Airbnb arbitrage is a new method of investing, though few investors actually use it.

Learn how it works, what benefits it offers, common mistakes, and whether we think it’s worth considering.

Airbnb arbitrage is a relatively new investment strategy that allows you to earn passive income without actually assuming the risk of buying property.

Arbitrage is one way users make Airbnb work for them (and their wallets).

If you can afford to lease or rent a place in a relatively high-traffic area, you can turn your initial investment (the amount paid to rent it out for a month) into much more, without the expenses, repairs, and responsibilities that come with owning a rental property.

Read on to learn about Airbnb arbitrage, why it works, advantages over traditional property investing, and how you can use this method to make money in real estate without owning property.

What Is Airbnb Arbitrage?

Vectormine/Shutterstock

Arbitrage is selling something for a profit in a different market, whether it’s a shipment of fruit or a rental property. When we say “Airbnb arbitrage,” we are referring to the method of “re-renting” a property to Airbnb users for a profit.

Empty apartments, houses, cabins, and condos are leased through a landlord, then sublet to Airbnb users on a night-by-night, weekly, or monthly basis.

The result is rental income that (hopefully) tallies up to be much more than the cost to rent the place by the month.

Is This Legal?

Airbnb arbitrage is not for everyone, though. There can be legal issues involved with subletting a property without permission from the landlord, so you have to make sure you have an agreement with your landlord in writing before you proceed.

Many landlords explicitly prohibit subletting, but some landlords will make exceptions on a case-by-case basis. In your agreement, address the Airbnb host protection insurance (which includes protection against liability from third-party claims up to $1 million).

Why Arbitrage Makes Sense

Why does Airbnb arbitrage make sense (and money)? It’s simple: the returns are higher than the investment required.

Let’s look at a couple of examples.

Example 1 (Traditional Investing)

Alesiakan/Shutterstock

A rental property real estate investor spends $175,000 to buy a home (it takes about 30 days to close) and another $5,000 making needed repairs. After the repairs are complete a month later, they start to look for a reliable tenant to move in.

They spend another two weeks interviewing renters, and when they’ve found the right person, they have them sign a 6-month lease. They collect $1,200 in rent per month.

It’s now 2 ½ months in, and the owner has made $1,200 in returns from their $180,000 rental property investment. Not terrible, but compared to the significant investment they just made, it pales in comparison.

Don’t forget – during the 6-month lease period, if anything goes wrong with the home – HVAC system, plumbing, even a fire – the responsibility falls squarely on the owner.

They stand to make about $7,200 in rental income during the lease period, but their expenses aren’t counted in this amount. In most cases, the investor’s cap rate is between 4% and 7%. Not bad, but not great, either.

Example 2 (Airbnb Arbitrage)

Let’s say the tenant from this scenario had the idea to use the property for Airbnb arbitrage. They owe the landlord $1,200 per month, but they realize they can make $500/week by subletting the house on Airbnb.

They get permission from the landlord and start collecting $2,000/month, renting it out on Airbnb. This is a profit of $800/month for the tenant (who is now subletting the home to Airbnb guests).

The landlord still gets paid on time according to the lease they have with the tenant, the property owner is protected from liability thanks to Airbnb’s host protection insurance, and the tenant makes a nice profit from the first month. It’s a win-win-win.

My Experience

When I was managing investment property, one of our tenants used the Airbnb arbitrage strategy. We made an exception to our subletting rule and made him carry special insurance, among other things.

In our case, we had a strange house that shouldn’t have even been a standard rental to begin with. We couldn’t rent the home because it was a 700 sq ft standalone home. The home was three rooms in a row with no hall, no closets, and no storage.

However, it made sense as an Airbnb rental. So we sublet it to an investor who then turned it into a “The Office” themed rental. We rented it to him for $695 and he’s renting it an average of 21 days per month for $75 per night.

He does the cleaning himself, and his supply cost is minimal. Call his expenses $250 per month, which covers supplies, insurance, and Airbnb fees. So this investor nets $1,325 each month while only paying $695. That’s a 91% monthly return — not bad at all!

How to Start Making Money with Airbnb Arbitrage

You’ve seen a few examples and realize the profitable potential of subletting a rental property on Airbnb.

Now, let’s talk about the details involved with each step and how you can actually begin making money with Airbnb arbitrage.

Find the Right City

Not every city is a hub of Airbnb activity. Before you commit to signing a lease of your own, make sure you’ve found the right area to get the most Airbnb traffic possible.

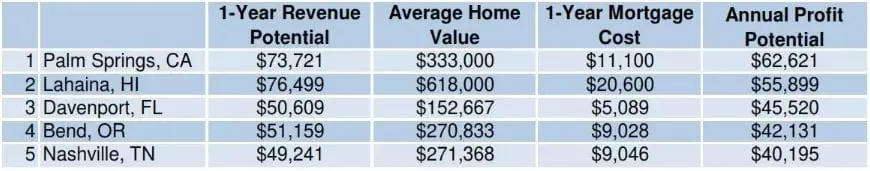

Airdna put together a chart of the best and worth cities using their most recent statistics. This includes their profit potential and costs in different cities across the United States.

Image Source: Airdna.co

The top cities for Airbnb profit are not the most populated or highest-priced cities. Instead, they represent a sort of median.

These prime locations for Airbnb see a lot of tourists, have comparatively few hotel rooms available, and have low housing costs.

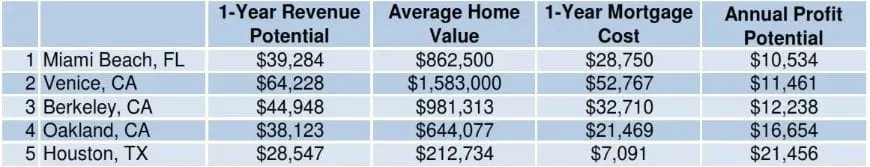

The worst cities for Airbnb are Miami, Venice, Berkeley, Oakland, and Houston. While these are popular destinations, they are saturated with Airbnb listings, and mortgages are higher.

Image Source: Airdna.co

Make sure your city is a promising location for an Airbnb listing before you make any commitment. Location is so important!

Start Leasing

When you’ve pinpointed the city in which you want to rent your Airbnb, start searching for properties for rent within close proximity to any tourist attractions, city centers, or recreational activities.

As you look at available rental properties, look at them through the lens of an Airbnb renter who wants a fun, clean, and safe place to stay for one night, a week, or a month. Your rental property should meet a few basic criteria:

- Low monthly rent. You want the monthly rent to be on the low average end of the location you’re in so you can charge more than the rent amount and make a profit. If the monthly rent is too high, you’ll struggle to recoup your costs through Airbnb stays, especially if there are cheaper locations nearby.

- Short leasing period. If this is your first foray into Airbnb arbitrage, it’s best to start with a short leasing period (6 months is an excellent place to start) to make sure you don’t get stuck with a location for too long if things aren’t going as well as you’d hoped.

- Clean, safe location. While you may be able to find rundown properties for rent very cheaply, it’s not worth the amount of expense you’d need to put in to renovate to attract Airbnb guests. If it’s a high-crime area, many guests will avoid the area – and your Airbnb listing.

- Proximity to attractions. You don’t have to pick a location that is directly in the downtown area of your city, but it needs to be close to something a tourist would want to do – outdoor recreation, the downtown area, tourist attractions, etc. This can be a selling point on your Airbnb listing: “2 miles from the downtown convention center!”

- A landlord that is open to arbitrage. This can be a tough one because there’s always a chance that once you tell your landlord about your plan to sublet the place on Airbnb, they may decide not to rent to you and use your plan instead. They may not like the idea of so many people coming in and out of the home or worry about potential damages or liability. Make sure the landlord is on board before you sign a lease or make any financial commitment.

Make a List of Expenses and Gather the Cash

Kitzcorner/Shutterstock

While subletting your rental property as an Airbnb location can earn you a nice profit, you will have some initial and ongoing expenses. Don’t go into this lease commitment blind!

Make sure you know exactly what you’ll be paying for upfront and what expenses will be ongoing. This is an excellent time to determine what your involvement with the location will be.

Will you be living here part-time and renting the home out on weekends?

Will you be living in a different location and renting the home out full-time?

Will you live there full-time and only rent certain rooms?

Do you have enough cash right now to cover them?

What would you do if your Airbnb location didn’t do as well as you’d hoped? Would you be able to cover the monthly rent amount? These are all important factors to consider.

Some expenses you may have:

- Utility expenses not covered by the landlord

- Reliable wi-fi connection for guests

- Furnishings, if not included, for the property

- Additional bed(s) to sleep more people if needed

- Deposit amount and monthly rent

- Cleaning service fees (if you don’t plan to do it yourself after each guest)

- Supplies for guests (toiletries, linens, basic kitchen supplies, light bulbs, etc.)

Some of these expenses are tax-deductible. Make sure you have enough cash to handle these expenses before you sign the lease.

Determine Your Airbnb Prices

You’ll want to do a little research for this step. Start by checking out Airbnb listings nearby and their fees. Pay attention to the rise in the fees on weekends, around holidays, and any local events.

This can help you determine how to price your place on Airbnb when you list it next. You can also use the Airbnb calculator to determine a price for your property here.

List Your Home on Airbnb

Once you’ve found the perfect location and property, signed the lease, gathered the money for all your expenses, and determined how you’ll price your location, you can begin staging the home and getting it ready to list.

You might need to furnish the property or redecorate (within your landlord’s rules) to make it more suitable for guests. Make sure there is adequate seating, sleeping areas, lighting, and plenty of basic supplies and essentials in the home.

Here’s the listing process on Airbnb:

- Take photos of the home and come up with a compelling description. Highlight any nearby attractions, centers, or recreational activities. It’s free to list the home on Airbnb.

- Choose the days, check-in and check-out times, any additional fees, the required number of nights, daily fees, and more. If you have any additional requirements for your guests, you can list them in this step.

- Submit your listing and make it public. Now, guests can see your property and reach out directly to you if they’re interested in booking a stay.

Make Yourself Available to Guests

Nicoleta Lonescu/Shutterstock

You don’t have to put long hours in, but make sure you’re available to your guests when they reach out. When they check in, ask if there’s anything you can provide. Have a few cots or a pull-out bed on hand for guests who request one.

If they have a problem in the middle of the night, make sure they have a way to reach you. If you don’t feel you can be available anytime a guest needs you, find someone you can trust to help you split the responsibility.

Customer service and responsiveness is a big part of building a successful Airbnb business. Without it, even a great property in the perfect location can lose popularity.

Our Take

If you’ve got the mentality of a real estate investor but not the cash reserves, Airbnb arbitrage can be the perfect solution.

You’re essentially subletting a rental property to not only cover the monthly rent you owe, but also earn yourself a nice profit in the process.

With a little research, you can find the perfect location for your property, discover a fairly-priced, centrally-located rental to sublet, take attractive photos and write a compelling description, and list it on Airbnb to start earning cash.

As long as your landlord is on board and you can cover the minimal expenses, there’s no reason not to try Airbnb arbitrage. While the risk is slightly higher than traditional property investing, it lets investors make big returns with little money down.

Should You Use Airbnb Arbitrage?

If you want to enter the real estate game but have little of your own cash to invest, Airbnb arbitrage is a great strategy to consider. While it’s not for everyone, we think the upside is huge.

With more and more travelers skipping the hotel, “house sharing” is in high demand. You are in a position to capitalize on this trend, but make sure to fully understand the risks before jumping in feet first. Happy investing!