMogul is one of the best options. Most of the properties listed here are already leased, so you can begin earning returns right away. You need at least $1,000 to start investing on this platform.

You don’t have to be an accredited investor to use RealtyMogul, but you can only use Real Estate Investment Trusts (REITs) if you’re not accredited.

- $1,000 minimum

- Non-accredited investors – REITs only

- Accredited investors

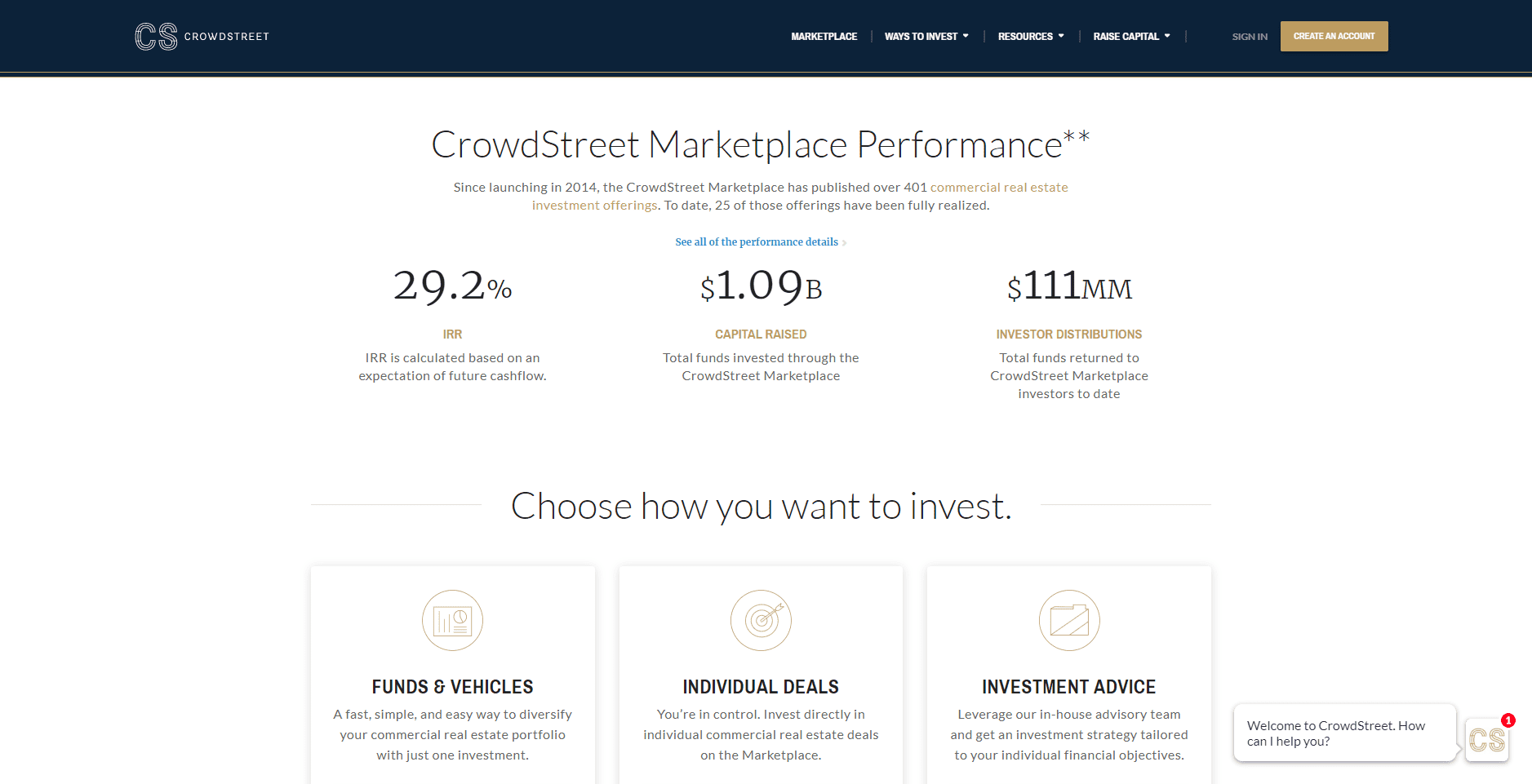

CrowdStreet

Image Source: Crowdstreet.com

More seasoned real estate investors can find a crowdfunding home on CrowdStreet. You’ll need to put up a minimum of $25,000 to invest here, but it’s a highly rated platform.

Every deal and investment opportunity is professionally managed, comes with access to investment tools, and features CrowdStreet user support if you have questions along the way.

You must be an accredited investor to use this platform.

- $25,000 minimum

- Accredited investors only

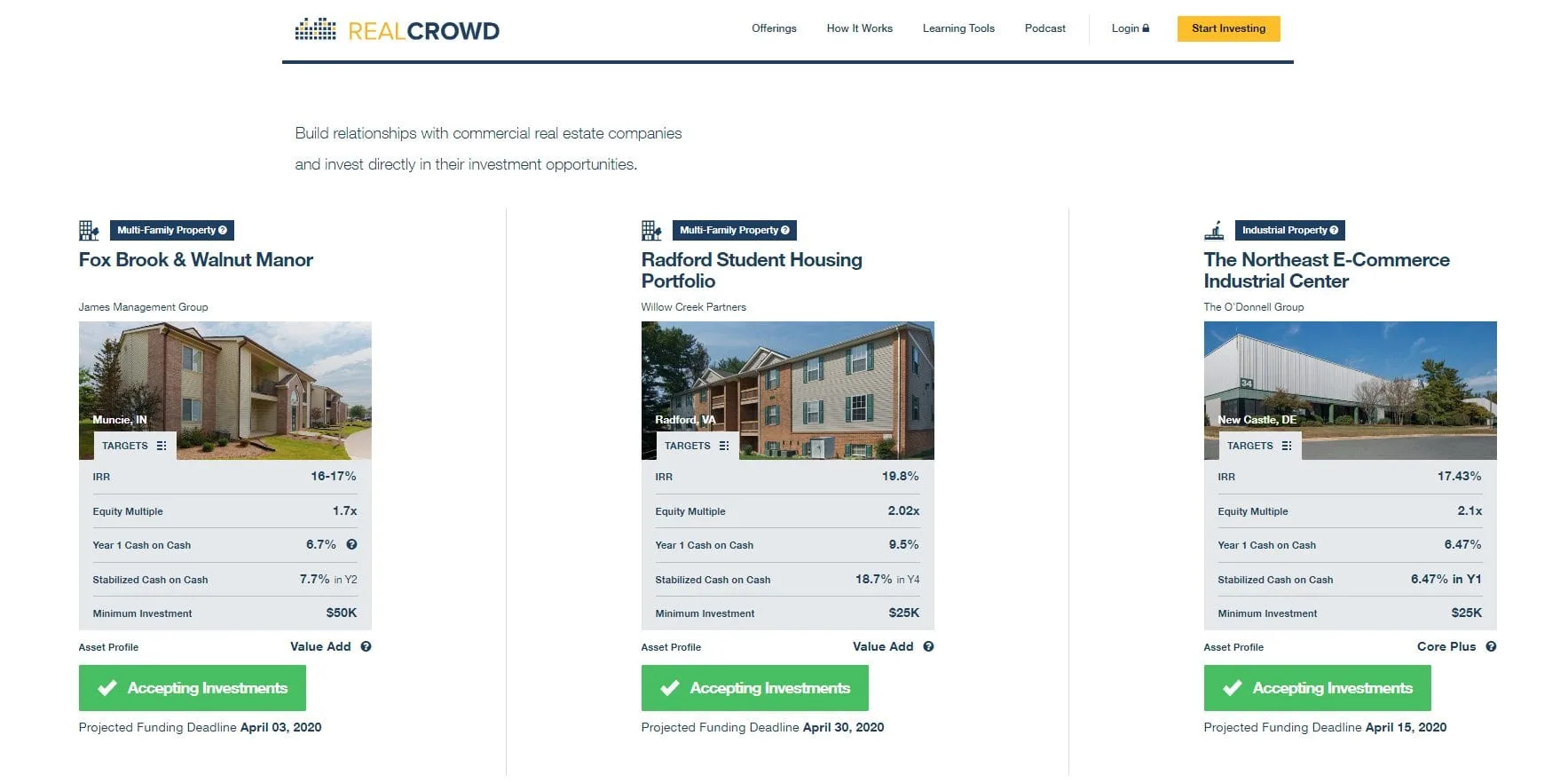

RealCrowd

Image Source: Realcrowd.com

This is a platform you can trust – it was part of the Y Combinator investment accelerator and has had a lot of success. There are a few barriers to entry here, though: You have to be willing to put up at least $25,000, and you must be an accredited investor.

This platform is top-notch and very picky about which opportunities are listed here and which investors are allowed to participate.

- $25,000 to $50,000 minimum

- Accredited investors only

Pros and Cons

As with any balanced review, there are pros and cons to consider. We highlight both to ensure you have all relevant information in order to make an informed buying decision.

We’ve looked at some of the best real estate crowdfunding platforms, so now let’s focus on the benefits these platforms may have.

- Low barrier to entry. Investors don’t need to invest their entire life’s savings or come up with $100,000 to help crowdfund property. They can invest as little as $500 using real estate crowdfunding.

- You don’t have to be accredited. Most real estate crowdfunding platforms don’t require you to be an accredited investor. If you’re new to real estate investing, that’s great news because accredited investors must have a net worth of $1 million or more and make at least $200,000 per year for at least two years in a row.

- Less risk for investors. When you invest a little in multiple properties, there’s less risk than having an all-equity portfolio.

- More investment opportunities. Both sponsors and investors can participate in more investment opportunities overall, whether they are the person who discovers the opportunity and puts up most of the cash or investing smaller dollar amounts into it for a small percentage of the profits.

Here’s what may be disadvantageous about using real estate crowdfunding opportunities to invest in real estate.

- Strict investment limits. The SEC limits the amount you can invest if you’re non-accredited to less than $107,000 if your net worth is less than that amount.

- Long holding periods. Your real estate investments made on crowdfunding platforms aren’t liquid assets, and the average holding periods are 5 to 7 years.

- Limited control. Because you’ll invest smaller amounts, you won’t have as much (or any) control over the property. If you’re interested in more closely managing real estate investments, this is not the method for you.

Is Real Estate Crowdfunding Right For You?

Whether you’re a new or experienced real estate investor, crowdfunding investments can be a smart way to diversify your portfolio and earn great returns.

From Groundfloor which enables you to start investing with as little as $10 to the prestigious RealCrowd requiring that you be an accredited investor with at least $25,000 to invest, there’s a real estate crowdfunding option for everyone.

This method of real estate investing is relatively low-risk and can help you get involved in more investments without the capital requirements of traditional real estate investments.